SoundHound AI Stock Exposed: The Hidden Power Players Behind the AI Disruptor

SoundHound’s AI stock isn’t just another tech play—it’s a battleground for big money.

Who’s pulling the strings?

From Silicon Valley VCs to Wall Street sharks, the ownership breakdown reveals a high-stakes game. No fluffy 'AI revolution' talk here—just cold, hard stakes. And let’s be real: if you’re not already positioned, you’re probably just funding someone else’s yacht.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

SoundHound is a leader in voice recognition and conversational AI technology. With a diversified client base spanning automotive, IoT, and quick-service restaurants, the company is positioned at the forefront of the growing voice AI market.

Who Owns SoundHound Stock?

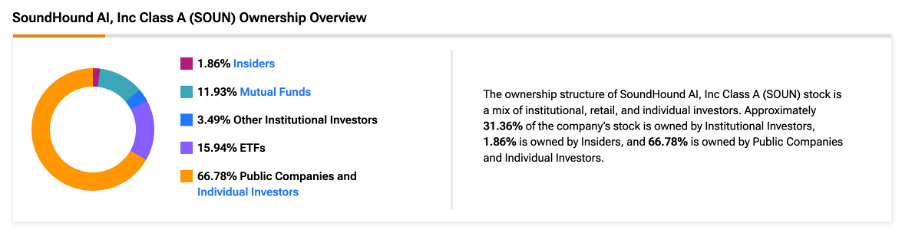

SoundHound AI stock has a diverse ownership base made up of institutions, insiders, and everyday investors. According to TipRanks’ ownership page, around 31.36% of the shares are held by institutional investors, while 1.86% are owned by company insiders. The majority, 66.78%, is held by public companies and individual retail investors.

When it comes to SoundHound AI’s top shareholders, Vanguard leads the pack with a 9% ownership stake. Notably, Vanguard Index Funds alone account for approximately 6.6% of the company.

Among ETF holders, the Vanguard Total Stock Market ETF (VTI) holds a 3.13% stake, followed by the iShares Russell 2000 ETF (IWM) at 2.2%. On the mutual fund side, Vanguard Index Funds make up 6.6%, while the Vanguard World Fund owns another 1.8% of SoundHound.

What is the Price Target for SOUN?

SoundHound stock has climbed roughly 130% over the past year, but it’s lost steam in 2025, currently trading below $10 and down over 50% year-to-date. While broader economic pressures may continue to weigh on the stock in the NEAR term, its long-term growth story remains intact.

According to TipRanks, SOUN stock has received a Moderate Buy consensus rating, with four Buys and three Holds assigned in the last three months. The average SoundHound AI stock price target is $11.50, suggesting a potential upside of 22% from the current level.