CRCL Under Siege: 3 Risk Factors Threatening Circle Internet Stock in 2025

Wall Street's latest whipping boy? Circle Internet's CRCL stock is flashing warning signs as institutional sharks start circling.

The bear case no one's talking about

Regulatory overhang from last quarter's stablecoin scrutiny hasn't disappeared—it's just been priced in wrong. Meanwhile, the Fed's balance sheet unwind threatens to drain liquidity from all crypto-adjacent plays.

Institutional exodus underway

Volume patterns show smart money rotating into boring utility stocks while retail traders double down on hopium. The last time this divergence happened? February 2024, right before the great crypto correction.

The Tether effect

Every 1% drop in USDT market cap historically correlates with 2.3% downside in CRCL—and Tether's reserves just got another side-eye from the SEC. But hey, at least Circle's accountants actually answer their phones.

Circle's facing the perfect storm of macro headwinds and sector-specific jitters. Will they innovate or become another cautionary tale in the crypto graveyard? Only time—and maybe a few subpoenas—will tell.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

The passage of the proposed stablecoin legislation, the GENIUS Act, by the Senate helped fuel investor Optimism about the crypto stock. Let’s look at the risks that have been recently highlighted.

CRCL Stock Faces These Risks

While the BIS report spoke positively about tokenization and the digitalization of money, it highlighted some shortcomings of stablecoins. BIS thinks that stablecoins “fall short of requirements to be the mainstay of the monetary system when set against the three key tests of singleness, elasticity, and integrity.” It added that without adequate regulation, stablecoins could present risks to financial stability and monetary sovereignty.

BIS also believes that these tokens cannot assure one-to-one parity with central bank money. They may also struggle due to liquidity issues and the lack of ability to prevent financial crimes. These risks, discussed by BIS, could weigh on investor sentiment.

Additionally, experts have noted Circle Internet’s high dependence on interest income, which could fall if interest rates are lowered. Further, the company owes 50% of its revenue from interest earnings on USDC reserves to crypto exchange Coinbase Global (COIN).

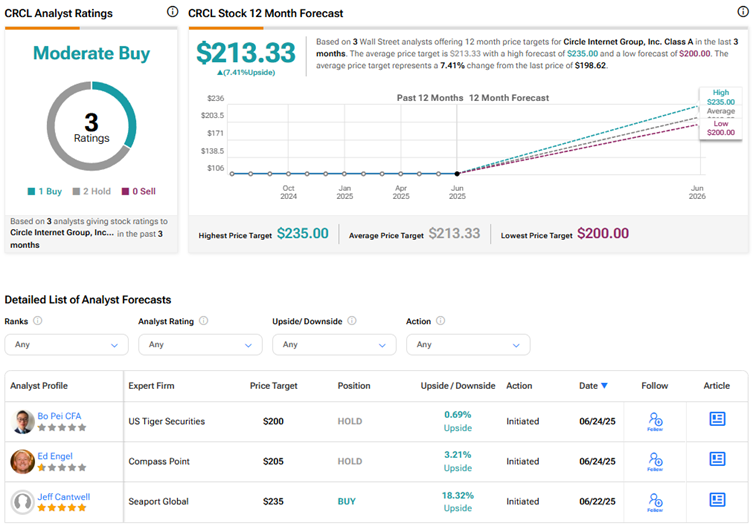

Meanwhile, Wall Street analysts acknowledge Circle Internet’s position as a dominant issuer of regulated stablecoins, which is well-positioned to benefit from increased adoption of stablecoins amid a favorable regulatory framework. However, they are concerned about CRCL stock’s steep valuation. For instance, Compass Point analyst Ed Engel, who recently initiated coverage of Circle stock with a Hold rating and a price target of $205, argues that it is tough to justify a higher valuation, as optimistic long-term assumptions are already priced into the stock.

Analysts have also noted the threat of rising competition from banks and fintechs, especially after there is more clarity on the regulatory front.

Is CRCL Stock a Buy, Sell, or Hold?

Overall, Wall Street is cautiously optimistic on Circle Internet Group stock, with a Moderate Buy consensus rating based on two Holds and one Buy rating. The average CRCL stock price target of $213.33 indicates 7.4% upside potential from current levels.