Intel Stock: One Investor Says It’s Time to Grab the Bull by the Horns

Intel’s bulls are charging—and one investor says now’s the time to hitch a ride. The chipmaker’s stock, long overshadowed by flashier tech rivals, might finally be shaking off its slump.

Forget ‘wait and see.’ This call is all about seizing momentum—even if Wall Street’s usual suspects are still busy overcomplicating their spreadsheets.

Confident Investing Starts Here:

- Easily unpack a company''s performance with TipRanks'' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks'' Smart Value Newsletter

But don’t throw the towel in just yet, says one investor, known by the pseudonym Oakoff Investments (OI). OI thinks the market is being “overly pessimistic” here and believes the stock represents a good opportunity right now.

“I find the INTC stock price too depressed to stay there, with a massive upside potential for patient value investors. That’s why I decided to remain bullish on INTC today.”

Driving OI’s positive thesis is an ace up Intel’s sleeve in the shape of new CEO Lip-Bu Tan. Being a “titan of the semiconductor industry,” he is the “perfect corporate figure, who can flip the old script of Intel’s history and make it grow sustainably in the next few years.”

Tan has made it clear that his top priority is cutting through the bureaucracy that has bogged Intel down, aiming to build an “engineer-driven culture.” His vision is to reshape the company so that everything revolves around supporting the people who actually design and build the products. That’s why he believes the cost structure needs a major overhaul – shifting the focus away from spending heavily on SG&A, and putting R&D at the center of future budgeting.

“So the 20% cut of Intel’s workforce should primarily impact the office administrative labor force, not those who are responsible for INTC’s future business turnaround,” says OI.

Meanwhile, in the data center and AI space, Intel is focused on halting its market share decline this year – a goal that appears within reach thanks to upcoming products like Granite Rapids, Clearwater Forest, and Diamond Rapids. The company is also taking a strategic turn by opening up its x86 architecture and tapping into its extensive software ecosystem, aiming to offer a compelling alternative to Arm-based custom silicon solutions.

Of course, the foundry business remains the biggest wild card in Intel’s turnaround narrative, as it continues to rack up massive operating losses. But Tan’s approach to launching the 18A process using an in-house product first seems like the “most logical and de-risked path forward.” With key partners like Synopsys and Cadence helping build out the broader ecosystem, the target of breaking even by FY27 is starting to look more achievable than it did just a few months ago.

Bottom line, OI sees a “compelling buying opportunity for contrarian investors out there, with a potential to see INTC much, much higher in the next few years as Tan’s plan develops.” Accordingly, OI rates INTC shares as a Buy. (To watch Oakoff Investments’ track record, click here)

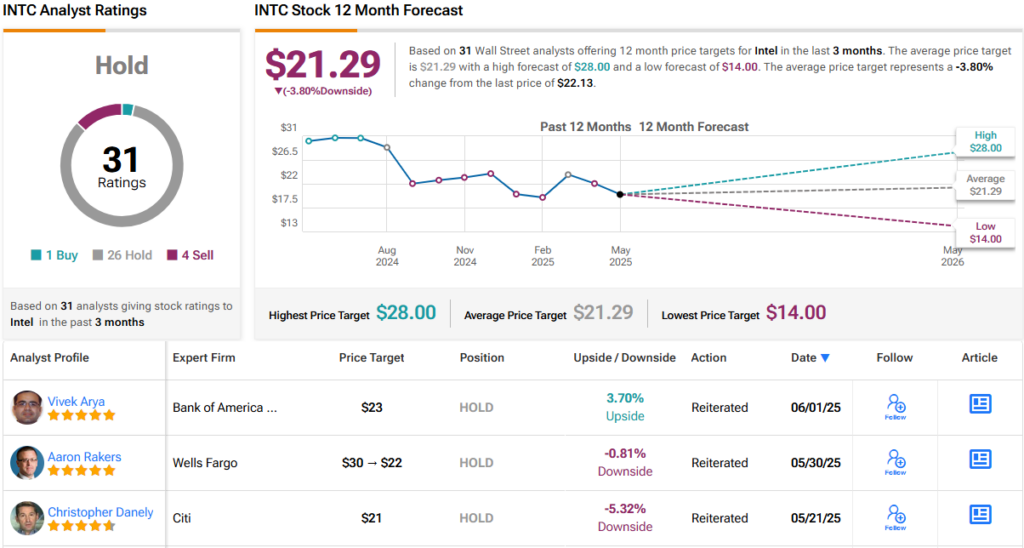

However, only one Wall Street analyst agrees with that thesis and with an additional 26 Holds and 4 Sells, the stock claims a Hold (i.e., Neutral) consensus rating. The average price target stands at $21.29, suggesting the stock will stay range-bound for the foreseeable future. (See)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.