Oracle (ORCL) Seals Monumental $300B Cloud Partnership with OpenAI

Tech giants collide as Oracle lands the cloud contract of the decade—OpenAI commits to a staggering $300 billion infrastructure overhaul.

The Architecture Behind the Deal

Oracle's cloud infrastructure will become the backbone for OpenAI's next-generation AI models, marking the largest enterprise cloud agreement in history. The deal spans 10 years and leverages Oracle's distributed cloud architecture across 66 global regions.

Market Shockwaves

Wall Street analysts scramble to upgrade price targets while legacy cloud providers watch market share evaporate overnight. Oracle stock surges 18% in pre-market trading—because nothing makes traditional investors happier than seeing old enterprise software suddenly become sexy again.

The AI Arms Race Escalates

This partnership fundamentally reshapes the cloud competitive landscape, giving OpenAI unprecedented compute scale while providing Oracle with the anchor tenant needed to challenge AWS and Azure dominance. The deal includes custom-built AI accelerators and exclusive access to Oracle's next-generation data center designs.

Sometimes the dinosaurs do learn new tricks—especially when there's $300 billion on the table.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The news comes as Oracle stock soared as much as 40% on Wednesday, its biggest single-day rally since 1999. Investors are bullish on its future, with the company projecting cloud infrastructure revenue to hit $18 billion this year, and potentially $144 billion by 2029.

Following this rally, co-founder Larry Ellison saw his net worth surge by $88 billion, making him the world’s richest person.

OpenAI Turns to Oracle for Massive AI Compute Power

Under the deal, OpenAI will purchase compute power from Oracle, using its expanding network of AI-focused data centers. The deal requires a huge 4.5 gigawatts of power, which is about as much as two Hoover Dams or enough to power four million homes.

Oracle’s infrastructure, known for its enterprise-grade reliability and cost efficiency, is expected to support OpenAI’s most advanced models and future innovations.

This deal WOULD significantly expand the existing relationship between the two companies. OpenAI began using Oracle’s cloud infrastructure in 2024. Also, it aligns with the $500 billion Stargate initiative, a joint effort by OpenAI, Oracle, and SoftBank (SFTBY) to build domestic data centers and supercomputing hubs.

High-Stakes Gamble for Both Companies

The agreement is a risky bet for both partiesWSJ said. OpenAI, a startup that is still losing money, is expected to spend $60 billion a year for this deal. This is far more than the $10 billion in revenue it disclosed in June.

For Oracle, the deal means concentrating a major portion of its future revenue on a single customer. To fulfill the contract, the company will likely need to take on additional debt to acquire the specialized AI chips required to power the new data centers.

Is Oracle a Buy, Sell, or Hold?

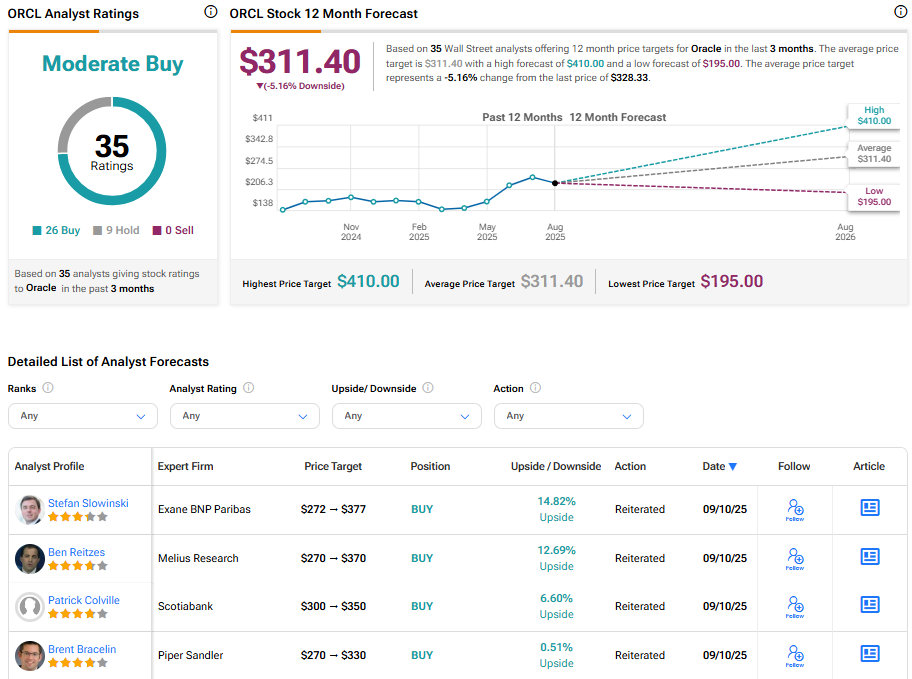

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ORCL stock based on 26 Buys and nine Holds assigned in the past three months. Further, the average ORCL price target of $311.40 per share implies 5.16% downside risk.