S&P 500 Stalls as Inflation Roars Back—Is This the Fed’s Nightmare Scenario?

Markets hit a wall as inflation resurges, threatening the S&P 500's rally. Traders brace for volatility—because nothing says 'stable economy' like erratic CPI prints.

Here’s the kicker: The Fed’s 'transitory' narrative just got another reality check. Will Powell pivot, or double down? Either way, Wall Street’s algo-trading overlords are already pricing in the chaos.

Meanwhile, crypto quietly smirks from the sidelines—decentralized, inflation-resistant, and utterly unimpressed by traditional finance’s recurring meltdowns. Sound familiar?

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

In May, the CORE PCE index rose by 0.2% month-over-month, higher than the expectation for a 0.1% rise. It rose by 2.7% on a yearly basis, also above the expectation for a 2.6% rise. In addition, April’s core PCE was revised higher to 2.6% from 2.5%. The core PCE index strips out food and energy prices from the PCE index given their volatile nature.

The PCE index increased by 0.1% MoM and 2.3% on a yearly basis, both of which were in line with their respective estimates.

Fed Warns of Delayed Inflation

In recent weeks, several Fed officials, including Fed Chair Jerome Powell, have advocated for a “wait-and-see” approach in regard to lowering interest rates. They have argued that tariff-driven inflation could materialize later on in the year. May’s core PCE update could be proving them right.

On the other hand, Fed Governors Chris Waller and Michelle Bowman have said that the central bank is in a good spot to begin cutting rates in July.

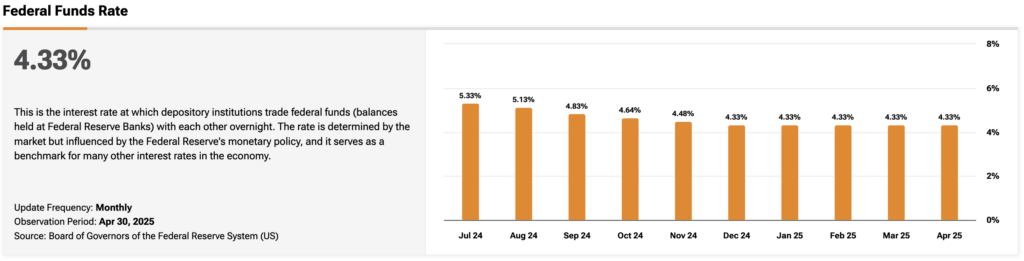

The odds of a 25 basis points rate cut in July are unchanged from yesterday at 20.7%, while the same odds in September have slightly fallen to 73.2% from 74.3%.

Track the federal funds rate and other key economic metrics with TipRanks’ Economic Indicators Dashboard.