Analyst Dan Ives Reveals 10 Must-Have AI Stocks - Nvidia and Microsoft Lead the Charge

Wall Street's AI whisperer just dropped his essential portfolio picks.

The AI Gold Rush

Dan Ives names Nvidia and Microsoft as top contenders in the accelerating artificial intelligence revolution. His ten-stock selection represents the core infrastructure powering the next technological transformation.

Market Dominance Plays

The list targets companies positioned to capture maximum value from AI adoption waves. From semiconductor manufacturers to cloud computing giants, these picks reflect the fundamental building blocks required for widespread AI implementation.

Strategic Positioning

Investors chasing AI exposure should focus on firms with established technological moats and clear revenue pathways. The selected companies demonstrate proven capabilities in turning AI hype into tangible financial returns.

Because nothing says 'strategic investment' like chasing whatever Wall Street analysts are hyping this quarter.

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

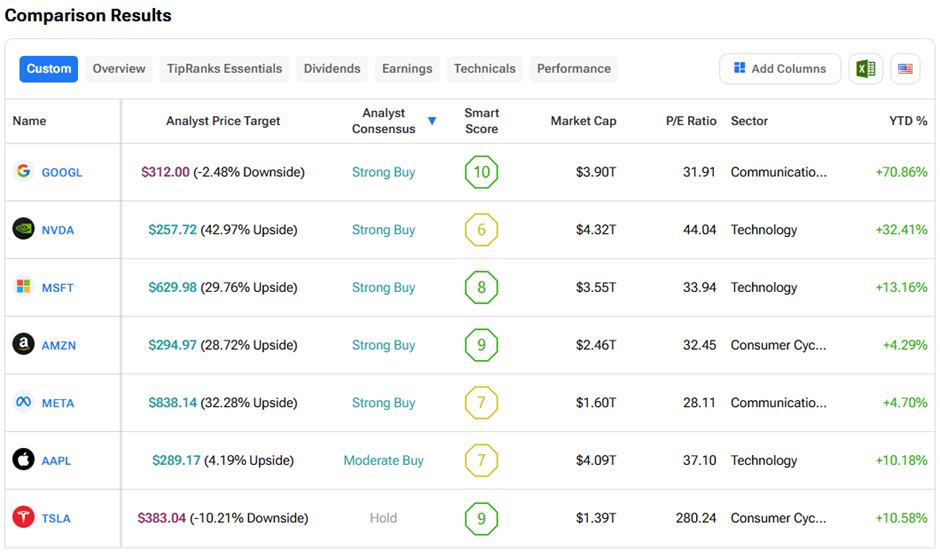

According to TipRanks data, Wall Street has assigned a “Moderate Buy” consensus rating on AAPL and a “Hold” consensus rating on TSLA, while Alphabet (GOOGL), Nvidia (NVDA), Microsoft (MSFT), Amazon (AMZN), and Meta (META) carry a “Strong Buy” consensus.

Is AAPL Stock Overvalued?

AAPL trades NEAR $277, with strong fundamentals, but growth has slowed from prior peaks. AAPL has a price-to-earnings (P/E) ratio of 37x, notably higher than the sector median and its own five-year average.

Analysts and investors remain cautious about Apple due to several ongoing challenges, including a court loss threatening App Store revenue, and tariffs uncertainty, which has boosted the iPhone maker’s costs, by $1.1 billion last quarter and $1.4 billion expected next quarter, and squeezed profit margins. Apple also trails rivals in artificial intelligence (AI) due to delays and slower innovation, faces supply chain woes, and weak China sales, all of which have threatened its market leadership.

Due to these issues, AAPL stock has a Moderate Buy consensus rating based on 21 Buys, 12 Holds, and two Sell ratings. The average Apple price target of $289.17 implies 4.2% upside potential from current levels. Year-to-date, AAPL stock has gained 11.3%.

What Is the Prediction for Tesla Stock?

Tesla shares priced around $426, face volatility from margin pressures and weakening electric vehicle (EV) demand. TSLA trades at a P/E of 279x, significantly higher than the sector average and its own five-year average.

Investors and analysts remain cautious about Tesla stock due to ongoing challenges such as slowing EV sales, especially in key markets like China and Europe, where local competition is intensifying. Production and supply chain disruptions have led to longer customer wait times and risk financial losses.

Moreover, rising tariffs on battery materials and imports, the elimination of U.S. EV tax credits, and CEO Elon Musk’s political issues have negatively affected investor confidence and the stock’s performance in 2025. Yet, Tesla’s advancements in Full Self-Driving (FSD) technology, rapid robotaxi expansion, and energy storage business offer promising long-term growth opportunities.

Owing to these issues, TSLA stock has a Hold consensus rating based on 13 Buys, 11 Holds, and 10 Sell ratings. The average Tesla price target of $383.04 implies 10.2% downside potential from current levels. Year-to-date, TSLA stock has gained 5.6%.

Concluding Thoughts

As Thanksgiving approaches, investors should approach Apple and Tesla with caution despite their status among the Magnificent Seven. Both companies face notable headwinds from regulatory pressures, supply chain challenges, and shifting market dynamics that temper their near-term growth outlooks. However, their long-term potential driven by innovation and technological advances remains intact.