AMD Stock Soars 60% Since March—AI Hype and Trade Optimism Fuel Rally

Tech investors are piling into AMD as semiconductor sentiment flips bullish. The stock’s meteoric rebound—up 60% from March lows—comes amid whispers of trade breakthroughs and an AI arms race heating up.

Wall Street’s latest love affair with chips? Cynics might call it FOMO dressed in silicon. But with AI workloads demanding brute-force processing, AMD’s positioning looks less like hype and more like a calculated bet on the compute gold rush.

One hedge fund manager muttered over espresso: 'If you’re not leveraged to AI in 2025, you’re basically shorting progress.' Harsh—but try telling that to the algo traders buying every dip.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

To add to the context, AMD recently posted stronger-than-expected Q1 2025 results, driven by solid data center growth. Earnings came in at $0.96 per share, slightly above the $0.94 forecast, while revenue ROSE 36% year-over-year to $7.44 billion. However, in April, the company warned of a potential $800 million hit due to tightening U.S. export rules. A favorable outcome from the talks could ease those pressures and support AMD’s near-term growth outlook.

AMD’s Technical Indicators Indicate Strength

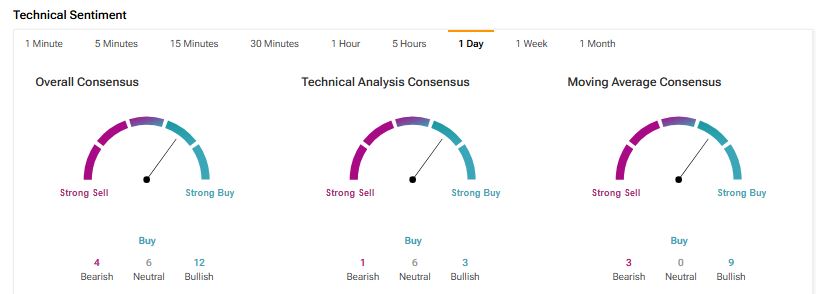

Beyond positive trade sentiment, technical indicators suggest that AMD stock is a Buy, implying further upside from current levels.

According to TipRanks’ easy-to-understand technical analysis tool, AMD is currently on an upward trend. . The stock’s 50-day Exponential Moving Average (EMA) is 107.54, while its price is $121.73, implying a bullish signal. Further, its shorter-duration EMA (20 days) also signals an uptrend.

Another technical indicator, Williams %R, helps traders determine if a stock is overbought or oversold. In the case of AMD, Williams %R currently indicates a Buy signal, suggesting that the stock is not overbought and has more room to run.

Upcoming AI Event Could Act as a Key Catalyst

AMD’s “Advancing AI 2025” event is scheduled for June 12, 2025, and could act as a catalyst for the stock. The event will highlight AMD’s AI strategy and future plans. Speakers will include AMD executives, key partners, customers, and developers from across the AI ecosystem.

Investors will be watching closely, as the event may reveal how AMD plans to compete in the fast-growing AI chip market. Any strong updates or product news could add to the recent momentum, which has already been boosted by trade Optimism and bullish technical signals.

Is AMD Stock a Good Buy, Hold, or Sell?

Overall, Wall Street has a Moderate Buy consensus rating on Advanced Micro Devices stock based on 22 Buys and 10 Holds. The average AMD stock price target of $127.24 implies 4.53% upside potential from current levels.