‘That’s Cute,’ Frontier (ULCC) CEO Fires Back at Budget Airline Viability Doubters

Frontier's chief just dropped the mic on critics who claim budget carriers can't survive today's turbulent markets.

The Confidence Play

While legacy airlines hedge fuel costs and overcomplicate revenue models, ULCCs like Frontier strip aviation down to its bare essentials—no frills, just profits. They're running leaner than a crypto trader during a bear market.

Numbers Don't Lie

Frontier's operating metrics tell a different story than the doom-and-gloom narrative. Their unit costs outperform traditional carriers by double-digit percentages—something Wall Street analysts seem to conveniently ignore while collecting fat consulting fees.

Market Realities

Ultra-low-cost carriers aren't just surviving; they're capturing market share from bloated competitors. Passengers vote with their wallets, choosing rational pricing over loyalty programs that haven't been valuable since frequent flyer miles were actually worth something.

Maybe the real question isn't whether budget airlines are viable—but whether traditional carriers can adapt before becoming aviation's next blockbuster nostalgia story.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Furthermore, Kirby said that if Biffle wants Frontier to be the top budget airline, he’ll end up being the “last man standing on a sinking ship.” In response, Biffle highlighted that Frontier’s operating costs are cheaper at $7.50 per seat mile compared to United’s $12.36. He also said that Frontier reaches customers who wouldn’t normally fly or who want to save money on flights so they can spend more on things like luxury hotels. When asked if Frontier depends on United’s leftover flight capacity, Biffle dismissed the idea.

Still, budget airlines have been struggling due to rising costs and tough competition from larger airlines that now offer cheaper basic economy seats. In fact, Kirby told CNBC that customers don’t see enough value in ultra-low-cost carriers anymore. In response, airlines like Frontier are starting to bundle more services together by offering upgrades that used to cost extra. As a result, Frontier believes the airline could return to profitability by 2026.

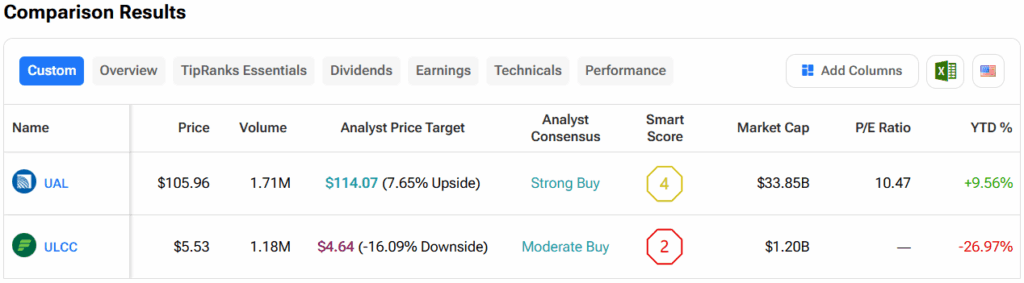

Which Airline Stock Is the Better Buy?

Turning to Wall Street, out of the two stocks mentioned above, analysts think that UAL stock has more room to run than ULCC. In fact, UAL’s price target of $114.07 per share implies 7.7% upside versus ULCC’s 16.1% downside risk.