UBS Bullish on Tesla: $235 Target Amid Robotaxi Skepticism—’Hype ≠ Valuation’

Wall Street's optimism meets reality check as UBS hikes Tesla's price target while throwing shade on Robotaxi dreams.

Numbers Don't Lie (But Narratives Do)

UBS analysts just slapped a $235 price target on Tesla—a bullish upgrade that still comes with a side of skepticism. The kicker? They’re calling out the Robotaxi hype train as 'not valuation-justified.'

The Fine Print

No one’s denying Tesla’s tech mojo, but UBS warns investors: don’t confuse Elon’s sci-fi promises with hard financials. The report suggests the stock’s current run might be fueled more by FOMO than fundamentals.

Cynical Finance Jab

Because nothing says 'healthy market' like analysts raising targets while simultaneously eye-rolling the company’s flagship growth narrative. Classic Wall Street—covering both bases before the bubble pops.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

A Cautious Approach Despite Huge Market

UBS estimates a potential fleet of 2.3 million robotaxis by 2040, generating about $200 billion in annual revenue. It values the robotaxi business alone at $99 per share. That number is now baked into its new model for Tesla. Still, the bank is cautious. It believes the stock remains fully valued even after factoring in the upside from robotaxis and humanoid robots.

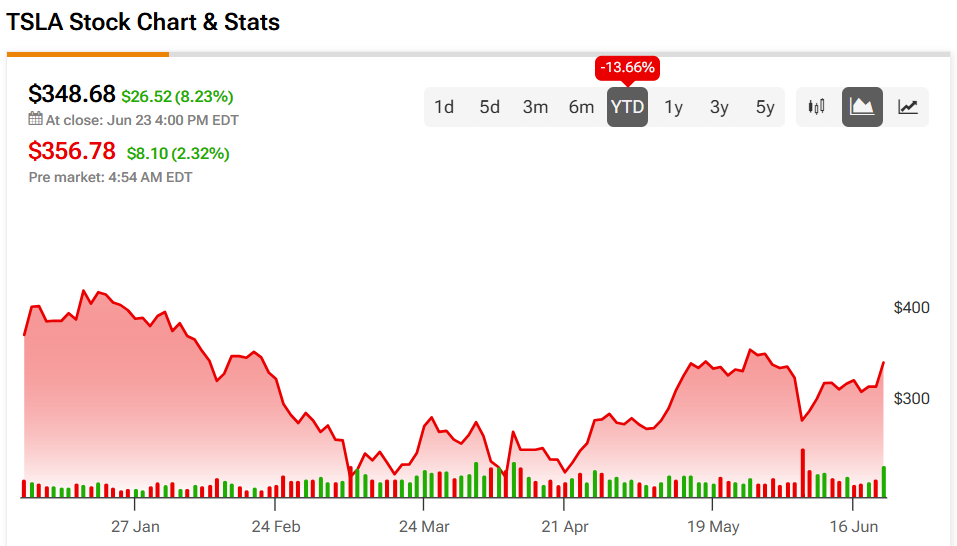

Elon Musk has described autonomy and robotics as key drivers of Tesla’s future. UBS agrees, but highlights significant execution risks. It also notes that Tesla’s valuation already prices in much of this growth. At a $1.14 trillion market cap and a P/E ratio of 181, the stock leaves little room for error.

While investor sentiment has turned bullish on Tesla’s AI and autonomous bets, UBS is taking a more reserved view. They are examining the fundamentals, regulatory hurdles, and the time required to realize the potential of these ventures fully.

In short, UBS sees long-term promise but is not convinced it justifies the current stock price. The firm is urging investors to remain grounded, even as Tesla makes headlines with key moves in autonomy.

Is Tesla Stock a Buy, Sell, or Hold?

On the Street, Tesla boasts a Hold position, based on 35 analysts’ ratings. The average TSLA stock price target is $287, implying a 17.69% downside.