AMD Stock Surges Following Critical AM5 CPU Socket Failure Resolution Update

AMD shares rocket upward as the chipmaker addresses widespread AM5 socket reliability concerns—proving once again that in tech, fixing catastrophic failures can be more profitable than preventing them.

Socket Gate Contained

AMD's swift response to mounting reports of AM5 socket failures on premium motherboards has investors breathing a sigh of relief. The company's technical update outlines concrete steps to address thermal and mechanical stress points that led to premature socket degradation.

Market Reaction Defies Logic

Traders piled into AMD stock despite the update containing zero financial guidance or warranty cost projections. Because nothing says 'bullish' like celebrating that a premium product didn't remain fundamentally broken. The finance crowd's enthusiasm suggests they'd buy stock in a sinking ship if management promised extra buckets.

Engineering Over Earnings

AMD's focus remains on technical remediation rather than financial damage control. The update detailed material improvements and validation processes without a single mention of revenue impact—a refreshing approach that somehow made shareholders even more optimistic about future earnings.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

These latest comments suggest that AMD isn’t to blame for failed AM5 CPU sockets and that consumers should take the issue up with motherboard makers. It could be that motherboard makers are trying to squeeze too much out of AMD CPUs with overclocking, resulting in the failures.

News of the AMD AM5 CPU socket issues picked up momentum in April, when a Reddit thread was created to compile consumer complaints. This Reddit thread swelled to over 100 reported failures, with the majority of them taking place on ASRock motherboards. Other boards that experienced failures included those made by Asus, MSI, and Gigabyte.

AMD Stock Movement Today

AMD stock was up 1.54% on Tuesday, extending a 37.33% year-to-date rally. The company’s stock has also increased 8.54% over the past 12 months. While AMD started off the year rough thanks to tariffs and artificial intelligence (AI) news, shares have slowly made up for losses earlier in 2025 with recent gains. Another bit of news lifting the stock up today is a deal with IBM (IBM) concerning quantum computing.

Is AMD Stock a Buy, Sell, or Hold?

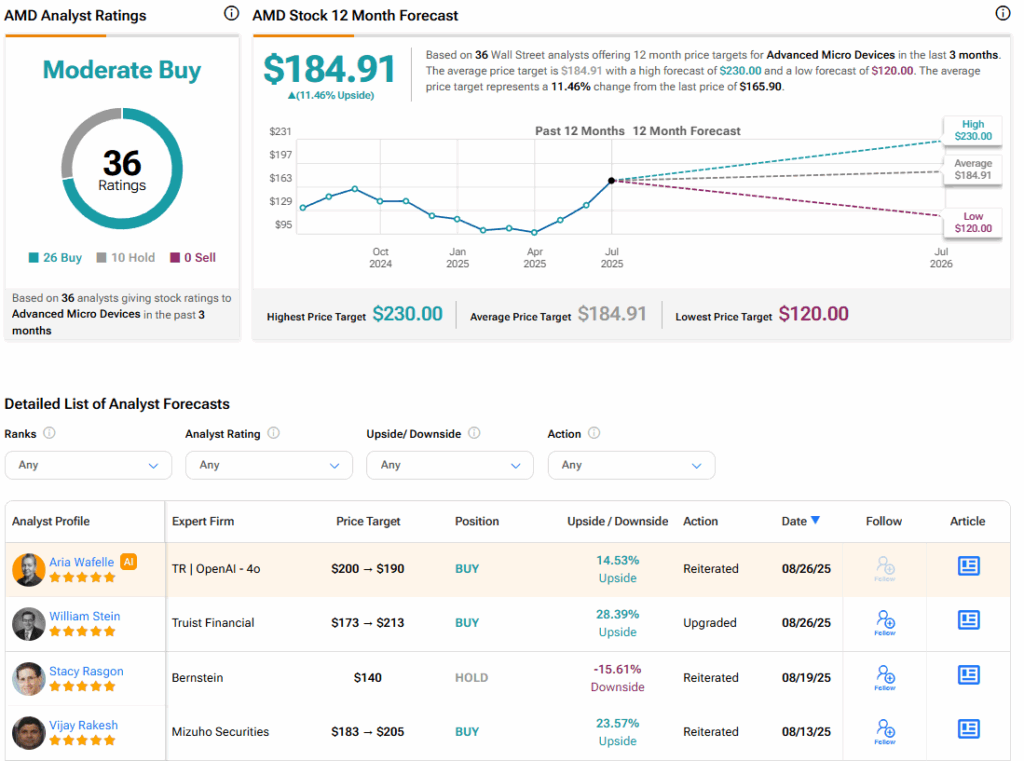

Turning to Wall Street, the analysts’ consensus rating for AMD is Moderate Buy, based on 26 Buy and 10 Hold ratings over the past three months. With that comes an average AMD stock price target of $184.91, representing a potential 11.46% upside for the shares.