Bitcoin Stands Strong Amid Oil Rally While SPK Plummets Post-Airdrop Mania – June 18, 2025

Crypto markets hold their breath as Bitcoin defies volatility—again. Meanwhile, SPK token holders learn the hard way that free money isn’t always free.

BTC: The Unshakable Giant

While oil markets go berserk, Bitcoin’s price action looks like a zen garden. No flashy moves—just steady dominance as the ultimate store-of-value play.

SPK’s Icarus Moment

That post-airdrop euphoria? Gone. SPK’s chart now resembles a cliff dive—proof that hype cycles still outlast common sense in crypto. (But hey, at least the airdrop farmers already dumped their bags.)

The Big Picture

Traders juggle black swans like circus performers—oil shocks, Fed whispers, and the occasional crypto project discovering that tokenomics ≠ free Lambos. Stay greedy, folks.

Newcomer Spark (SPK) dominated social channels with multiple exchange listings and a Binance airdrop before crashing hard on day one. AB also made waves after announcing a major security upgrade, and investors are watching closely to see if the token can hold its upward momentum.

Bitcoin (BTC)

-2.94%$104,308.22

BTC''s institutional accumulation continues with Strategy (formerly MicroStrategy) acquiring 10,100 BTC via a $1 billion SEC-regulated public offering, pushing its total holdings to 591,055 BTC. This underscores long-term corporate confidence in Bitcoin. Meanwhile, chatter around the U.S. and Texas forming strategic Bitcoin reserves further legitimizes BTC’s position as a sovereign-grade asset. On the macro side, Bitcoin reserves on exchanges have fallen below 2.5M BTC, lowest in years, signaling dwindling supply. However, short-term volatility persists as the market digests these bullish developments.

$2.07T$54.22B19.87M BTC

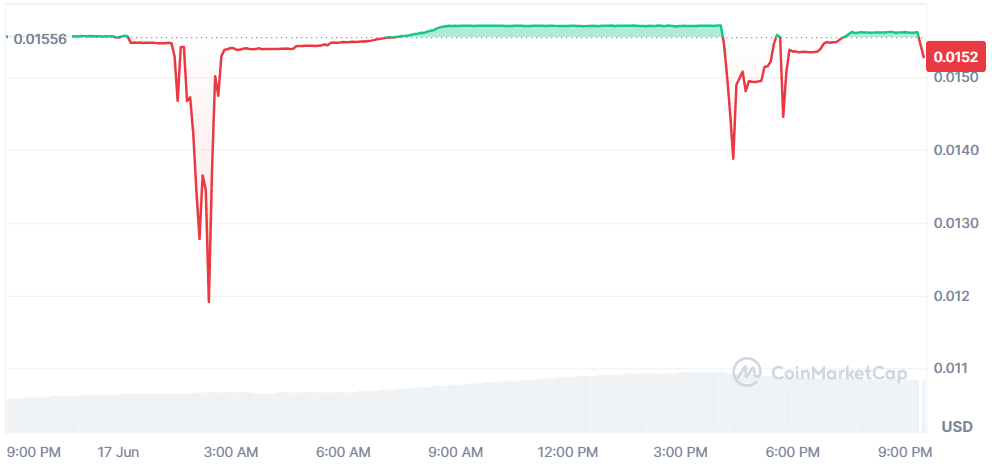

AB (AB)

-1.74%$0.01529

AB DAO announced a major security upgrade to its AB Connect cross-chain bridge. The update will segregate system assets and fees into dedicated accounts, launching on June 27. Additionally, SlowMist will audit the architecture, with results expected by September 10. These initiatives are part of AB’s broader push for transparency and centralized risk controls, signaling a maturing project. Trading volume surged 50%, reflecting heightened user interest amid upcoming changes.

$970.98M$5.14B63.48B AB

Ethereum (ETH)

-5.04%$2,499.34

Bitcoin remains the talk of the town after another massive corporate buy fueled long-term conviction, while ethereum is drawing deep institutional interest amid strong ETF inflows and staking activity. Meanwhile, XRP gears up for its historic ETF debut in Canada but slips in price ahead of the launch. Newcomer Spark (SPK) dominated social channels with multiple exchange listings and a Binance airdrop before crashing hard on day one. AB also made waves after announcing a major security upgrade, and investors are watching closely to see if the token can hold its upward momentum. continues attracting institutional capital. SharpLink Gaming bought 176,270 ETH worth $463M, staking over 95%, making it the largest ETH holder among public companies. This supports Ethereum’s PoS economy while reducing circulating supply. At the same time, Ethereum futures trading volumes have surpassed Bitcoin’s, reflecting increased institutional preference. ETH spot ETFs saw $528M in inflows last week, driven by BlackRock and Fidelity. Analysts expect a medium-term price range of $3,200–$4,100, with long-term potential at $5,000+.

$301.72B$26.45B120.72M ETH

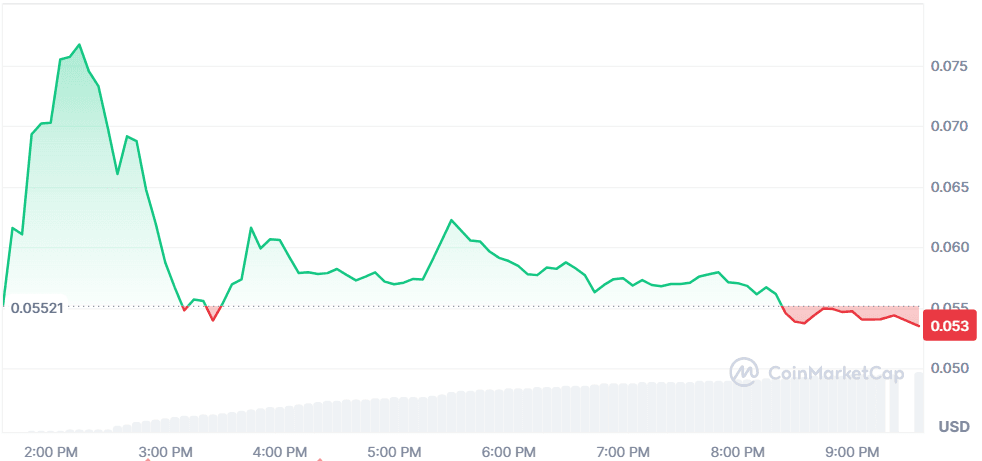

Spark (SPK)

-57.46%$0.05346

SPK launched with major listings across Binance, Bybit, OKX, and Bithumb (both spot and futures). Binance’s Alpha program offered airdrops to users with 240 points, driving massive short-term interest. However, despite the initial pump, SPK faced a sharp correction, possibly due to early profit-taking post-airdrop and over-leveraged positions in derivatives markets. Still, its listing across top exchanges reflects long-term potential for user engagement and token utility.

$90.88M$249.31M1.7B SPK

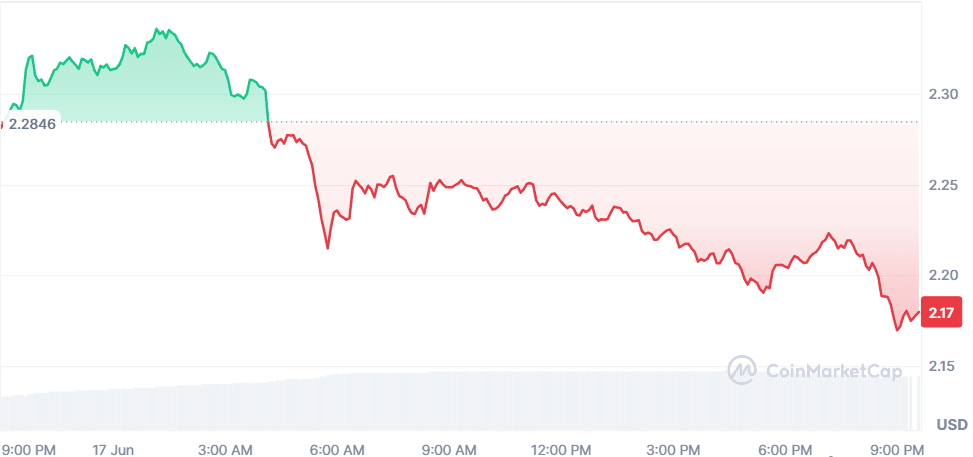

XRP (XRP)

.

.

-5.30%$2.17

Canada officially approved the [Purpose XRP Spot ETF](https://coinmarketcap.com/community/post/362067721/_, set to launch June 18 across three currency-based tickers (CAD hedged/unhedged, USD). This marks a significant milestone for XRP, offering regulated exposure and potentially boosting institutional access. Meanwhile, final settlement talks between Ripple and the SEC are nearing closure, with community sentiment on edge. If the lawsuit concludes in Ripple''s favor, it could trigger renewed partnerships and institutional inflows. Trading volumes jumped 49%, reflecting anticipation.

$128.35B$4.74B58.88B XRP

Global Market Snapshot

Global markets opened the day in a state of cautious watchfulness as two major forces shaped investor sentiment: intensifying geopolitical tensions and surprising transatlantic diplomacy. Oil prices surged after four straight days of conflict between Israel and Iran, raising concerns about potential disruptions to the Strait of Hormuz, one of the world’s most critical oil chokepoints. With Shell, TotalEnergies, and EnQuest sounding the alarm, Brent ROSE 3% while WTI climbed 2.7%, as energy markets braced for what is being called the most serious supply risk since the 2022 Ukraine invasion.

Meanwhile, a rare moment of political harmony emerged between the U.S. and the U.K., as President TRUMP finalized a trade deal with British Prime Minister Keir Starmer. The agreement lowers tariffs and signals a deepening “special relationship,” with Trump citing a personal fondness for the U.K. as a key reason behind the partnership. As macro uncertainty looms large, investors are parsing these developments for clues on inflation, trade resilience, and energy stability heading into the second half of 2025.

Closing Thoughts

Investor sentiment across both crypto and traditional finance appears split between long-term confidence and short-term caution. On one side, major institutional moves—like SharpLink’s $463M Ethereum stake and Strategy’s billion-dollar BTC buy, signal that whales are positioning for a future where crypto is tightly integrated with macro finance. On the other, geopolitical volatility, particularly the escalating Israel-Iran conflict and its impact on oil prices, has revived inflationary fears and injected a wave of uncertainty into global markets.

Sectors tied to institutional infrastructure and compliance (ETH, XRP, BTC) are seeing the most activity and liquidity, while hype-driven projects like SPK continue to be vulnerable to sharp reversals. With altcoin rotations accelerating and energy markets heating up, capital is flowing into safe-haven tokens and yield-generating assets. This is a market still in motion, cautious, reactive, but clearly hungry for catalysts.