‘Load Up Now,’ Says 5-Star Analyst on Micron Stock (MU) Before Q4 Earnings Drop

Micron's gearing up for a monster Q4 reveal—and one top analyst says it's time to back up the truck.

Why the hype? Memory's back, baby. AI workloads are chewing through DRAM like it's going out of style, and data centers can't get enough. Pricing's firming, inventories are lean, and demand's not just bouncing—it's soaring.

Earnings aren't just numbers; they're signals. And this quarter? It’s looking like a green flare for the whole semi space.

Load up—or watch from the sidelines like another cautious fund manager missing the next leg up. Your call.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, DRAM is fast memory for data a computer or server needs immediately, while NAND is long-term flash storage used in devices like SSDs and smartphones.

Why Ho Is Bullish on Micron Stock

Ho pointed out that DRAM supply is likely to stay constrained well into 2026 as high-bandwidth memory (HBM) absorbs a growing share of bit capacity. He said the favorable supply-demand setup is lifting average selling prices and should support sustained margin expansion.

In NAND, Ho sees momentum building as device makers increase storage content. He highlighted demand from recent smartphone launches and hyperscalers ramping enterprise SSDs as positive signs for pricing trends.

The analyst also addressed investor concerns over HBM pricing in 2026, which he views as overstated. He believes Micron can hold market share and profitability in HBM even if pricing normalizes, given its strong position in AI-related demand. He now expects CY26 revenue of $54.3 billion, up 3% from prior estimates, and EPS of $15.45, up 6% from $14.55.

He added that management is unlikely to provide new details on HBM contract talks, given uncertainty around 2026 supply and customer product launches.

Is Micron a Good Stock to Buy?

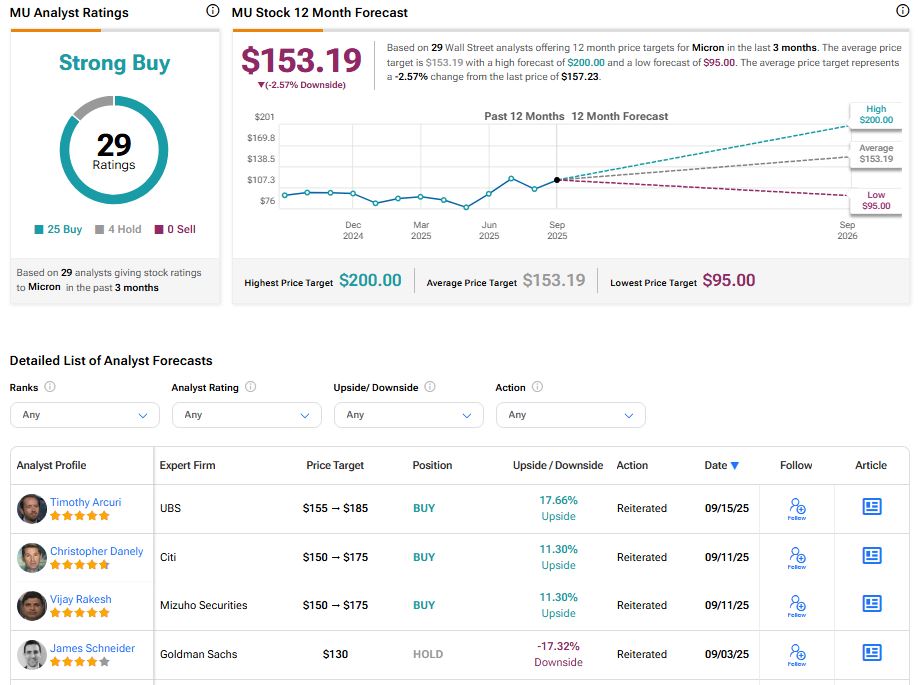

Wall Street analysts maintain a Strong Buy rating on Micron stock, with 25 Buys and four Holds assigned over the past three months. The recent rally has brought the stock close to Micron’s average price target of $153.19, implying about 2.57% downside from current levels.