Tesla Stock Skyrockets as Robo-Taxi Revolution Hits the Streets in 2025

Elon's autonomous gamble pays off—TSLA surges as first fleet of driverless cabs goes live.

Wall Street scrambles to revise price targets while crypto bros rage-tweet about 'legacy auto catching up to DeFi mobility.'

The real winner? Short sellers getting steamrolled—again.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Tesla Hits the Gas with $4.20 Rides

Over the weekend, Tesla deployed its self driving fleet in Austin, charging a flat $4.20 per ride to select users. Social media lit up with first impressions. Many passengers praised the experience but not everything went smoothly. One clip showed a vehicle missing a turn and drifting into the wrong lane. Still, the launch proved Tesla’s autonomy play is moving beyond theory.

Wall Street Starts Pricing in the Robo-Taxi Future

The service marks a new phase for Tesla. Autonomous driving has always been the moonshot, and now it has real world traction. Analysts say the implications are huge. Battle Road’s Ben ROSE compared the rollout to “the first inning” of a long game. Alphabet’s (GOOGL) Waymo currently runs 250,000 rides a week and generates an estimated 260 million dollars annually. Tesla is not there yet, but the race has officially started.

Geopolitical Calm Fuels Risk Appetite

It wasn’t just Tesla that bounced. The whole risk asset complex caught a tailwind after U.S. President TRUMP brokered a temporary ceasefire between Israel and Iran. Global tensions cooled, markets relaxed, and growth stocks surged. Tesla, already positioned for a sentiment rally, became the breakout beneficiary. In a world tense with war and inflation, even a brief peace can swing billions.

Tesla stock is still in the red for 2025 but up more than 90 percent over the past 12 months. Monday’s rally, and Tuesday’s pre market follow through, show renewed investor belief. Tesla is no longer just an electric car company. It is positioning as an AI and software leader on wheels.

Can Tesla Scale?

The big question now is whether Tesla can scale. Waymo has been operating for years and still struggles with profitability. Tesla will face regulatory tests and public scrutiny. Edward Jones analyst Jeff Windau said accidents are inevitable and the real test will be how Tesla handles them. But for now, it has momentum on its side.

Is Tesla a Buy, Sell, or Hold?

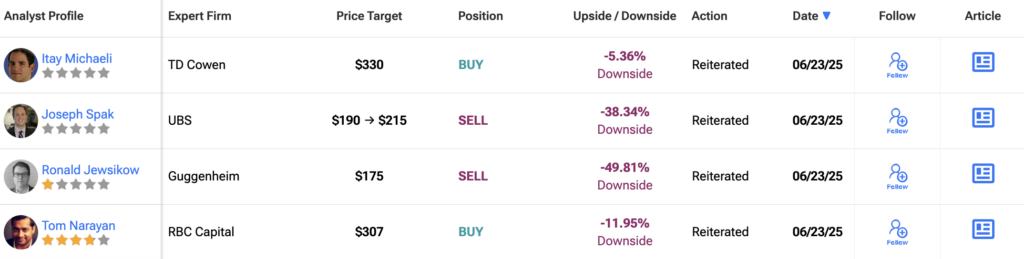

Despite the robo-taxi launch, Wall Street isn’t exactly throwing confetti. According to data from TipRanks, Tesla holds a lukewarm “Hold” consensus rating based on 35 analysts. Analyst sentiment is mixed, with 14 rating the stock a Buy, 12 opting to Hold, and nine recommending a Sell. In short, Wall Street is split.

The average 12-month TSLA price target sits at $287, which implies a sharp 18% downside from current levels around $348.

But if the robo-taxi launch goes well and Tesla shows it can scale, expect analysts to start nudging up their price targets and shifting their tone.