🚀 Crypto Storm Brewing: BTC ETF Mania Collides With ETH Staking Boom Amid Macro Uncertainty

Bitcoin ETFs are sucking up institutional capital like a black hole while Ethereum validators lock up supply at record rates—just as economic storm clouds gather.

The ETF effect: Wall Street's late arrival

Spot BTC funds now hold the equivalent of three Satoshi-era whale wallets daily, forcing analysts to revise price targets upward despite traditional finance's trademark sluggish adoption curve.

Staking goes mainstream (with strings attached)

ETH's proof-of-stake revolution hits escape velocity as staked coins surpass liquid supply—though the 'passive income' crowd might regret locking tokens when volatility returns with a vengeance.

Meanwhile, bond markets flash recession signals that could make crypto's recent gains look like a quaint memory. But hey—at least the blockchain doesn't care about your 401(k).

Ethereum, meanwhile, is building momentum on the back of record on-chain activity and the SEC greenlighting the first staking ETF proposals. While Arbitrum stole the show with double-digit gains on Robinhood partnership rumors, Pi Coin couldn’t capitalize on fiat on-ramp announcements, hinting at weak demand in the face of an incoming token unlock. XRP, on the other hand, is positioning itself at the crossroads of DeFi and regulation, fresh off a major sidechain launch and lawsuit resolution.

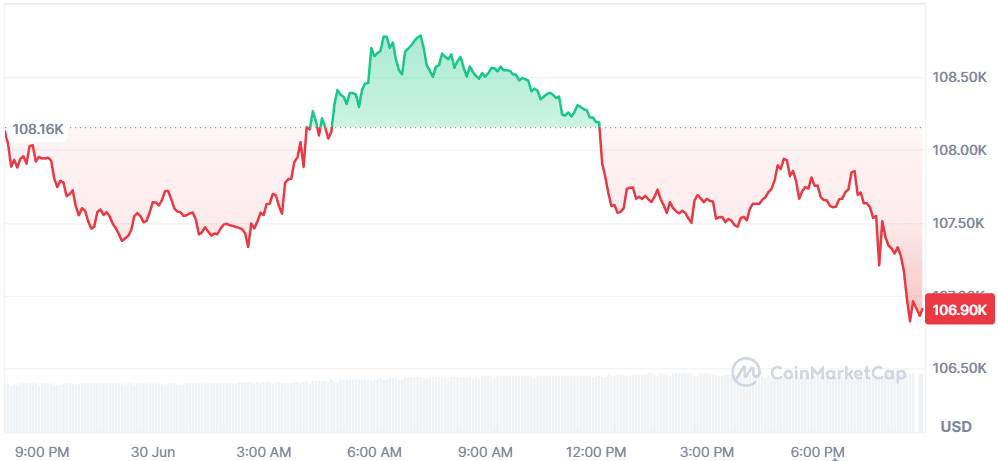

Bitcoin (BTC)

-0.96%$106,893.55

Bitcoin's price slightly dipped despite bullish fundamentals, as institutional demand continues to outpace new supply. U.S.-listed Bitcoin ETFs, led by BlackRock and Fidelity, acquired over 21,000 BTC this week, compared to just 3,150 newly mined BTC, creating intensified demand-side pressure. Simultaneously, BTC exchange balances have fallen below 2.9 million, the lowest since 2019, indicating increased long-term holding and reduced market liquidity.

Additional bullish sentiment comes from the U.S. considering bitcoin for mortgage underwriting and continued ETF inflows (over $1.3B by BlackRock alone). However, short-term profit-taking and technical resistance at $110K have caused some pullback.

$2.12T$40.92B19.88M BTC

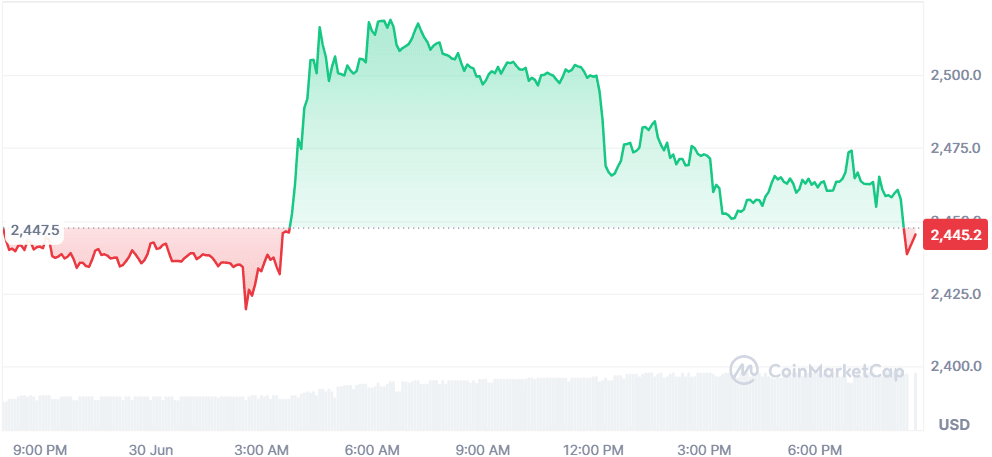

Ethereum (ETH)

+0.4%$2,450.96

Ethereum is holding steady as bullish developments stack up. The SEC has cleared the way for the first ETH staking ETFs by REX and Osprey Funds, which could increase institutional exposure. Meanwhile, transaction activity on the ethereum network has surged to its highest since 2023, signaling rising on-chain engagement. Analysts are targeting a potential breakout toward $3,200 and possibly $10,000 based on Wyckoff and Elliott Wave models. In parallel, SharpLink Gaming’s $4.82M ETH purchase and the live Pectra upgrade, enabling stablecoin gas fees, have improved Ethereum’s utility and institutional appeal.

$295.87B$16.85B120.71M ETH

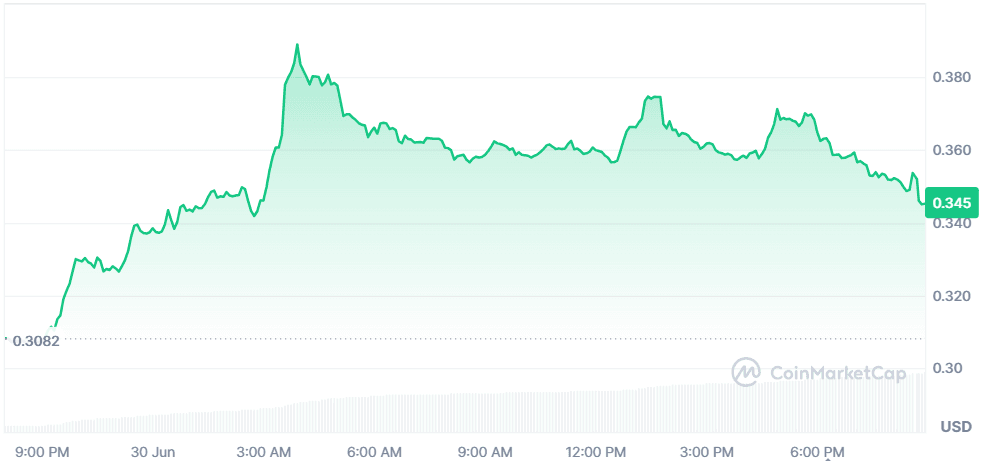

Arbitrum (ARB)

+12.39%$0.3452

Arbitrum surged on speculation of an imminent partnership with Robinhood. This follows a Robinhood post teasing a major crypto announcement involving Ethereum co-founder Vitalik Buterin, Robinhood Crypto’s GM, and Arbitrum’s CSO. The market interpreted this as a signal that Robinhood might integrate or even build on Arbitrum. The price spiked from ~$0.31 to $0.38 before stabilizing, making ARB the day’s top gainer. Separately, Gemini also launched tokenized US stock trading on Arbitrum, further boosting its visibility and perceived utility in regulated tokenized asset ecosystems.

$1.71B$956.9M4.96B ARB

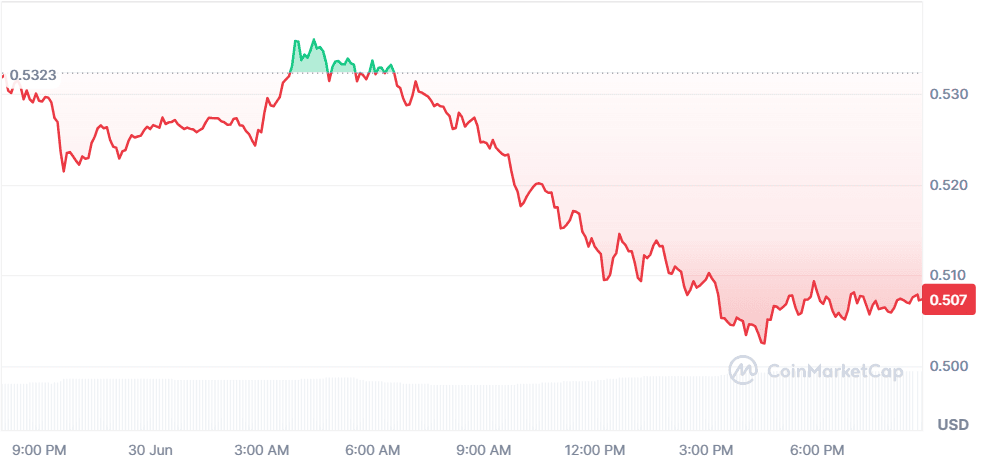

Pi Network (PI)

-4%$0.5081

Despite announcing partnerships with fiat on/off-ramp giants Banxa and Onramper, making it easier to convert Pi into fiat, PI Coin failed to rally. Banxa has already acquired over 30.5 million PI and offers KYC onboarding support, while Onramper expands payment options. Still, the price declined as the market remains wary of a massive upcoming token unlock in July (~337M PI), which could flood the supply. The muted price action reflects a demand shortfall amid positive utility developments.

$3.87B$92.8M7.61B PI

XRP (XRP)

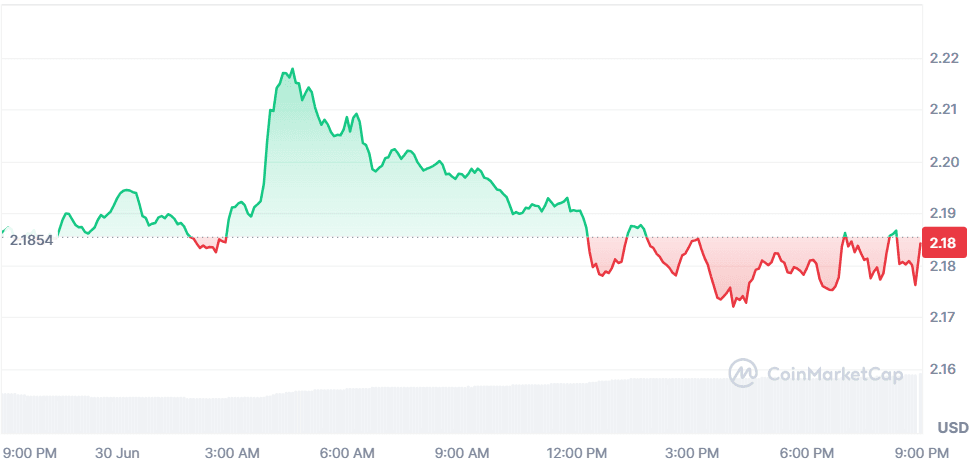

-0.1%$2.18

Ripple launched its long-awaited XRPL EVM-compatible sidechain, bridging XRP to Ethereum’s DeFi ecosystem. The Axelar-integrated bridge now enables smart contract deployment in Solidity, while using XRP as gas. Projects like Vertex and Securd are already launching dApps, signaling a vibrant start. Additionally, Ripple settled its SEC lawsuit for $125M, ending years of regulatory uncertainty. With institutional adoption on the rise and the legal cloud lifting, analysts see XRPL as entering a new era of utility, especially for tokenized assets.

$128.88B$2.07B59B XRP

Global Market Snapshot

U.S. equity markets closed last week at all-time highs, buoyed by Optimism around trade deals and tariff reprieves. But underneath the celebratory mood lies an economy riddled with uncertainty. The Fed’s outlook remains divided, with President Bostic emphasizing that economic modeling is “very difficult” due to fast-moving geopolitical shifts and inflation drivers.

While traders are betting on multiple rate cuts by year-end, the Fed remains cautious, especially with President Trump’s pressure on Chair Powell fueling speculation of a preemptive leadership shakeup. Meanwhile, progress on Trump’s tariff-focused “big, beautiful bill” and bilateral trade breakthroughs (like the U.K. auto tariff deal) have been cheered by markets, despite lingering unresolved disputes in steel and tech sectors.

Across the Atlantic, Germany delivered a surprise with inflation falling exactly to the ECB’s 2% target, bolstering hopes of another rate cut by September. While France and Spain showed minor inflation upticks and Italy stayed flat, the euro zone overall is signaling disinflation. Still, experts warn that service inflation remains sticky and external shocks, especially volatile oil prices, could derail the trend. Meanwhile, Canada abruptly canceled its digital services tax under U.S. trade pressure, signaling that North American trade talks remain highly sensitive to political volatility. For now, global equities are thriving, but policy fragility, trade fragmentation, and shifting inflation narratives keep markets on edge.

Closing Thoughts

The broader market tone is split between long-term bullish conviction and short-term caution. On the crypto side, infrastructure and interoperability are clearly stealing the spotlight. Ethereum’s staking innovations and XRP’s new EVM compatibility signal growing institutional appetite for scalable, compliant smart contract ecosystems.

Meanwhile, BTC continues to serve as a macro hedge, now propped up not just by retail enthusiasm but by BlackRock-sized inflows and ETF custodial shifts. Still, coins like Pi remind us that even real utility announcements don’t guarantee investor confidence without liquidity and market structure to back it.

On the traditional finance front, record-breaking U.S. equities and Germany’s inflation cooling to target levels add to the narrative of easing macro stress, Bitcoin may be facing minor intraday pullbacks, but institutional sentiment has rarely looked stronger—with ETFs soaking up more BTC than what’s being mined, and whispers of a looming supply shock dominating headlines. Ethereum, meanwhile, is building momentum on the back of record on-chain activity and the SEC greenlighting the first staking ETF proposals. While Arbitrum stole the show with double-digit gains on Robinhood partnership rumors, PI Coin couldn’t capitalize on fiat on-ramp announcements, hinting at weak demand in the face of an incoming token unlock. XRP, on the other hand, is positioning itself at the crossroads of DeFi and regulation, fresh off a major sidechain launch and lawsuit resolution.at least on the surface.