IREN Stock (IREN) Soars as AI Cloud Business Expands - Nvidia GPU Fleet Arrives

IREN rockets higher as artificial intelligence infrastructure demand hits fever pitch.

Nvidia's next-gen GPUs land—just as compute-hungry AI models explode across enterprise and consumer applications.

The market's betting big on infrastructure plays—while traders who missed the early AI wave now scramble for exposure.

Another day, another stock pumped on AI hype—because fundamentals are so 2023.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The boost comes a day after Daniel Roberts, the company’s co-founder and co-CEO, noted that the “demand for our AI Cloud is accelerating.” Roberts also said the firm was preparing to receive over 9,000 Blackwell graphics processing units (GPUs) from chipmaker Nvidia (NVDA) over the coming months to expand its artificial intelligence-powered cloud business.

IREN was recently admitted into the Nvidia Preferred Partner Program, giving the company priority access to the chip designer’s latest GPUs. As part of its expansion, the Sydney-based firm plans to install the incoming GPUs at its site in Prince George, British Columbia, Canada, where it is constructing a new facility to install Nvidia’s GB300 NVL72 systems. These systems are Nvidia’s high-end, liquid-cooled AI servers built around the Blackwell GB300 GPU.

IREN Misses Wall Street’s Estimates

IREN has continued to rally despite missing Wall Street’s revenue projection for its most recent quarter. In its fiscal fourth-quarter 2025 results released in late August, the company, which also mines Bitcoin, generated $187.3 million in revenue, below the estimated $188.91 million.

However, for a company that frequently reports a net loss, IREN saw a net income of $176.9 million during the recent quarter. This is even as the company looks to expand its AI Cloud server business to 10,900 Nvidia GPUs, with over 80% of those from the chipmaker’s Blackwell models.

Furthermore, IREN mined fewer Bitcoins in August, with the number dropping by over 8% from 728 BTC in July to 668 BTC in August. However, the company continues to maintain a positive outlook.

“Following record fiscal year and quarterly earnings, we delivered another month of solid performance, generating $53m of hardware profit in August despite seasonal curtailment and electricity prices,” said CEO Daniel Roberts.

IREN’s brighter prospects for its AI cloud business coincide with the time investors in Oracle (ORCL) are focusing on the enterprise technology giant’s cloud infrastructure revenue as a key driver for future growth.

Is IREN a Good Stock to Buy?

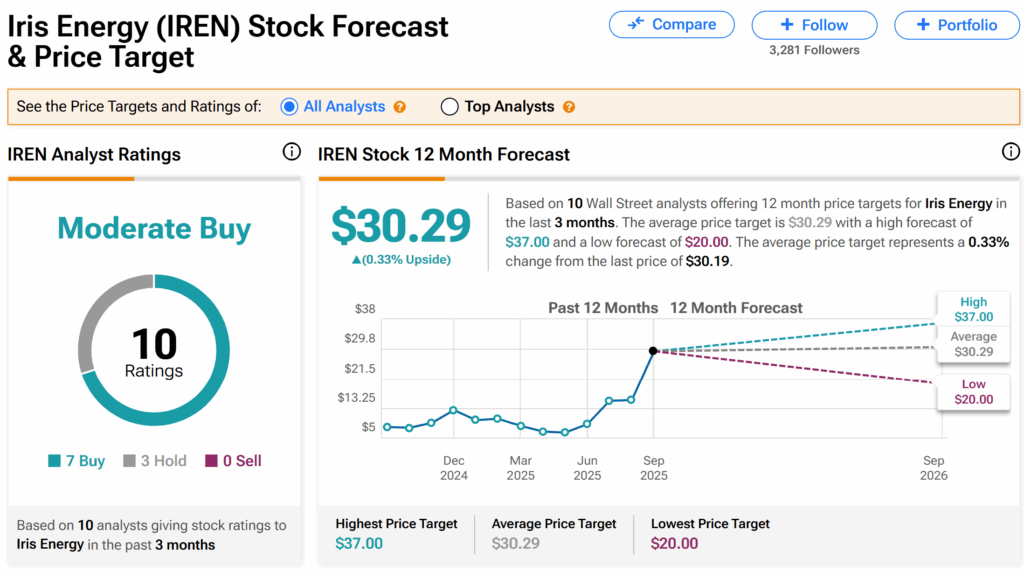

Analysts on Wall Street are generally cautious about IREN’s shares. On TipRanks, the stock has a Moderate Buy consensus recommendation based on seven Buy and three Hold ratings by 10 Wall Street analysts over the last three months.

The average IREN price target is $30.29, which indicates a potential marginal growth of 0.33% from current levels.