🚀 June 26, 2025: PI & SYRUP Tokens Surge as DeFi Outpaces Traditional Finance (Again)

DeFi's relentless march forward just minted two new winners today—PI and SYRUP tokens are riding the wave as liquidity pools overflow and yield farmers party like it's 2021.

### The Sweet Spot: PI/SYRUP Pair Defies Market Gravity

While Wall Street struggles with 'AI-powered blockchain ETFs' (read: buzzword bingo), these tokens are posting double-digit gains by actually doing what crypto does best—cutting out middlemen and printing APYs that'd make a banker weep into their spreadsheet.

### The Bigger Picture: DeFi Eats Another Bite

No ATHs today, but the sector's quiet grind upward keeps proving one thing: when TradFi institutions finally 'get' DeFi, they'll probably try to sell it back to us wrapped in a 2% management fee.

Meanwhile, Aptos (APT) cooled after its Shelby-fueled breakout, Chainlink (LINK) slipped despite a game-changing partnership with Mastercard, and Bitcoin Cash (BCH) edged higher, eyeing a breakout above key resistance. The divergence underscores how narrative-driven altcoins are stealing the spotlight, even as broader sentiment remains mixed.

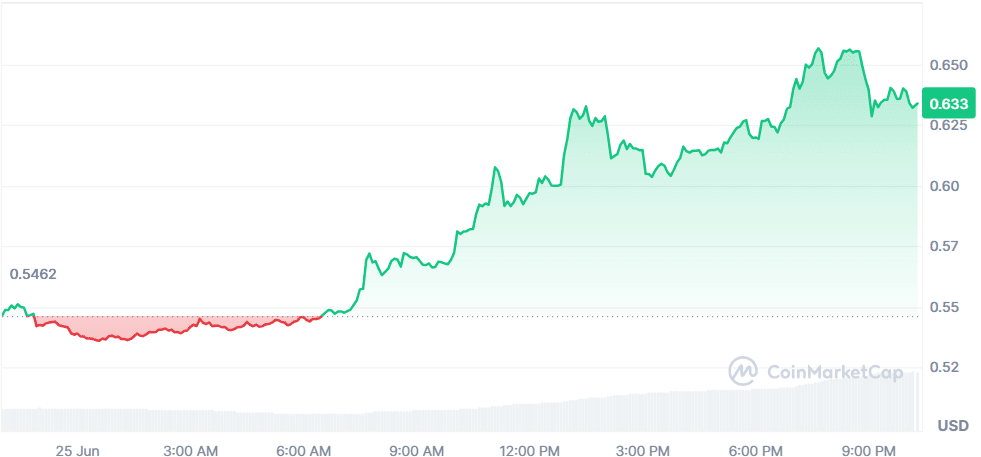

Pi (PI)

+15.27%$0.6351

Pi is surging ahead of its annual Pi2Day event (June 28), driven by HYPE around generative AI integration and the long-awaited KYC sync upgrade. Co-founder Nicolas Kokkalis’ AI panel at Consensus 2025 stoked speculation, and rumors of Binance listing added momentum. Technically, PI broke above the $0.55–$0.57 resistance with a sharp volume spike and RSI over 80. A successful Pi2Day could trigger a breakout to $1.50.

$4.79B$286.8M7.54B PI

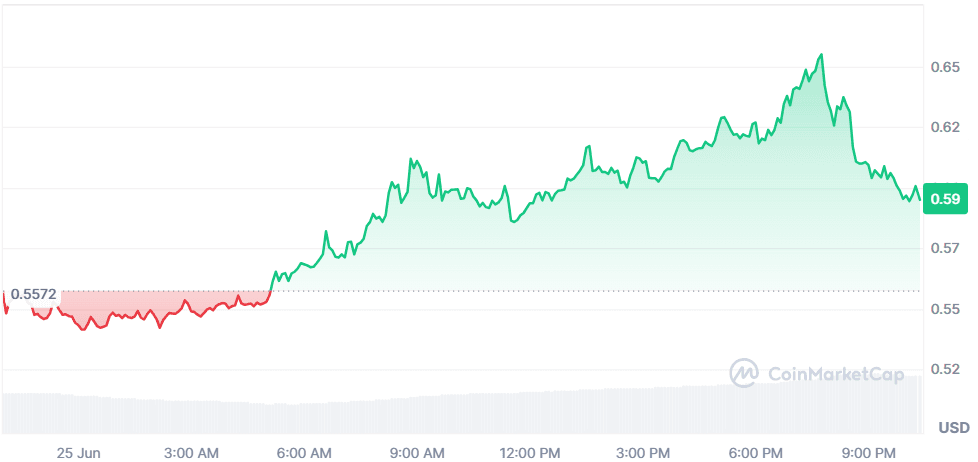

Maple Finance (SYRUP)

+7.33%$0.5953

SYRUP hit a new all-time high of $0.62, fueled by surging TVL ($1.58B) and a steep rise in wallet retention (67.55%). On-chain metrics show low exchange inflows, signaling strong holder conviction. With CMF at 0.35 and RSI climbing, the token may push toward $1, though overbought signals could trigger a short-term pullback.

$662.86M$229.54M1.11B SYRUP

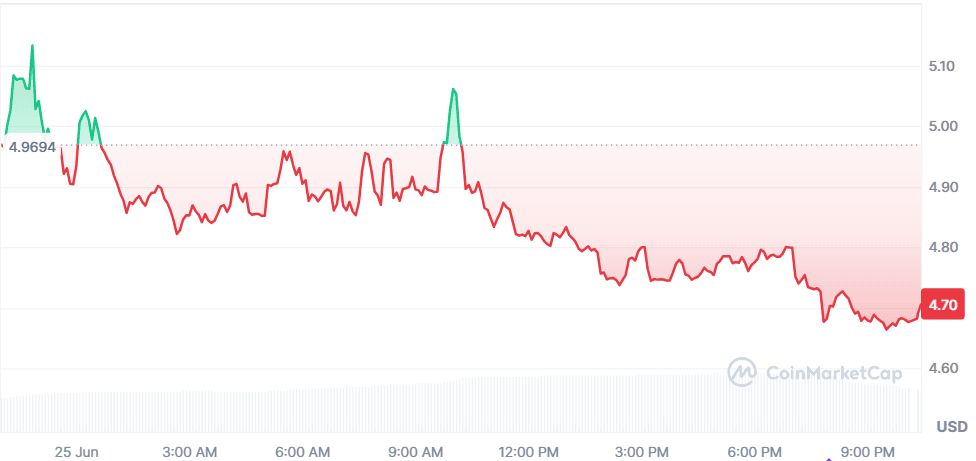

Aptos (APT)

-7.4%$4.70

APT is cooling off after yesterday’s 36% rally triggered by the Shelby announcement, a Web3-native, hot cloud storage protocol designed for AI, streaming, and DePIN. The collaboration with Jump crypto has placed Aptos at the center of decentralized infrastructure development, but today’s price dip reflects some profit-taking after the news spike.

$3.02B$474.74M643.88M APT

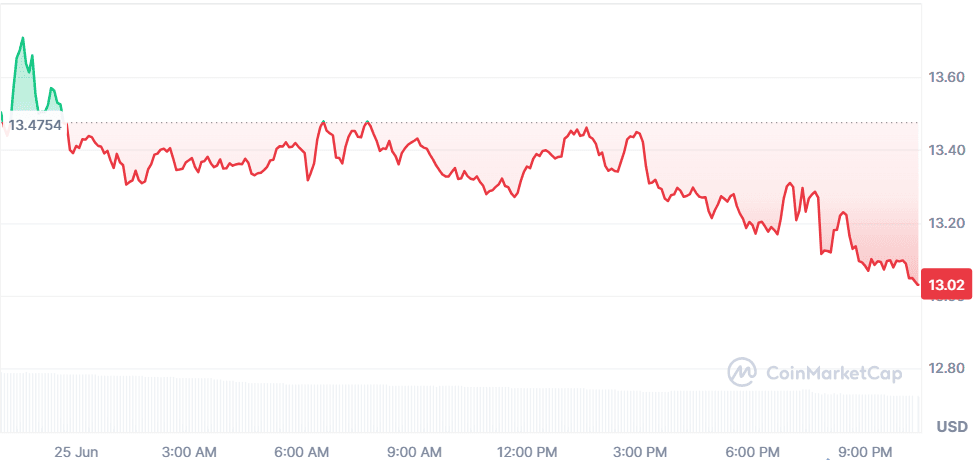

Chainlink (LINK)

-4.6%$13.02

Despite a major announcement, a partnership with Mastercard to let 3 billion users access DeFi directly through Uniswap, LINK slipped. The collaboration includes payment rails, on-chain liquidity, and compliance tools from firms like Zerohash and XSwap. However, the price action suggests technical fatigue, with the market yet to fully price in long-term utility.

$8.83B$423.34M678.09M LINK

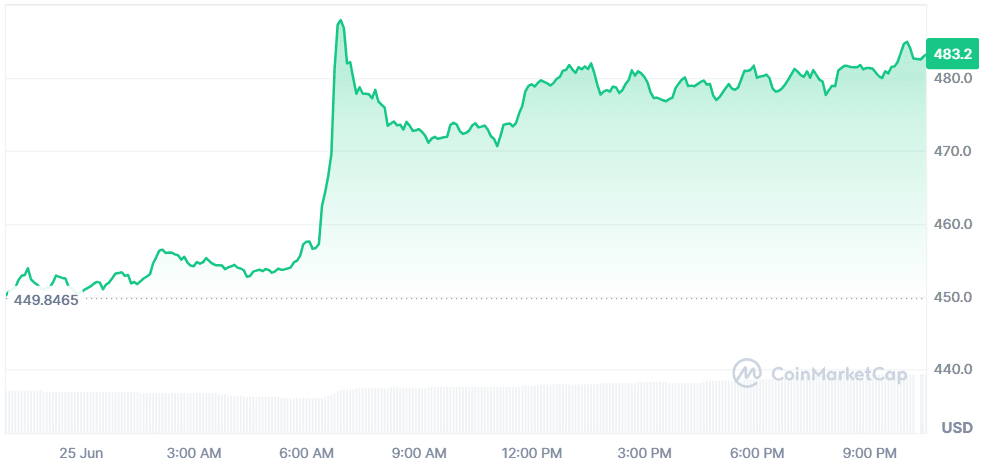

Bitcoin Cash (BCH)

+6.44%$483.21

BCH is nearing a breakout above its resistance level at $454.74, with a bullish continuation pattern targeting $612.88. Positive sentiment from the CashTokens upgrade, which brings native smart contract functionality, and easing geopolitical risks are helping push the coin upward. As capital rotates into high-utility mid-cap coins, BCH remains a key contender.

$9.61B$633.57M19.88M BCH

Global Market Snapshot

Geopolitical friction is back in focus as President TRUMP warned Spain of punitive trade terms over its refusal to meet NATO’s new 5% defense spending target. The escalation follows NATO’s collective budget hike aimed at countering long-term threats from Russia and terrorism.

Meanwhile, BP surged over 10% after rumors of a Shell acquisition surfaced, though later denied, fueling speculation of large-cap energy consolidation.

On the market side, the S&P 500 is flirting with all-time highs as easing tensions in the Middle East and continued AI-led gains (Nvidia, Microsoft) provide tailwinds. The British pound also hovered NEAR a 3-year high, driven less by domestic strength and more by ongoing dollar weakness. In this cautiously bullish environment, altcoins with high activity or strong utility narratives, like Pi and SYRUP, are gaining momentum, while others are seeing rotation-led corrections.

Closing Thoughts

Despite the S&P 500 hovering just under record highs and AI stocks powering Nasdaq gains, investor sentiment remains cautiously opportunistic. Traditional finance is reacting to geopolitical friction, like Trump’s NATO stance and energy M&A rumors, while crypto investors are flocking to ecosystems offering either immediate hype (PI’s AI speculation) or tangible utility (SYRUP’s DeFi growth). This selective participation is telling: the market isn’t broadly bullish, but it's rewarding coins with strong engagement or forward momentum.

Today’s action shows growing retail and institutional appetite for infrastructure-backed coins and real-world utility tokens, especially within DeFi and alt-layer protocols. Meanwhile, ecosystem tokens without fresh momentum, like LINK and APT, are seeing sharp retracements despite fundamentally strong developments. The crypto market remains narrative-led, and those narratives are shifting faster than ever.