Chinese AI Firms Secretly Hoard Banned Nvidia Chips to Power Covert Model Training

Silicon smugglers are at it again. Chinese AI companies are running shadow operations to train next-gen models on restricted US hardware—while regulators play whack-a-mole.

The chip shuffle

Underground data pipelines now circumvent export controls, funneling Nvidia''s forbidden GPUs into black-box research labs. No one''s reporting inventory, but warehouse manifests suggest enough A100s are floating around to make a Wall Street quant blush.

Hardware hunger games

When the US slammed the door on advanced chip exports, Beijing''s AI labs didn''t starve—they got creative. Rerouted supply chains and ''repurposed'' data centers keep the tensor cores humming. Meanwhile, domestic alternatives still can''t match Nvidia''s CUDA ecosystem.

The irony? These contraband chips are probably training models that''ll undercut US tech dominance. Wall Street''s still betting on both sides—because when has hypocrisy ever stopped a good trade?

Confident Investing Starts Here:

- Easily unpack a company''s performance with TipRanks'' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks'' Smart Value Newsletter

Regulations’ Achilles’ Heel

This workaround highlights the growing challenge U.S. regulators face in enforcing chip restrictions. While Washington has blocked the sale of Nvidia’s high-end chips, such as the H100, to Chinese buyers, it has fewer controls on data movement and cloud computing use. Chinese firms are exploiting these loopholes to access powerful computing overseas, legally renting infrastructure in Southeast Asia to continue training large-scale AI models.

The suitcase strategy is just one part of a broader effort. Some Chinese AI developers are also using cloud services from global providers like Amazon (AMZN) and Microsoft (MSFT), which are not yet restricted. Others are working with international brokers to set up offshore compute hubs in Australia, the UAE, and Singapore, further blurring the lines of enforcement.

For U.S. companies, the picture is mixed. Nvidia continues to experience strong demand for its chips globally, despite restrictions on direct sales to China. However, these reports raise the risk of tighter future regulations that could target cloud services or indirect sales. That could limit the growth of Nvidia’s data center segment, which accounted for $39 billion out of its $44 billion in Q2 revenue.

What’s Next

The impact may not be limited to Nvidia. If Chinese firms succeed in maintaining their AI development pace through these circumvention strategies, U.S. tech companies face renewed competitive pressure. China’s DeepSeek model, for instance, was reportedly (though not verified) trained on smuggled chips and has achieved performance close to OpenAI’s GPT-4.

Malaysia, now a hotspot for this activity, is facing scrutiny from U.S. officials. The Malaysian government says it is tightening rules around its data center industry. Still, enforcement remains complex.

In conclusion, Global enforcement gaps are hindering the development of AI. While U.S. restrictions slow China’s access to high-end chips, they haven’t stopped it. For NVDA and its peers, that means continued demand, but also growing uncertainty.

Is NVDA Stock a Buy?

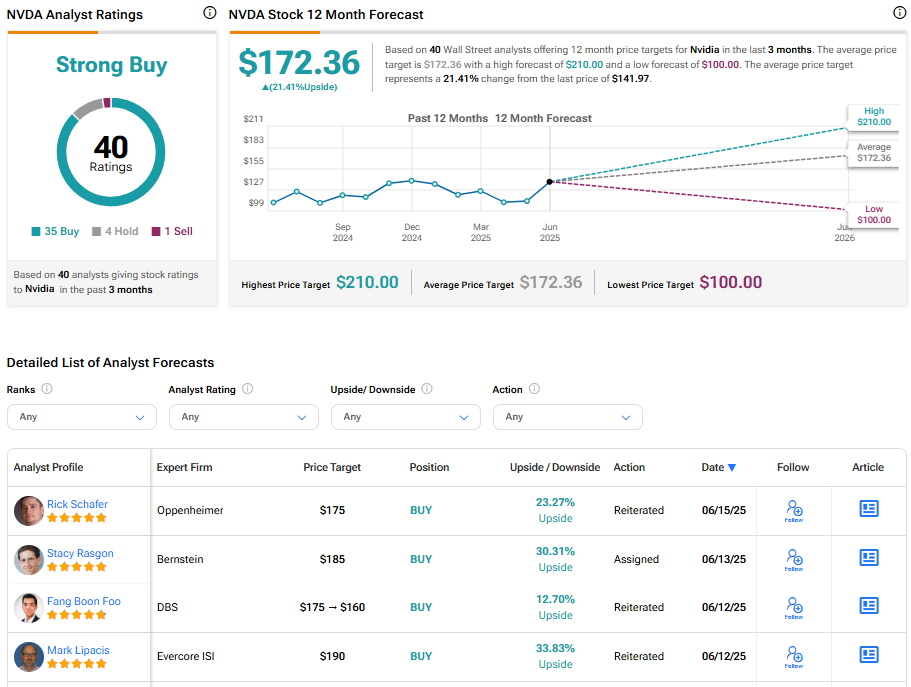

Turning to the Street’s analysts, Nvidia boasts a Strong Buy based on 40 recent ratings issued. The average NVDA stock price target is $172.36, implying a 21.41% upside.