JBL Rockets 40% on Stunning $7.8B AI-Powered Earnings Blowout - 2025 Targets Cranked Up

Wall Street's favorite audio-tech play just dropped a mic.

The AI cash cannon fires

JBL's Q2 earnings didn't just beat—they vaporized expectations with $7.8B in revenue. Turns out slapping 'AI-enhanced' on everything works even better than analysts' cocaine-fueled spreadsheet models predicted.

2025 guidance? Try moon mission

The company now projects 2025 revenue will eclipse early forecasts by 22%. Apparently 'premium noise-canceling algorithms' is investor catnip these days—never mind that 90% of users can't tell the difference between AI-processed audio and their grandma's AM radio.

The cynical take

Another quarter, another tech firm discovering that attaching 'neural networks' to existing products lets them charge 300% markup. At this rate, JBL's market cap will soon surpass small EU nations—until the SEC asks where exactly all these 'AI synergies' actually live on the balance sheet.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Core operating income came in at $420 million, representing a 5.4% Core margin. Core diluted earnings per share rose 35% from the prior year to $2.55. GAAP diluted earnings per share were $2.30. JBL shares are up more than 8% since the earnings call yesterday.

AI Leads the Way

Jabil credited AI-related demand in data center infrastructure as the key driver behind the strong performance. The Intelligent Infrastructure segment saw a 51% jump in revenue, reaching $3.4 billion. Meanwhile, the Regulated Industries segment was flat year-over-year, as weakness in electric vehicle and renewable energy markets offset growth in healthcare. The Connected Living and Digital Commerce segment declined 7% due to softer sales of consumer products.

Operating cash FLOW for the quarter totaled $406 million. Free cash flow was $326 million, bringing the year-to-date total to $813 million. The company repurchased $339 million in shares during the quarter. Jabil raised its full-year revenue forecast to approximately $29 billion. It reaffirmed its full-year core operating margin of 5.4% and projected core EPS of $9.33. Free cash flow for the year is expected to exceed $1.2 billion.

For the fourth quarter, Jabil expects revenue between $7.1 billion and $7.8 billion. CORE operating income is projected to be between $428 million and $488 million. Core EPS is forecast to range from $2.64 to $3.04. The company also announced a $500 million investment to construct a new U.S. facility that will support the demand for AI data center infrastructure. Jabil expects to generate $8.5 billion in AI-related revenue in fiscal 2025.

Is JBL Stock a Buy?

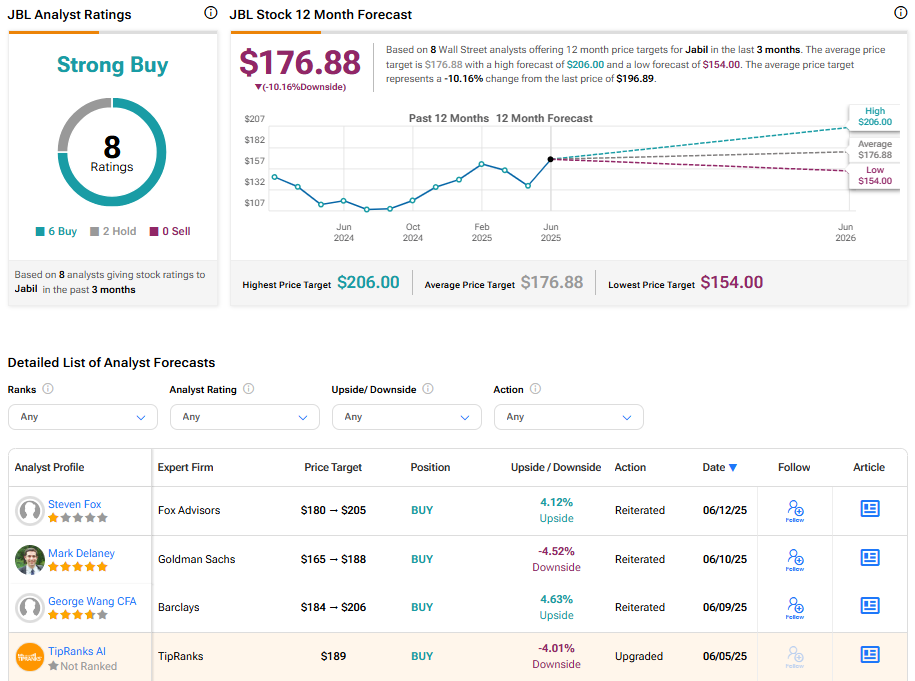

Jabil is indeed a Strong Buy according to eight analysts covering the stock. The average JBL stock price target is $176.88, implying a 10.16% downside.