BETR Stock Explodes as Opendoor Bull Eric Jackson Dubs It the ’Shopify of Mortgages’

Better Home & Finance just became the hottest ticket on Wall Street—and one influential voice is betting it will revolutionize the entire mortgage industry.

Why Traders Are Piling In

Eric Jackson—notorious for his early Opendoor bullishness—just dropped the comparison that sent BETR soaring. Calling it the 'Shopify of Mortgages' implies this isn't just another lender; it's a platform play set to disrupt the entire home financing ecosystem.

The Platform Play No One Saw Coming

While traditional banks drown in paperwork, Better's digital-first approach cuts processing times from weeks to days. Their tech stack bypasses legacy systems entirely—think algorithmic underwriting meets seamless user experience.

What This Means for Mortgage Tech

Jackson's endorsement signals a broader shift: investors finally recognizing that mortgage origination deserves the same tech transformation that reshaped e-commerce and payments. The space remains brutally fragmented—ripe for a platform that standardizes the chaos.

Wall Street's latest darling might actually deserve the hype—or this could just be another case of finance folks overhyping anything with a '.com' suffix. Either way, the mortgage industry won't look the same.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Eric Jackson’s EMJ Capital Is Bullish on BETR Stock

In a post on X, Jackson stated that Better Home & Finance is rebuilding a $15 trillion industry from scratch through its artificial intelligence (AI)-powered solutions. He believes that BETR stock is trading at attractive valuation levels and sees it as a “potential 350-bagger in 2 years.”

In particular, Jackson highlighted that blockchain lender Figure Technology Solutions (FIGR), which went public earlier this month, trades at 19x 2026 sales, while Better Home & Finance trades at a valuation multiple of just 1x, despite growing at a faster rate.

Drawing comparisons to Carvana (CVNA) and Opendoor, Jackson said, “They laugh at BETR now at $34 like they laughed at CVNA at $3.50 and OPEN at 51¢. But this is no meme.” Interestingly, Jackson triggered a retail-driven rally in OPEN stock in July, when he expressed his bullish views on X. Opendoor stock has jumped about 424% year-to-date.

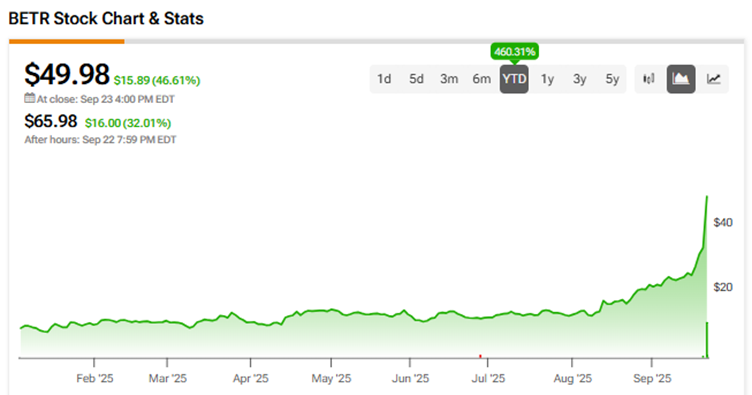

BETR stock, which went public in August 2023, has rallied more than 460% year-to-date.