CoreWeave Stock: Analyst Predicts $180 Target—Here’s the Bull Case

Cloud infrastructure play CoreWeave just got a major vote of confidence—one analyst sees shares rocketing to $180. Here’s what’s driving the optimism.

High-Performance Demand

AI and rendering workloads are exploding—and CoreWeave’s GPU-heavy infrastructure sits right in the sweet spot. The company’s not just renting out generic cloud space; it’s supplying the computational muscle behind generative AI, large-scale simulations, and complex scientific workloads. That specialization fuels premium pricing and sticky contracts.

Financials & Scaling

Massive rounds of funding—we’re talking billions—have positioned CoreWeave to aggressively expand its data center footprint. Revenue multiples in cloud infra have traditionally made Wall Street drool, and CoreWeave’s growth trajectory appears to be hitting a rhythm that justifies the hype. At least, that’s what the bulls are banking on.

Risks & Realities

Let’s be real—every infrastructure company claims it’s ‘AI-native.’ Execution is what separates the winners from the also-rans. Supply chain constraints for high-end GPUs, competition from hyperscalers, and the cyclical nature of tech spend all loom as potential headwinds. And sure, another analyst upgrade wouldn’t hurt—Wall Street loves a good narrative almost as much as it loves fees.

Bottom line: $180 isn’t just a number—it’s a bet on CoreWeave dominating the next era of accelerated computing. Nail execution, and it’s within reach. Miss, and it’s just another ambitious price target collecting digital dust.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

That turbulence set in after the company’s Q2 2025 results, with shares tumbling more than a third. Revenues were a robust $1.21 billion, beating estimates by $131.4 million, but earnings of $-0.27 per share missed by $0.04. Adding to investor unease, interest expenses ballooned from $67 million in Q1 2024 to $267 million in the latest quarter.

Beyond the earnings miss, the August lockup expiration opened the door for early investors to cash out, unleashing heavy selling volume.

Even so, not everyone sees the selloff as the end of the story. H.C. Wainwright’s Kevin Dede argues that the recent pullback could set the stage for long-term gains, noting, “We like the CoreWeave story as a leader in perhaps one of the most influential technology adoption cycles of our time.”

Backing his bullish stance, Dede points to management’s decision to raise FY 2025 revenue guidance to $5.25 billion, alongside his own FY 2026 forecast of $11.2 billion. On that basis, the analyst believes the lower share price opens the door for investors to “enjoy healthy returns to previous stock levels.” Using his FY 2026 EBITDA estimate of $6.2 billion, CRWV trades at just 8.4x EV-to-EBITDA, well below the 15x to 20x range typically awarded to cloud and datacenter players.

But numbers alone don’t capture the full picture. Dede highlights what he views as the company’s ace-in-the-hole – its unusually close partnership with Nvidia, a relationship that strengthens CoreWeave’s positioning far beyond software development. Combined with the stock’s recent dip, he sees this as a compelling entry point, especially as AI adoption continues to reshape nearly every business sector.

Tying it all together, Dede sets a $180 price target – representing 91% upside – and says he is now “fully on the bullish side,” upgrading CRWV to a Buy. (To watch Kevin Dede’s track record, click here)

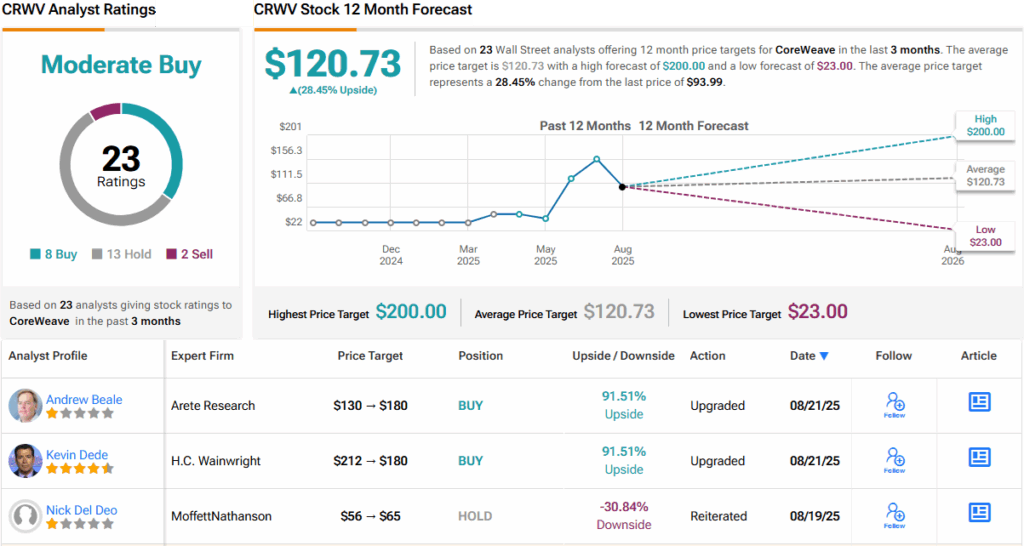

Overall, Wall Street’s stance on CRWV leans positive, though not without caution. The stock carries a Moderate Buy consensus based on 8 Buys, 13 Holds, and 2 Sells. Analysts’ 12-month average price target of $120.73 implies upside potential of ~28% from current levels. (See)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.