Crypto Rollercoaster: XRP and ETH Defy Market Chaos as COOKIE Gets Dunked

While traditional markets wobble on trade tensions, crypto’s heavyweights flex resilience—XRP and ETH post gains as speculative altcoin COOKIE tanks hard. Here’s the breakdown:

XRP/ETH: The Anti-Fragile Duo

No safe-haven gold? No problem. Traders pile into XRP and Ethereum as hedges against macro uncertainty—proving, yet again, that crypto marches to its own volatile beat.

COOKIE Crumble: Meme Coin Reality Check

Another day, another ’utility token’ with a cartoon mascot getting rekt. COOKIE’s 40% nosedive smells like yet another ’community-driven project’ forgetting to drive actual demand.

Crypto’s two-tiered reality: blue-chips thrive while the rest fight for survival. Meanwhile, Wall Street still can’t decide if this is ’digital gold’ or a casino—why not both?

Ethereum (ETH) sees a spike in activity following Base’s Layer 2 upgrade news, XRP rallies on institutional traction from ETF launches and real-world adoption in Dubai, and PEPE stirs up retail excitement with a potential breakout pattern. Meanwhile, Virtuals Protocol (VIRTUAL) is defying correction fears with strong on-chain momentum, while Cookie DAO (COOKIE), after an explosive week, is now showing signs of cooling off.

Ethereum (ETH)

+1.65%$2,548.33

Ethereum surged in trading activity following Base’s announced Layer 2 upgrade, aiming for 200ms confirmation times and fees below $0.01. Backed by Coinbase, the upgrade intends to decentralize further by shifting protocol elements to Layer 1 ethereum via smart contracts. This news triggered an 18% spike in ETH trading volume. Meanwhile, Vitalik Buterin highlighted concerns over centralization in Nordic countries and stressed Ethereum’s role in privacy and resilience. Institutional interest soared with a $45M inflow into Grayscale’s ETHE. On-chain data also showed ETH exchange reserves hitting multi-year lows, reflecting strong holding sentiment and sustained Layer 2 growth.

$307.64B$14.88B120.72M ETH

Pepe (PEPE)

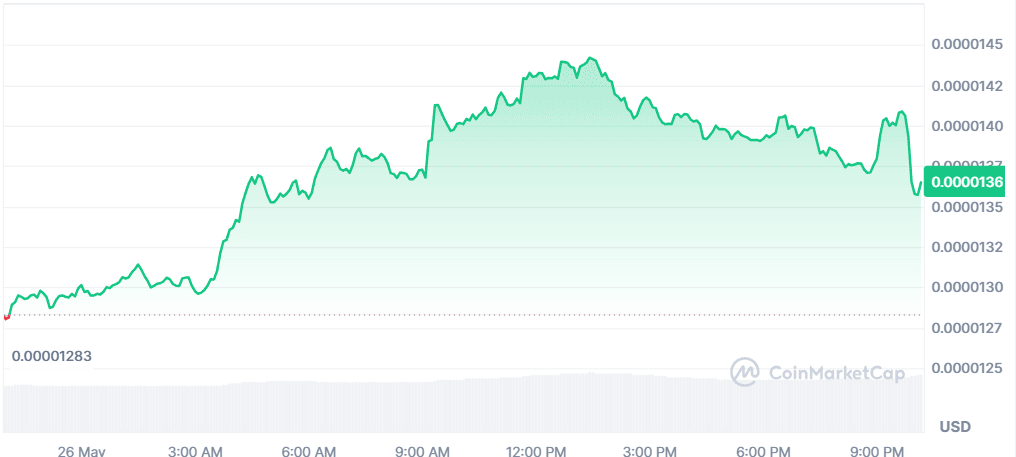

+5.20%$0.0000136

PEPE displayed bullish momentum by forming a cup-and-handle pattern on the charts, with analysts anticipating a 61% breakout rally toward $0.0000238 if it clears $0.0000147. A recent golden cross and break above the 200-day EMA reinforced optimism. Whale accumulation and volume spikes added to confidence. The market is watching resistance levels for a confirmation of the upward trend, while current momentum hints at a potential breakout and all-time highs ahead.

$5.72B$1.56B420.68T PEPE

Virtuals Protocol (VIRTUAL)

+15.27%$2.15

VIRTUAL rebounded sharply, reclaiming the $2 level and dismissing fears of a deeper correction. Technicals show bullish indicators with CMF signaling accumulation and price-DAA divergence surging over 400%, implying rising network activity. The token is now approaching $2.22 resistance with momentum to break above and target $3.38. Bull Bear Power remains strongly in the green. Broader AI agent sector growth and capital rotation into Virtuals Genesis further strengthen its upward trajectory.

$1.4B$439.4M654.57M VIRTUAL

XRP (XRP)

+1.39%$2.32

XRP remained in a tight range amid anticipation of the SEC meeting on May 29. The Dubai Land Department launched a government-backed real estate tokenization pilot on the XRP Ledger, reducing transaction costs by 50%. Meanwhile, XRP became the first altcoin to have a futures ETF launched on Nasdaq, signaling mainstream institutional entry. Derivatives trading volume surged 25.82%, and open interest ROSE to $4.76B. Investors await regulatory clarity, while technicals show tight Bollinger Bands, hinting at an imminent move.

$136.16B$2.02B58.68B XRP

Cookie DAO (COOKIE)

-9.86%$0.2675

COOKIE dropped nearly 10% despite last week’s impressive rally fueled by the launch of Cookie.fun v1.0 and the Cookie Snaps feature. After breaking out of a bull pennant and reaching a high of $0.33, COOKIE faced overbought signals with an RSI above 78 and narrowing MACD histograms. The price now retraces after failing to hold above resistance. Analysts still eye a long-term target of $0.45 if momentum resumes, supported by the token’s reclaim of the $0.15 support earlier this month.

$137.57M$206.5M514.2M COOKIE

Global Market Snapshot

Markets briefly breathed a sigh of relief after U.S. President Donald TRUMP postponed a steep 50% tariff on EU imports to July 9, following a call with European Commission President Ursula von der Leyen. The delay sparked a modest rebound in European stocks and pushed the euro to a three-week high. However, analysts warn this is merely a pause, not peace. The threat of escalation looms large, with political will and negotiation clarity still in question.

Despite the recovery, investor sentiment remains fragile. Trump’s unpredictable negotiating style and unclear demands have left both sides scrambling. Sectors like tech and industrials are particularly exposed to volatility, while market participants brace for a potential supply chain jolt. With muted U.S. and UK trading due to holidays, attention now shifts to upcoming inflation data and further ECB commentary. As one analyst put it, “buckle up, this ride’s far from over.”

Closing Thoughts

Investor sentiment across both traditional and crypto markets is walking a tightrope. On one hand, the temporary calm in equity markets, driven by Trump’s tariff delay, offers some breathing room, but not enough to restore confidence. Crypto, meanwhile, is seeing clear sectoral shifts. AI-related assets like VIRTUAL are benefiting from renewed capital inflows, while memecoins like PEPE show that retail euphoria hasn’t died down, even amid volatility. Institutions continue to gain exposure through regulated vehicles, evident from XRP’s futures ETF debut and Ethereum’s $4B inflows.

What we’re witnessing is a bifurcation: investors are leaning into coins that offer utility or future-facing narratives, whether that’s Ethereum’s decentralization push, XRP’s real-world use cases, or VIRTUAL’s role in the AI sector. Memecoins and experimental tokens like COOKIE are facing higher scrutiny as RSI levels flash warnings and rallies lose steam. With regulatory updates and inflation data on the horizon, both markets are bracing for impact. The difference lies in how prepared each sector is to absorb it.