Cathie Wood’s Bold $37M Biotech Bet—Trims KTOS, TEM, and ROKU in Strategic Pivot

Cathie Wood just placed a massive $37 million wager on biotech's future—while cutting ties with three key holdings. The ARK Invest CEO isn't just shuffling deck chairs; she's rebuilding the entire ship mid-voyage.

Biotech's Bright—Everything Else? Not So Much

Wood's latest move screams conviction. That $37 million injection into biotech signals she's betting on science over speculation—for now. Meanwhile, KTOS, TEM, and ROKU got the axe. No tears, no drama—just cold, hard portfolio calculus.

Rotations Over Revelations

This isn't some panic-driven fire sale. It's a calculated reallocation—trimming the fat to fund the future. Wood's always played the long game, even when Wall Street screams for quarterly results. Classic Cathie: ignoring noise, chasing breakthroughs.

Because nothing says 'financial genius' like dumping solid performers to chase the next miracle drug that may or may not exist. But hey—if you're not swinging for the fences, why even step up to the plate?

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Alongside these buys, the ARK Genomic Revolution ETF (ARKG) acquired 398,934 shares of Atai Life Sciences (ATAI) for $1.85 million. ARKG also picked up 22,754 shares of Arcturus Therapeutics (ARCT), a company focused on RNA medicines, valued at $411,000. In addition, ARKK expanded its stake in Intellia Therapeutics (NTLA) with a 211,618-share purchase worth $2.6 million.

Other Notable Buys Across ARK Funds

Beyond biotech, ARK spread capital across several sectors. The ARK Autonomous Technology and Robotics ETF (ARKQ) and the ARK Space Exploration ETF (ARKX) jointly added 10,508 shares of AeroVironment (AVAV) for about $2.8 million. ARKQ alone also acquired 5,164 shares of Baidu (BIDU) valued at $639,000.

The ARK Next Generation Internet ETF (ARKW) boosted exposure to Robinhood Markets (HOOD), purchasing 33,783 shares worth nearly $4 million. ARKQ also bought 88,335 shares of Pony AI (PONY), valued at $1.5 million. Smaller trades included 36,328 shares of Bullish (BLSH) across ARKK and ARKW, totaling $1.87 million, and 9,209 shares of L3Harris Technologies (LHX) for $2.62 million.

Wood Cuts Holdings in KTOS, ROKU, and Tempus AI

On the sell side, ARK reduced its stake in Kratos Defense & Security Solutions (KTOS), offloading 131,177 shares across ARKQ and ARKX for more than $10 million. The ARKK ETF also trimmed 5,000 shares of Roku (ROKU), worth $489,550, and 8,850 shares of Tempus AI (TEM) for about $770,000.

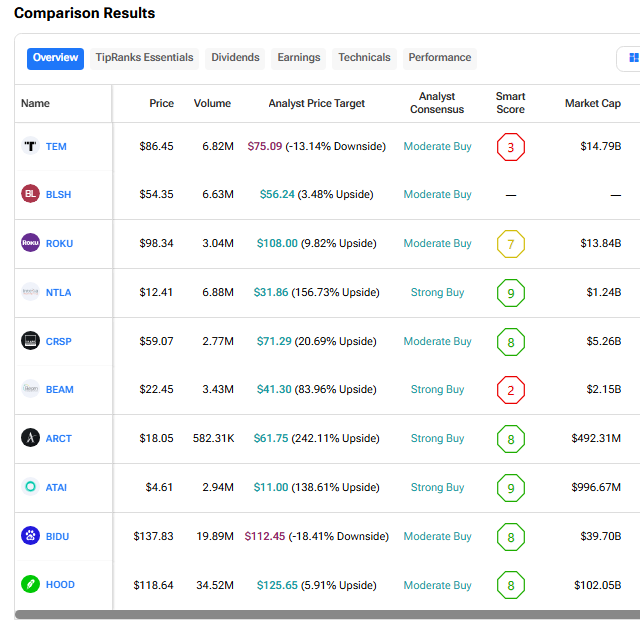

Here’s how these stocks perform on TipRanks’ Stock Comparison Tool: