Breaking: CoreWeave (CRWV) Nears Game-Changing Acquisition of Core Scientific

Mining titan Core Scientific could soon fall under the umbrella of GPU-cloud powerhouse CoreWeave—marking what could be the most consequential crypto infrastructure deal of 2025.

Why it matters: This isn't just another boring M&A footnote. We're talking about a potential vertical integration play that could reshape competitive dynamics in both AI compute and Bitcoin mining.

The cynical take: Because nothing solves a company's problems quite like getting acquired by a well-capitalized competitor—until the integration headaches begin. Wall Street analysts are already placing bets on how long until the first 'synergy-related' layoffs.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Core Scientific, which is now valued at roughly $3.7 billion despite a 15% drop in its stock price this year, is one of the largest digital infrastructure providers for Bitcoin mining and hosting in North America. Meanwhile, CoreWeave—valued at around $75 billion after going public in March—offers AI cloud services and leases access to Nvidia GPUs to major tech clients, such as Microsoft (MSFT), Meta (META), and IBM (IBM). In fact, Microsoft alone accounted for 62% of CoreWeave’s revenue in 2024, based on the company’s IPO filing.

It is worth noting that the two companies already have a strong working relationship. In June 2023, they entered a 12-year hosting deal in which Core Scientific would provide hundreds of megawatts to power CoreWeave’s operations. As demand for data centers and power surges due to the AI boom, Core Scientific and other Bitcoin miners are looking to capitalize on the growing shortage of digital infrastructure.

Is CRWV a Good Stock to Buy?

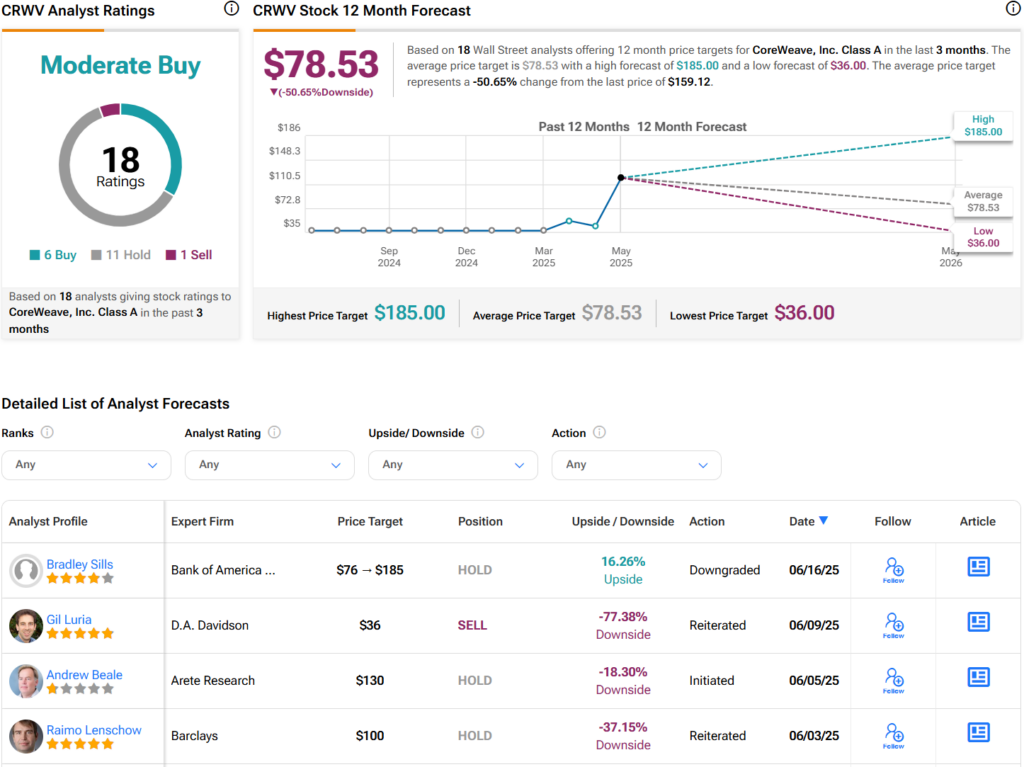

Turning to Wall Street, analysts have a Moderate Buy consensus rating on CRWV stock based on six Buys, 11 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average CRWV price target of $78.53 per share implies over 50% downside risk.