Starbucks Slashes Prices in China—SBUX Stock Gets a Caffeine Jolt

Starbucks just brewed up a bold move in China—cutting prices to compete in the world's most cutthroat coffee market. Investors are gulping it down, sending SBUX shares steaming.

Discounts Brewing in the Middle Kingdom

The Seattle giant's rare price drop signals a shift: even premium brands sweat when local rivals undercut them. Luckin’s ghost is still haunting the market.

Wall Street Sips the Kool-Aid

Traders cheered the news—because nothing excites finance bros more than a company sacrificing margins to chase growth. Again. SBUX popped 3% on the announcement, proving shareholders will swallow any story if it’s served with a side of ‘China potential.’

One cynical take? This reeks of desperation—the same playbook every Western brand tries before realizing they’re just subsidizing China Inc.’s eventual dominance. But hey, at least the stock got its sugar rush.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Accessible Drinks

SBUX stock was up 0.3% in pre-market trading as it announced in a post on its Weixin social media account that it WOULD offer more “accessible” prices on dozens of its drinks.

As a result it lowered prices on drinks, such as non-coffee tipples and the Frappuccino, by an average of around 5 yuan or $0.70 across China. This brings those drinks to around 23 yuan.

The MOVE was made to see off the growing threat from domestic rivals including Luckin Coffee and Cotti, which have priced their drinks as low as 9.9 or even 8.8 yuan. Internet giants such as JD.com (JD) and Alibaba (BABA) have also entered the fray as part of their food delivery offerings.

Starbucks has also cut prices in response to customers becoming more cautious about their spending as the economy slows.

Crucial China

China is important to Starbucks as it is its second-largest market outside of the U.S. with around 8,000 stores. In its most recent second-quarter results Starbucks reported a 5% lift in net revenues in China to $739 million. However, same-store sales were flat during the period.

According to Reuters, Starbucks said the reduction in prices was not in response to competition but to attract more customers during the afternoons.

However, there have also been reports that Starbucks is considering its options in China reaching out to private equity and tech firms over a potential sell-off.

Starbucks’ share price has dropped around 10% over the last 6 months hit by concerns over tariffs hiking coffee prices. However, investors are still hopeful of a turnaround under new CEO Brian Niccol who joined the group last September.

Is SBUX a Good Stock to Buy Now?

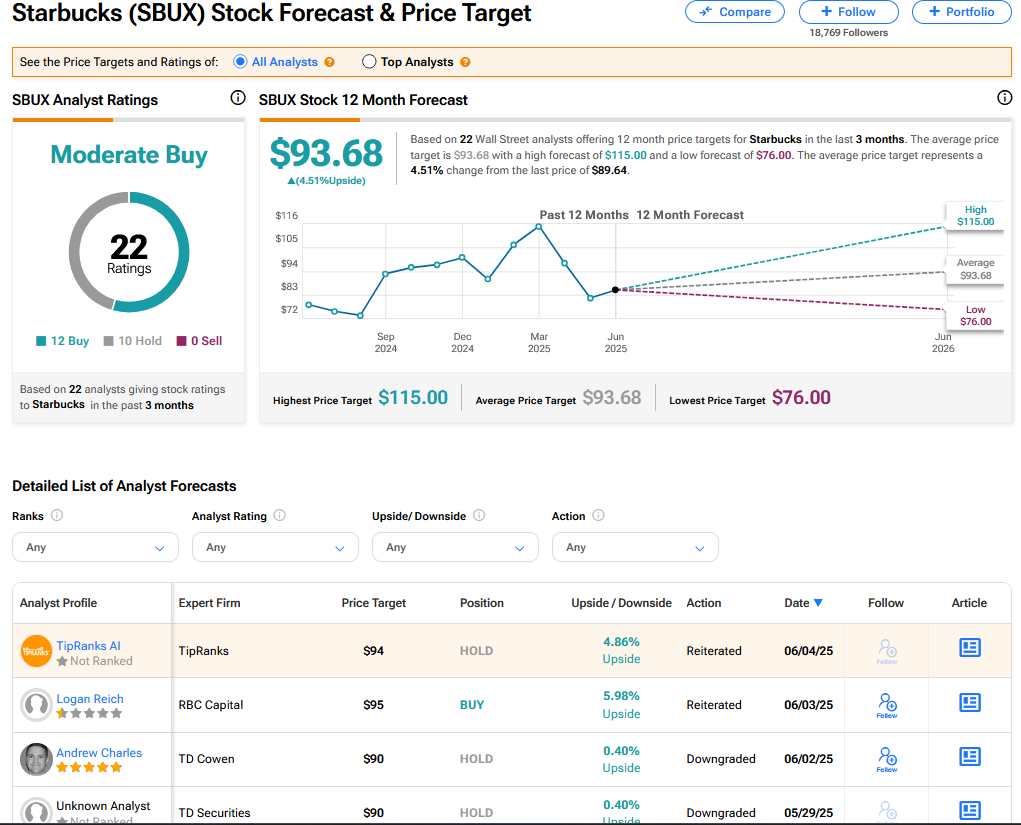

On TipRanks, SBUX has a Moderate Buy consensus based on 12 Buy and 10 Hold ratings. Its highest price target is $115. SBUX stock’s consensus price target is $93.68 implying an 4.51% upside.

See more SBUX analyst ratings

.