Crypto and TradFi Rally as U.S. Court Decision Ignites Market Revival—BMT and SPX Lead Charge

Markets roar back to life after a surprise legal ruling shakes off weeks of regulatory FUD. Crypto traders cheer while Wall Street pretends it saw this coming all along.

BMT and SPX spearhead the rebound—proof that even legacy systems can catch a bid when the Fed’s liquidity hose gets turned back on. Meanwhile, Bitcoin maximalists quietly recalculate their ’flippening’ timelines.

Another day, another ’risk-on’ narrative manufactured by the same institutions that warned you about inflation last quarter. Funny how that works.

Bubblemaps (BMT) capitalized on the growing demand for on-chain transparency with its V2 launch, and WalletConnect Token (WCT) rode anticipation around its solana expansion and upcoming token claims. Together, these assets reveal how narratives in both macroeconomics and multichain crypto are shaping trading behavior today.

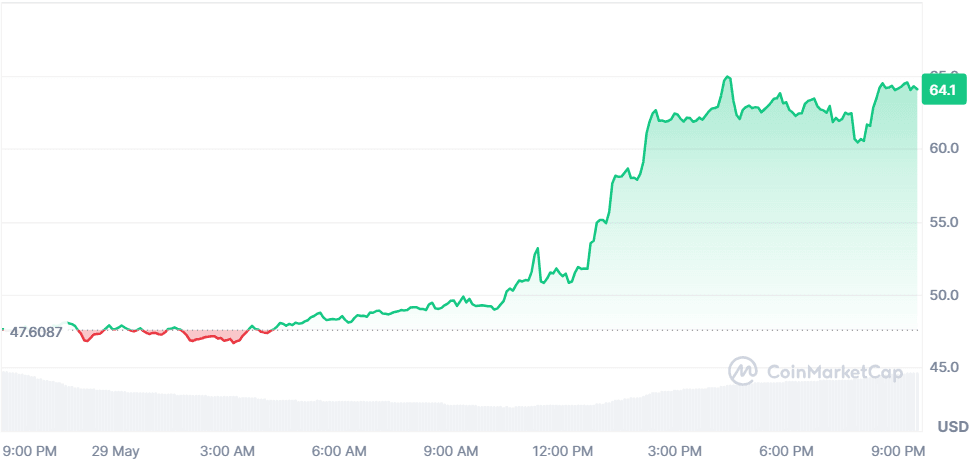

Tellor (TRB)

+33.09%$63.65

Tellor surged over 33% on speculative momentum, breaking above the critical 127.2% Fibonacci level ($64.30). Despite the absence of fundamental news, traders chased a technical breakout backed by bullish MACD and RSI signals. Whale dominance (77% of supply) and high turnover (2.69x) further amplified the move, making TRB one of the most volatile assets of the day. The rally also stands out in contrast to broader “Bitcoin Season” trends, showing isolated altcoin strength.

$169.7M$460.33M2.66M TRB

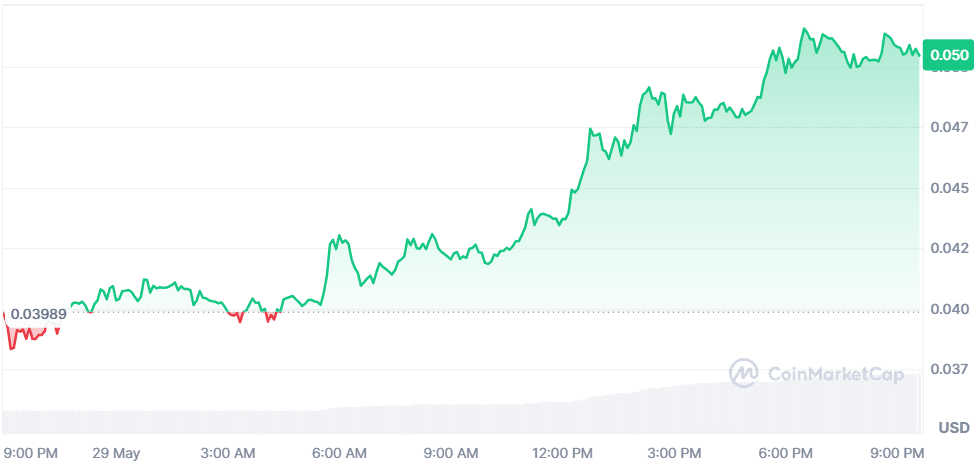

Status (SNT)

+29.56%$0.05041

Status saw a sharp 29.5% increase, largely driven by technical momentum. The RSI-7 hitting 84.5 and a MACD crossover suggest aggressive short-term buying. Despite no new announcements, volume ROSE 159%, indicating heightened speculative interest. SNT’s liquidity profile (24H turnover ratio: 0.95) makes it responsive to such sentiment swings. Whale control remains high, with 83% of the supply held by the top 10 wallets.

$201.72M$191.33M4B SNT

WalletConnect Token (WCT)

+25.28%$1.15

WCT jumped over 25% after the WalletConnect Foundation confirmed airdrop eligibility for Jupiter stakers, tying into WCT’s expansion to Solana. The move adds to the bullish momentum following a 276% rally since mid-April. Anticipation around multichain support and the upcoming 5 million token claim via Solana wallets like Phantom and Backpack drove demand.

$215.98M$689.78M186.2M WCT

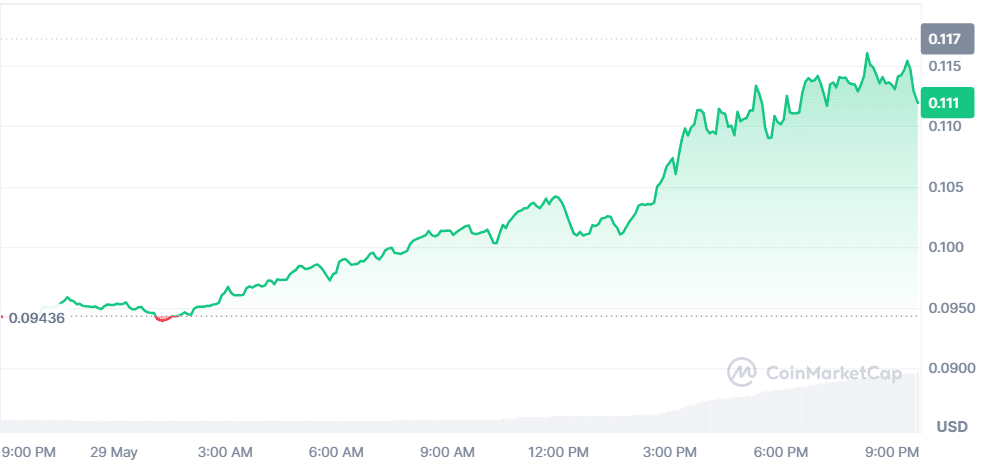

Bubblemaps (BMT)

+19.07%$0.1118

Bubblemaps launched its V2 platform, extending InfoFi capabilities across Ethereum, Solana, Base, and BNB Chain. The upgrade introduces Magic Nodes and Time Travel features enabling forensic-grade visual analysis of wallet behavior. With Solana integration and rising institutional interest in InfoFi, Bubblemaps’ role as an on-chain analytics layer is expanding, driving today’s price rally.

$36.41M$70.2M325.56M BMT

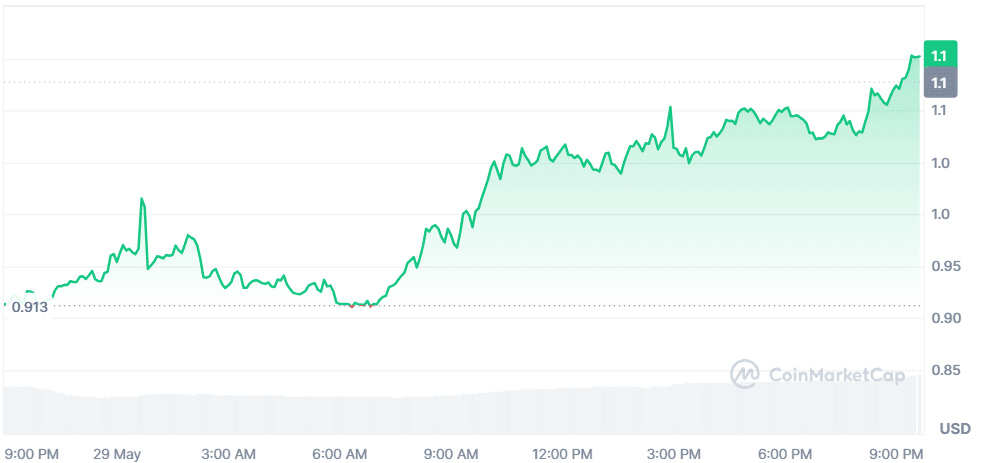

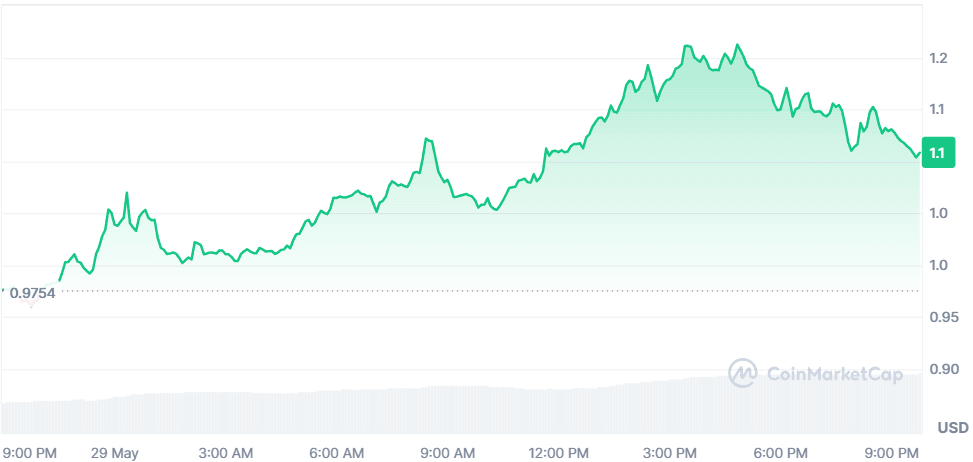

SPX6900 (SPX)

+15.41%$1.10

SPX6900 rallied on news of a tech protocol upgrade and a whale purchase, reigniting interest in the cryptography-focused token. With technicals flashing strong signals (MACD crossover, RSI at 70.84) and momentum building, traders rushed in. The Fear & Greed Index at 74 also points to elevated risk appetite. This price move has outpaced typical S&P volatility, signaling both potential and danger, especially on Leveraged platforms.

$1.03B$91.79M930.99M SPX

Global Market Snapshot

Markets opened with cautious Optimism following legal and political developments in the U.S. crypto regulation space. Representative Bryan Steil warned lawmakers against attaching unrelated provisions to upcoming crypto bills, pushing for faster passage of the GENIUS Act and the FIT21 follow-up. With bipartisan alignment improving, the path for clearer U.S. crypto frameworks is becoming more realistic.

Meanwhile, DeepSeek released an upgraded AI model without fanfare yet the implications were loud. The stealth release of R1’s improved version sparked fears of accelerated Chinese AI advancement, with global tech markets reacting sharply. U.S. chipmakers and AI developers like Nvidia saw volatility return after a brief period of stability.

On the trade front, a federal court ruling blocked Trump’s sweeping tariffs, challenging the administration’s legal strategy under IEEPA. Though the WHITE House is expected to find legal workarounds, the ruling has already boosted global equities, with the Dow and S&P 500 futures in the green.

Closing Thoughts

The intersection of macro legal shifts and crypto infrastructure upgrades defined market activity today. The U.S. court’s halt on Trump-era tariffs injected optimism into global equities, pushing the dollar and equity futures upward, while in crypto, that momentum carried over to altcoins with strong technical setups or upcoming ecosystem milestones. SPX6900’s sharp reaction to its protocol upgrade shows how macro-friendly sentiment can amplify localized catalysts, especially when paired with speculative leverage platforms.

In crypto, participation concentrated in low- to mid-cap tokens offering event-based upside, from TRB’s technical breakout to WCT’s eligibility expansion. Activity in InfoFi platforms like Bubblemaps indicates growing user preference for real-time, transparent analytics across chains, aligning with a broader trend toward structured data in DeFi. While volatility remains high, today’s flows reflect a market hungry for momentum, fueled by both legislative clarity and multichain innovation.