SoFi Stock Surges 6% — Is This the Start of a Sustained Bull Run?

SoFi shares just ripped a 6% gain—now Wall Street's favorite question is whether this fintech can keep the momentum alive.

Breaking Down the Rally

No fluke here—the move comes amid heavy trading volume, suggesting real conviction behind the bid. Traders are clearly betting on SoFi's hybrid model of banking and tech disrupting stale incumbents.

The Big Question

Can SoFi turn a single-day pop into a lasting trend? The stock's been volatile—up 120% in 2024 before giving back half those gains. Classic fintech whiplash.

Bottom Line

Another case of 'buy first, ask questions later'—because nothing fuels FOMO like a chart screaming vertical. Just don't mention profitability timelines.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

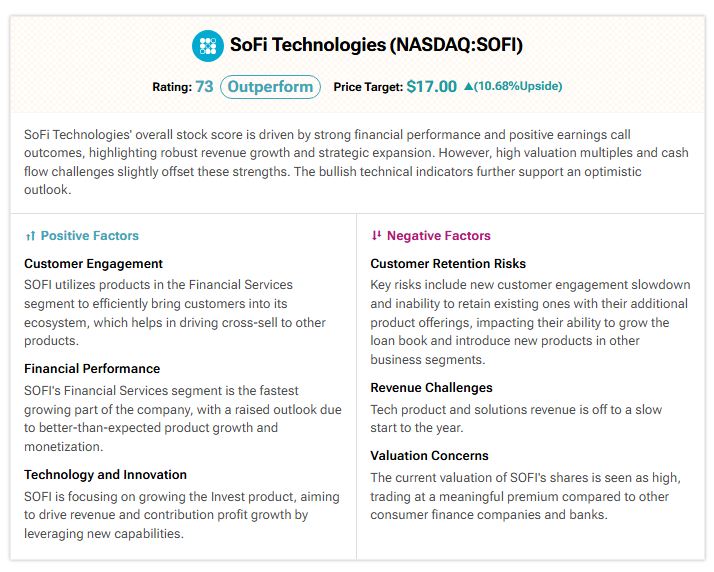

This AI-powered tool uses automated, data-backed evaluations to assess a stock’s outlook across key metrics. In SoFi’s case, TipRanks’ AI-powered stock analysis gives SoFi a score of 73 out of 100, with an “Outperform” rating, and a price target of $17, implying over 10% upside from current levels.

TipRanks AI Highlights Strong Financial Momentum

SoFi has already gained more than 20% over the past three months, supported by solid growth in its Financial Services segment. This area, which includes personal loans, banking, and investment products, remains the company’s fastest-growing business. TipRanks’ AI notes that stronger-than-expected product performance and better monetization are helping drive this momentum.

In addition, the platform highlights SoFi’s success in bringing more customers into its ecosystem. This cross-sell strategy—encouraging users to adopt multiple services—has improved engagement and supports future revenue growth.

Risks Remain

Still, the AI analysis also points to key risks. One concern is customer retention, as engagement trends have started to soften. Meanwhile, slower uptake of new offerings is expected to impact SoFi’s ability to grow its loan book or expand into other segments. Another challenge is SOFI’s steep valuation. The stock currently trades at a premium compared to peers in the financial sector.

Is SOFI Stock a Buy, Hold, or Sell?

To summarize, Wall Street has a Hold consensus rating on SoFi stock based on seven Buys, five Holds, and three Sell recommendations. The average SOFI stock price target of $14.05 implies a limited downside potential of about 8.5% from current levels.