Why Are Investors Fleeing Palantir Stock (PLTR)? The Shocking Truth Behind the Exodus

Palantir's bleeding—and Wall Street's watching the exits.

Data darling PLTR faces a brutal reckoning as institutional money pulls the plug. The once-unstoppable gov-tech play now trades like a meme stock—all hype, zero patience.

Revenue growth? Stalling. Profit margins? Squeezed. The AI narrative that fueled its epic run now sounds like a broken record to traders chasing hotter plays in crypto and semiconductors.

Meanwhile, retail bagholders keep chanting 'long-term vision' while hedge funds cash out quietly. Classic Wall Street—pump the story, dump the stock, and let Main Street hold the bag.

Palantir either reinvents itself fast or becomes another cautionary tale in the tech graveyard. Tick tock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What’s Happening with PLTR Stock?

Shares of Palantir closed slightly higher on Friday. Still, the stock ended the session at $158.74, marking a 9.5% drop over the past five trading days. This pullback, combined with other market signals, has raised questions about whether the rally in AI-related stocks is beginning to cool.

Despite the recent weakness, PLTR shares remain up about 109% so far in 2025, fueled by strong demand for AI solutions and lucrative government contracts. However, the stock continues to trade nearly 15% below its all-time high.

What’s Driving Palantir’s Pullback?

Recently, concerns around the AI sector have started to grow. OpenAI’s CEO warned that the current AI boom could be nearing a bubble. Moreover, a study from the Massachusetts Institute of Technology found that many large companies are seeing disappointing returns from their AI projects.

Adding to the pressure, short seller Andrew Left of Citron Research said he is betting against Palantir, pointing to the stock’s high valuation. Meanwhile, CFRA analyst Janice Quek noted in a Thursday report that Palantir shares have been sliding as part of a broader market pullback and rotation, particularly within the information technology sector.

Is PLTR a Good Stock to Buy Now?

Despite recent concerns, investors remain confident in the stock due to its solid footing in the rapidly expanding AI sector. Looking ahead, many believe the company is well-positioned to translate its advanced AI technologies into practical solutions for both government agencies and enterprise clients.

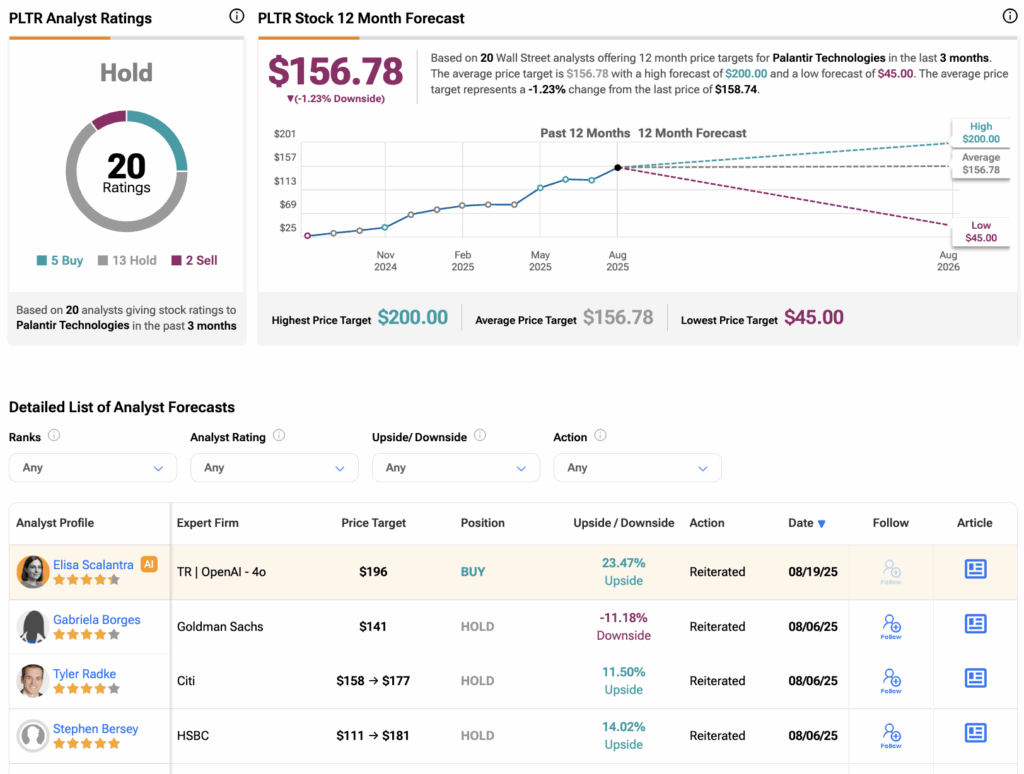

According to TipRanks consensus, PLTR stock has a Hold rating, based on five Buys, 13 Holds, and two Sells assigned in the last three months. The average Palantir share price target is $156.78, which implies a downside of over 1.23% from current levels.