Intel Stock: ‘The Elephant in the Room Is Screaming—Are You Listening?’ Warns Top Investor

Intel's bulls keep polishing the silver while the house burns. Here's why Wall Street's favorite dinosaur might need more than a rebrand to survive the AI arms race.

The chip giant's identity crisis

Once the undisputed king of silicon, Intel now plays catch-up in a world where Nvidia writes the rules. Foundry woes? Check. Missed deadlines? Obviously. But the real tragedy? Watching TSMC and AMD eat their lunch with better margins and hotter products.

Wall Street's dangerous game

Analysts still price Intel like it's 2015—all those 'turnaround' bets ignore the brutal math: you can't cost-cut your way to process leadership. Meanwhile, the smart money's already betting on RISC-V to make x86 obsolete.

Intel's stock isn't a value play—it's a corporate archaeology project. And unless Pat Gelsinger really did bring a time machine back from VMware, shareholders might want to check the expiration date on those blue-chip fantasies.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

But while Optimism around Tan’s strategic overhaul is building, not everyone is convinced the path ahead is clear. INTC’s share price has yet to reflect the renewed enthusiasm – and one investor, known by the pseudonym Livy Investment Research, is raising a red flag about a looming geopolitical threat that could derail Tan’s ambitious plans.

“The increasingly adverse regulatory backdrop facing Intel’s China-dominant exposure remains a prominent yet underappreciated risk at current levels,” says the 5-star investor.

Livy points out that roughly a third of Intel’s revenues are related to China, leaving the company at risk for steep drops if this market gets cut off. While the investor notes that the current regulatory focus of the TRUMP administration is on advanced datacenter chips, there is no guarantee that this will not eventually segue into PC processors.

Adding to the investor’s worries, Taiwan recently added Huawei to its “Strategic High-Tech Commodities” Entity List. This is a big deal for Intel, as Huawei is a major customer of Intel’s PC chips that are manufactured at TSMC’s Taiwan facilities. Moreover, a parallel MOVE in China to boost domestic production will also hit Intel where it hurts.

“The momentum behind coordinated export controls by the U.S. and its allies, versus Beijing’s domestic tech substitution efforts, result in a double bind on Intel’s growth prospects,” adds the investor.

At the same time, Livy reminds investors that Tan’s capital-intensive initiative to revive Foundry has “steep execution hurdles” awaiting – while Intel has not shared its roadmap for AI infrastructure applications.

Put simply, Livy believes the market hasn’t fully digested these mounting headwinds – and that investors could be in for a rude awakening.

“We believe Intel remains prone to a potential downward re-rating from current levels, as rising geopolitical and execution risks mount across multiple fronts,” sums up Livy Investment Research, who rates INTC shares a Sell. (To watch Livy Investment Research’s track record, click here)

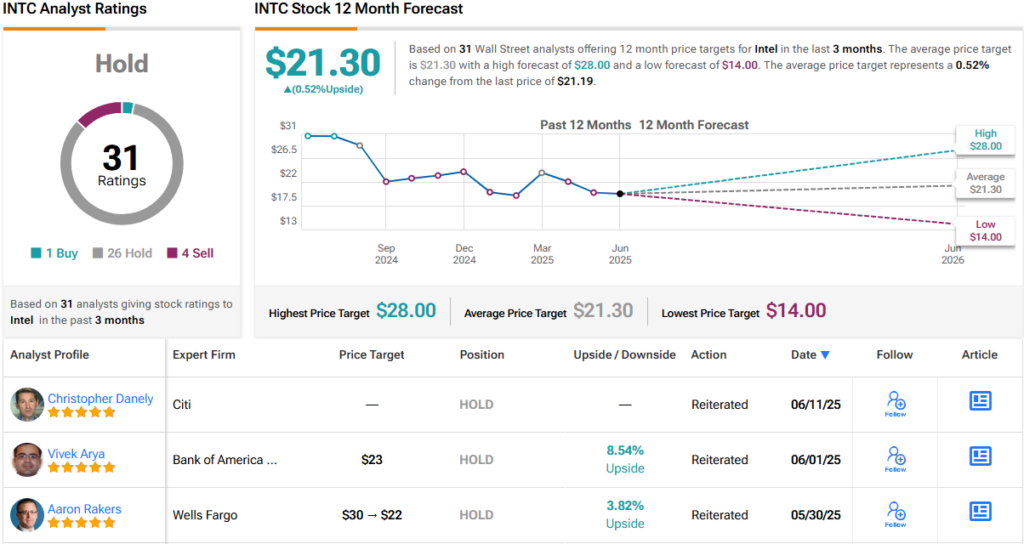

Wall Street at large is also hesitant to get behind Intel. Of the 31 recent analyst ratings, a lopsided 26 are Holds, compared to just 1 Buy and 4 Sells – all coalescing to a Hold (i.e., Neutral) consensus rating. The average 12-month price target of $21.30 suggests analysts see little movement ahead. (See)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.