Analyst Sounds Alarm: Downgrades NIO Stock to ’Hold’ Amid Market Turbulence

NIO investors hit the brakes as Wall Street sentiment shifts sharply.

Time for caution—that's the message ringing across trading floors today. A prominent analyst just slashed NIO's rating to Hold, signaling potential turbulence ahead for the electric vehicle maker.

Market nerves are showing. The downgrade reflects growing concerns about valuation pressures and competitive headwinds in the EV space. No specific numbers were cited—just a clear warning to reassess risk exposure.

Timing is everything. With macroeconomic uncertainties looming, the move suggests a wait-and-see approach might outperform aggressive positioning. Typical finance wisdom—close the barn door after the horse has bolted.

Bottom line: NIO's ride gets bumpier. Investors might want to fasten their seatbelts instead of reaching for the accelerator.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Notably, the company reported second-quarter sales of $2.65 billion, up 9% year-over-year but shy of the consensus estimate of $2.73 billion. Meanwhile, adjusted earnings per ADS came in at $0.32, just above the forecast of $0.31. On the deliveries front, the company reported 72,056 vehicles in Q2, up 25.6% year-over-year. Looking ahead, the company expects to deliver 87,000 to 91,000 vehicles, representing growth of 41% to 47%. It also projects revenue of $3.04 billion to $3.19 billion, an increase of 16.8% to 22.5% from a year earlier.

Analyst Moves to the Sidelines on NIO Stock

Pozdnyakov said NIO posted strong growth in vehicle deliveries during the quarter, helped by the initial sales from its new FIREFLY sub-brand. At the same time, he noted that the refresh of NIO’s models has pushed the average selling price (ASP) lower, which is putting pressure on margins.

He also pointed to NIO’s third-quarter delivery and revenue guidance, which came in well below Wall Street forecasts. Even though the company is delivering more vehicles, he sees weaker pricing and a softer outlook as signs that profitability will remain under pressure.

Given these factors, Pozdnyakov raised his target price to reflect the recent recovery in the stock but said the downgrade to Hold was necessary. In his view, upside will stay limited until NIO can stabilize pricing and show clearer progress on earnings.

Is NIO Stock a Buy?

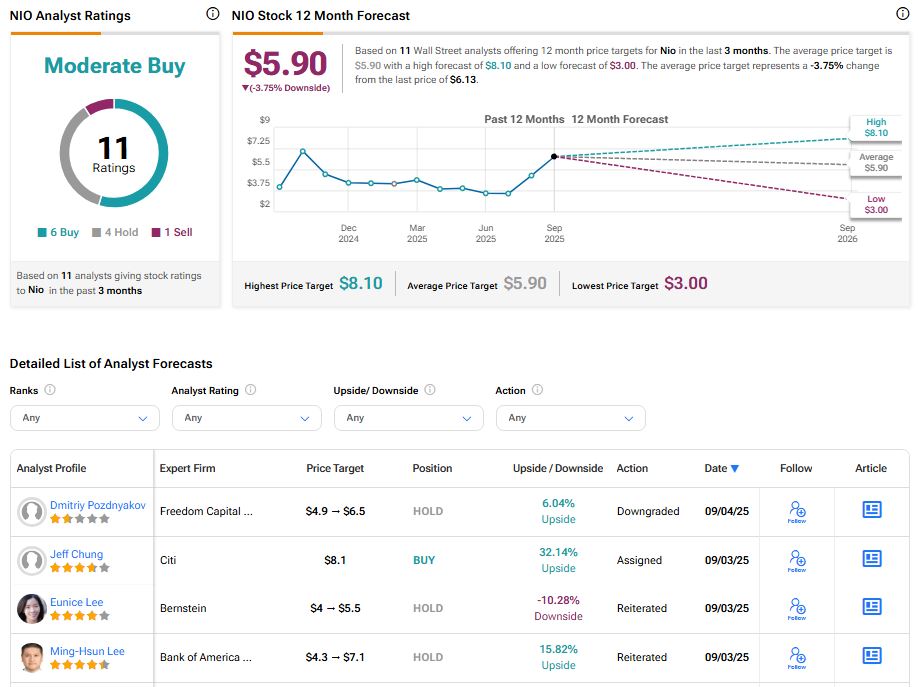

On TipRanks, Nio stock has a Moderate Buy consensus rating based on six Buys, six Holds, and one Sell rating. The average Nio price target of $5.90 implies 3.75% downside potential from current levels. Meanwhile, NIO stock has surged 40.6% so far this year.