Snap Stock Surges as Q2 Earnings Clear ’Low Bar’—Wall Street Breathes (For Once)

Snapchat's parent company just pulled off a classic 'beat the lowered expectations' rally—because when the bar's on the floor, even a stumble looks like a leap.

Wall Street's favorite parlor trick: Set expectations so comically low that missing them would require corporate sabotage. Snap's Q2 earnings? A textbook case.

The market's reaction? A Pavlovian green candle. Because in 2025's casino economy, 'less bad' is the new 'good.'

Cynical footnote: If every 'beat' came from analysts moving goalposts, we'd all be Warren Buffett.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

The Edgewater Research analysts specifically note that Wall Street’s average revenue estimate of $1.343 billion is too low. Instead, the firm provided a higher revenue estimate for Snap to overcome, set at $1.362 billion. It highlighted ongoing progress with Direct Response but noted that the company has been capped by ongoing macroeconomic concerns.

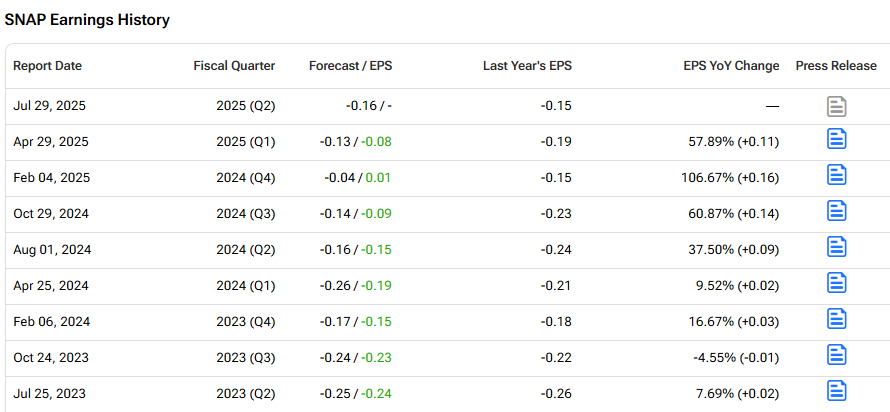

Investors will also note that Wall Street expects Snap to report adjusted earnings per share of -16 cents in Q2 2025. The company is likely to do so, as it has beaten analysts’ EPS estimates in all eight of its most recent quarters.

Snap Stock Movement Today

Investors have taken a liking to Snap stock ahead of the company’s earnings report. This has shares up 6.76% this morning, but the stock is still down 19.31% year-to-date and 50.99% over the past 12 months. Today’s rally also came with heavy trading, as 26.94 million shares changed hands this morning, compared to a three-month daily average of about 28 million units. SNAP stock’s current momentum suggests it will surpass its daily average trading volume.

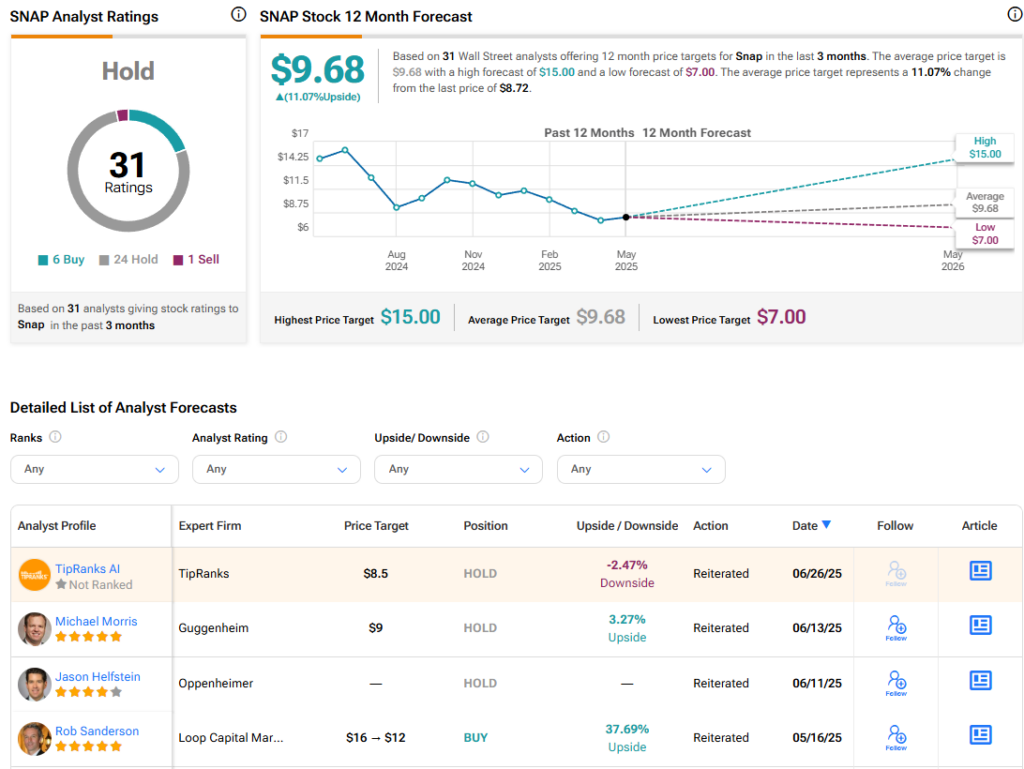

Is Snap Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus estimate for Snap is Hold, based on six Buy, 24 Hold, and a single Sell rating over the past three months. With that comes an average SNAP stock price target of $9.68, representing a potential 11.07% upside for the shares.