TRX & NXPC Surge Amid Global Tariff Chaos – Crypto Markets React

Tariff tremors shake traditional markets—crypto rides the volatility wave.

TRX and NXPC lead the charge as digital assets prove their resilience (or recklessness, depending on who you ask).

While politicians play trade war bingo, traders are stacking satoshis—because nothing hedges against geopolitical incompetence like a speculative asset class.

Meanwhile, TRX faced profit-taking despite surging on-chain stablecoin flows, and HMSTR saw DEEP selling amid post-airdrop fatigue. Today’s market showed clear pockets of risk-on behavior even as traditional assets pulled back on tariff and macro risks.

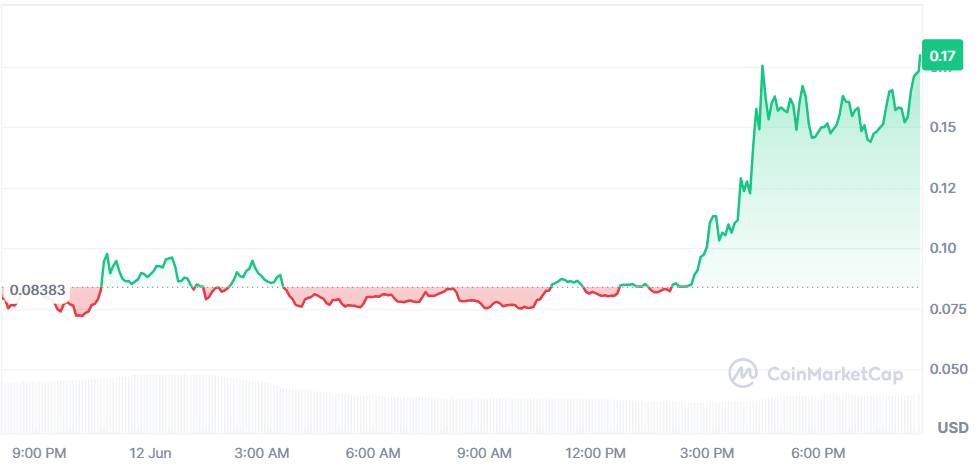

Aura (AURA)

+117.03%$0.1800

AURA extended its speculative rally, surging another 117% after yesterday’s +3,500% breakout. The latest MOVE is still fueled by whale-driven momentum (Lookonchain flagged a fresh $500K buy tied to SPX community) and extreme social media hype. AURA remains the #2 trending token on DexScreener with RSI at 99.16, deeply overheated. CMC’s Altcoin Season Index rising to 31 confirms capital rotation into speculative microcaps.as top holders concentrate tokens and trading patterns mirror historical pump-and-dump setups on Solana.

$173.45M$39.06M963.28M AURA

GOUT (GOUT)

+18.73%$0.00004779

GOUT posted another double-digit daily gain (+18.7%) with no clear news driver. The move is mostly speculative, with whales controlling 30.2% of supply, making the token prone to sharp swings. The volume spiked +64.49% to $3.85M as thin liquidity allowed whales and trading groups to dominate price action. After a 968% weekly rally, today’s -6.3% hourly pullback hints that some profit-taking is underway. GOUT’s surge remains an outlier amid a market where BTC dominance still hovers above 63%.

$7.33M$3.85M153.45B GOUT

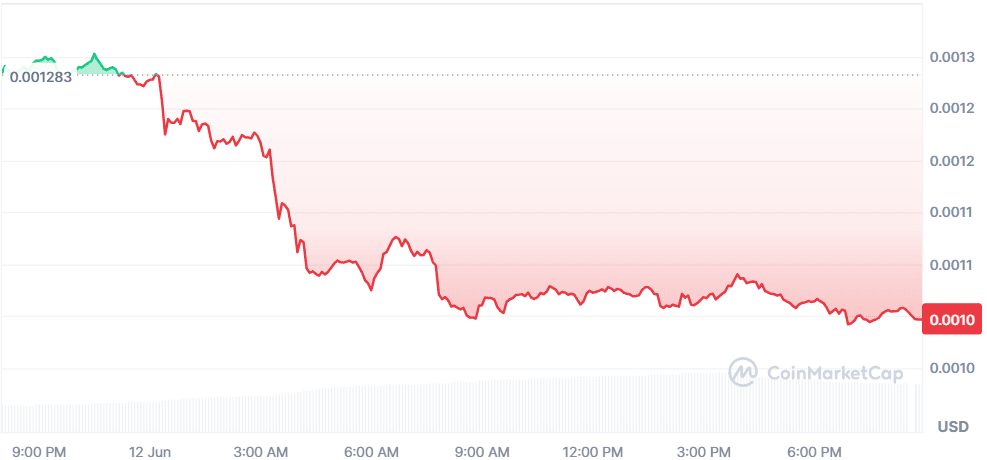

Hamster Kombat (HMSTR)

-19.20%$0.001046

HMSTR extended its post-airdrop collapse, dropping another -19.2% as airdrop recipients flooded the market with sell orders. Whale-controlled wallets (87.8% of supply) contributed heavily to the dump. Active users have plummeted from 300M to 13M, undermining the tap-to-earn model. RSI at 14.64 signals panic levels, while $137M in trading volume confirms bearish momentum. Analysts now eye $0.00095 as the next key support level.

$67.38M$137.08M64.37B HMSTR

Nexpace (NXPC)

-2.02%$1.37

NXPC volatility spiked after rumors that Tencent is exploring the acquisition of gaming giant Nexon, whose blockchain gaming platform is linked to NXPC. News from BlockBeats and Bloomberg sparked an initial +11% rally, but the token retraced after the report clarified that no deal structure has been finalized. NXPC, tied to MapleStory N blockchain gaming, remains highly sensitive to M&A rumors in the Asian gaming sector. Traders are watching for deal confirmation to gauge further upside.

$244.37M$242.4M177.52M NXPC

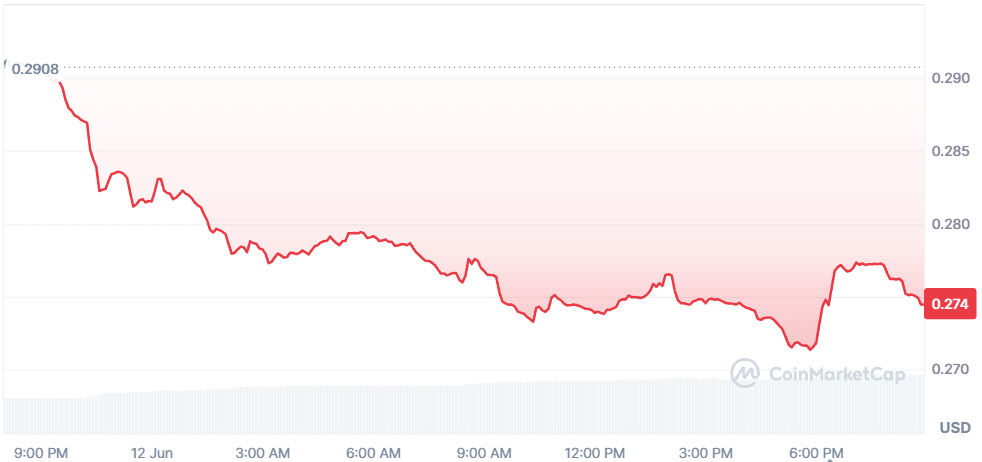

TRON (TRX)

-5.58%$0.2744

TRX dipped -5.58% despite strong on-chain fundamentals. The launch of Trump-backed USD1 stablecoin on TRON and $1B in new USDT mints confirmed TRON’s growing dominance in stablecoins (leading all chains with $75.7B USDT). However, broader market concerns over tariffs and global volatility weighed on price action. Futures funding rates remain bullish, and whale activity continues to drive USDT transfers ($700B in May). TRX’s correction appears technical amid a broadly cautious market.

$26.02B$1.06B94.84B TRX

Global Market SnapshotGlobal markets turned risk-off today as trade tensions escalated and European economic data disappointed. European stocks declined, with Stoxx 600 down 0.7%, weighed by weak UK GDP (-0.3% in April) and record UK exports plunge to the US. The Euro surged to a 3.5-year high amid a weakening dollar, as US tariff threats rattled investor confidence. Oil prices fell ~2% on Israel-Iran tensions. US markets showed mixed action as S&P 500 edged higher on tech gains led by Oracle, but tariff uncertainty capped broader gains.

Closing Thoughts

Investor sentiment across both traditional and crypto markets remains fragmented. Traditional equity markets wobbled under the weight of negative tariff headlines and weaker UK data, while crypto saw sharp divergences like risk capital rotated heavily into microcaps (AURA, GOUT), signaling that pockets of retail and speculative players remain active. At the same time, the TRON ecosystem’s stablecoin dominance and record USDT activity suggest that institutional players continue leveraging blockchain rails for large-scale capital movement, irrespective of spot token volatility.

Today’s trending coins reflect a broader market tone of selective risk-taking: meme coins and microcaps are attracting opportunistic retail flows, while Layer 1 networks tied to real utility (TRX) and gaming narratives (NXPC) are battling macro headwinds. The bifurcation highlights an environment where traders remain highly reactive to both on-chain trends and macro news cycles. Until global tariff clarity improves, expect choppy conditions with bursts of speculative activity rather than broad-based crypto market conviction.