🚀 SOLX & HFT Skyrocket While Tesla Crashes: July 2, 2025 Market Frenzy

Crypto bulls feast as SOLX and high-frequency trading tokens defy gravity—meanwhile, Tesla's battery fires spark a selloff. Wall Street analysts shrug and order another latte.

SOLX Goes Supernova

The Solana ecosystem's dark horse token rips past resistance levels, leaving bagholders of 'legacy' tech stocks in the dust. No fundamentals? No problem.

HFT Algorithms Party Like It's 2021

Quant-driven tokens pump on pure liquidity momentum—because who needs use cases when you've got leverage and hopium?

Elon's Empire Stumbles

Tesla shares tank after another 'production hell' tweet. Traders rotate into assets that don't rely on factory ramps or SEC goodwill.

Another day in the casino—where crypto volatility looks almost rational compared to the dumpster fire of traditional markets.

MAV followed suit as capital rotated into low-FDV altcoins. Meanwhile, ARB stumbled despite Robinhood’s Layer-2 expansion, and XRP steadied after a legal breakthrough, awaiting ETF catalysts. The divergence across these tokens mirrors the broader market mood, where short-term speculation is heating up, even as macro headwinds mount.

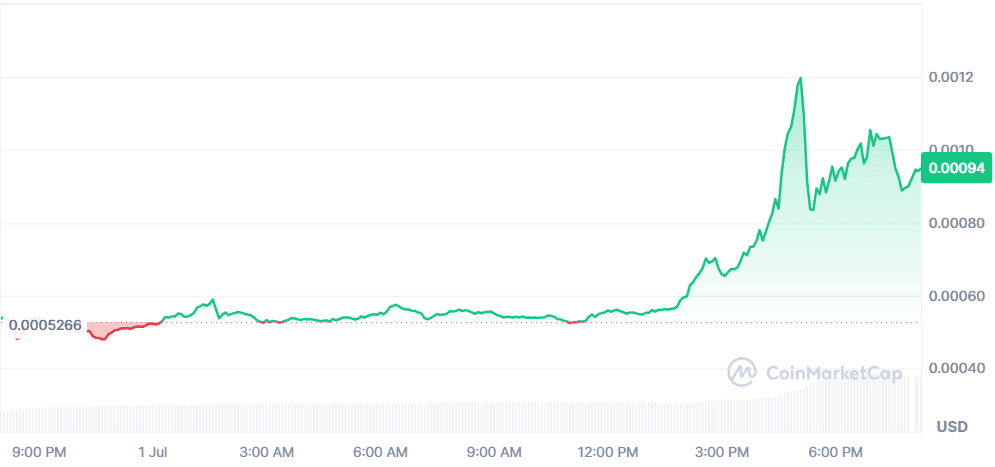

Solaxy (SOLX)

+83.62%$0.0009564

Solaxy surged 83% in the past 24 hours as post-presale momentum, massive DEX liquidity, and anticipation of its Solana Layer-2 mainnet fueled investor excitement. The $58M presale that ended on June 23 set the stage for a speculative rally. Its debut on Uniswap saw $28M in 24h volume, and the upcoming July 7 mainnet launch has sparked more interest. With SOLX addressing Solana congestion via off-chain bundling and promising 10,000 TPS, it’s drawing comparisons to the $BONK rally, despite developer adoption still being untested.

$96.79M$4.85M102.99B SOLX

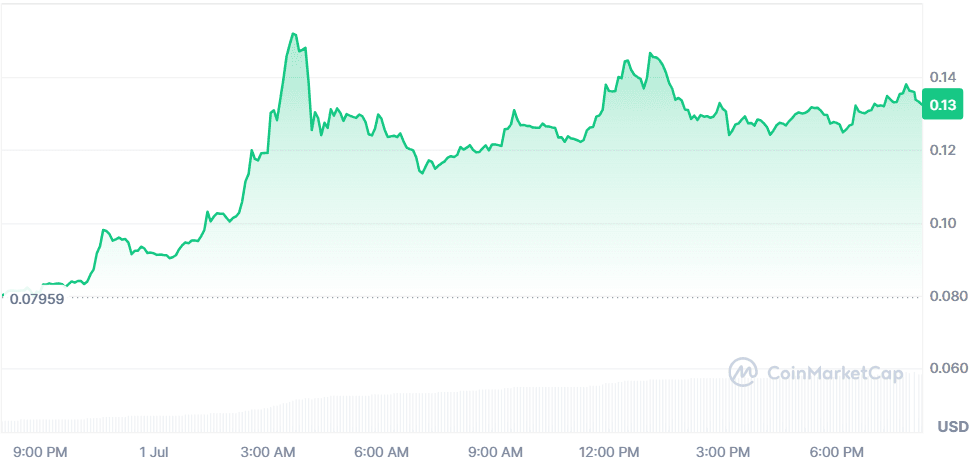

Hashflow (HFT)

+62.38%$0.1356

Hashflow skyrocketed 62% following renewed attention around its solana integration and improved tokenomics. The token’s accessibility on Binance as of July 1 via Solana boosted exposure. A clear token unlock schedule with no sudden vesting dumps reassured investors. Technically, HFT broke resistance at $0.126 with high RSI (84.93), despite being in overbought territory. Its controlled inflation model and ecosystem outreach are driving bullish sentiment.

$78.93M$639.17M581.88M HFT

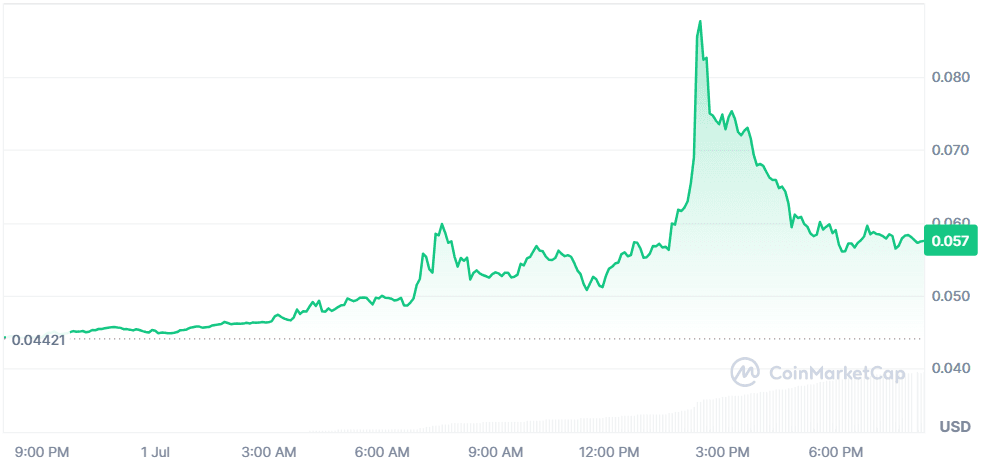

Maverick Protocol (MAV)

+29.21%$0.057

MAV jumped over 29% today, driven by capital rotation into low-FDV tokens amid rising BTC dominance. With a fully diluted valuation of just $57.7M and a microcap market cap of $0.84M, traders are viewing MAV as a high-beta altcoin. Technical breakout signals, rising RSI, and volume explosion (+5,544%) are supporting the narrative. However, 91.6% whale holdings make it a volatile play.

$26.64M$225M596.42M MAV

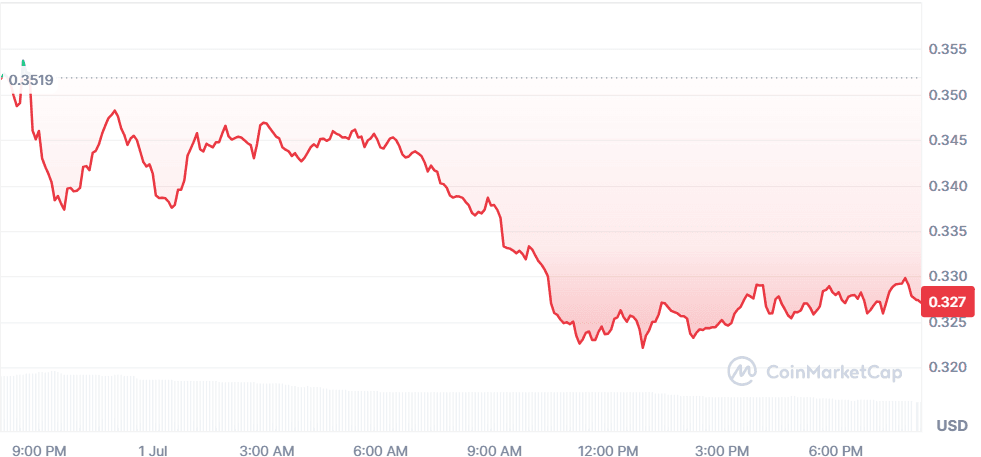

Arbitrum (ARB)

-13%$0.327

Arbitrum crashed 13% following profit-taking after its 46% rally tied to Robinhood’s Layer-2 blockchain partnership. Despite Robinhood’s launch of tokenized stocks and crypto futures on Arbitrum, influencer dumps and a bearish “death cross” on charts flipped the sentiment. While the long-term outlook remains tied to real-world asset tokenization, short-term price action is currently bearish with weak momentum.

$1.62B$404.96M4.96B ARB

XRP (XRP)

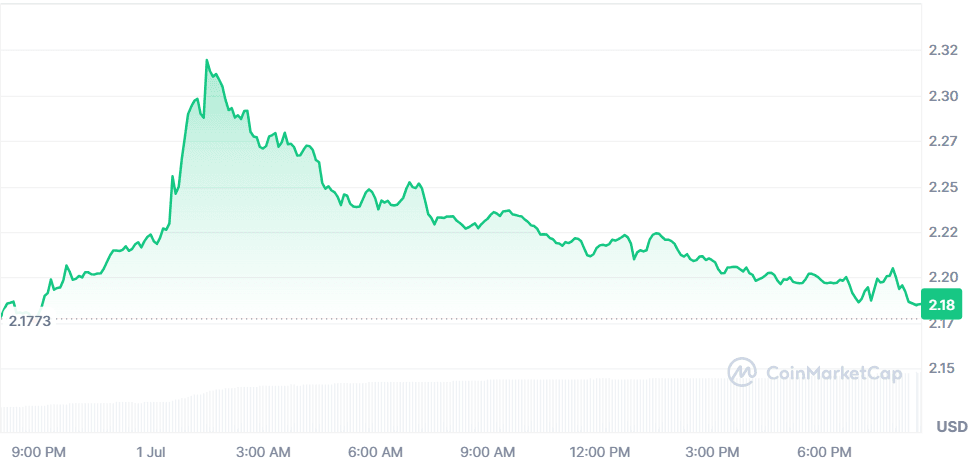

+0.02%$2.18

XRP remained steady as Ripple officially ended its legal battle with the SEC via a $50M settlement. With appeals dropped, the market anticipates the launch of spot XRP ETFs in July. XRP also saw a technical boost from XRPL’s new EVM-compatible sidechain, enabling cross-chain DeFi and using XRP as gas. Analysts expect inflows if firms like BlackRock launch ETFs, with potential for significant ETF-driven liquidity over the coming months.

$129.15B$4.48B59B XRP

Global Market Snapshot

Markets opened the second half of the year with caution, digesting the political drama in Washington and lingering uncertainties around trade and tariffs. President Trump’s sweeping “One Big Beautiful Bill” edged closer to final Senate approval, with Republican lawmakers negotiating through a marathon vote-a-rama. While banks like Citi and the American Bankers Association back the bill for its short-term economic boost and tax cut extensions, concerns around its $3 trillion deficit impact remain front and center. Investors are watching closely as the legislation attempts to stave off a 2026 fiscal cliff triggered by the expiration of Trump’s 2017 tax cuts. Meanwhile, Fed Chair Jerome Powell confirmed that rate cuts would likely have occurred already if not for the inflationary impact of Trump’s tariff policy. Despite criticism from the WHITE House, Powell emphasized that monetary decisions will remain data-dependent, leaving July’s outcome uncertain.

On Wall Street, the S&P 500 dipped 0.3% following a record-breaking Q2 close, while Tesla plunged 5% after TRUMP called for a review of Elon Musk’s federal subsidies, escalating their ongoing feud. Broader sentiment remains cautiously bullish with traders hopeful that Trump’s 90-day tariff reprieve will be extended amid active trade negotiations with Canada, Europe, and Asia. In Europe, markets wavered as the Bank of England hinted at a gradual rate-cut trajectory, while UK fiscal headwinds loom.

Asian equities traded mixed, reflecting a split reaction to U.S. gains and tariff fears. The U.S. ISM manufacturing index came in better than expected (49.0 vs 48.6), but consumer tech and biotech saw pressure amid regulatory rumblings around Medicare rule changes. With Fed expectations softening and macro risk still high, investors appear to be treading water ahead of key fiscal and trade developments.

Closing Thoughts

Closing out the day, it’s clear investors are embracing calculated risks in the altcoin space, particularly within infrastructure and DEX tokens. SOLX and HFT’s breakouts were powered not just by headlines but by clear on-chain volume confirmations, indicating real participation, not just bots or whales. Retail seems to be selectively rotating capital into coins with near-term roadmaps, while institutions sit on the sidelines awaiting clarity on ETF approvals and interest rate directions. MAV’s sharp MOVE despite its whale-heavy profile reinforces how fast sentiment can swing in microcaps under the right narrative.

Zooming out, while crypto traders are leaning into momentum plays, equity markets are showing signs of fatigue. Tesla’s sharp pullback and Powell’s hawkish hold reflect a global investor base that’s still uncertain about inflation, fiscal policy, and growth. With rate cut timelines drifting and Trump’s controversial “Big Beautiful Bill” nearing the finish line, the macro backdrop is anything but stable. Yet, the altcoin surge suggests retail is positioning early, anticipating that when fiscal taps open, risk assets will catch a bid, starting with tokens that show life before the rest.