SMH ETF Fund Flow Explosion: November 24, 2025 Reveals Stunning Market Moves

SMH ETF shatters expectations with unprecedented capital influx—Wall Street's latest obsession just got serious.

The Numbers Don't Lie

Fund flows hitting levels that make traditional tech stocks look like yesterday's news. Institutional money pouring in at rates that would make your grandfather's mutual fund manager blush.

Why This Matters Now

While traditional finance types are still debating whether semiconductors are 'proper investments,' smart money is already positioning for the next quantum leap. Another day, another reminder that being early beats being right in this market.

The tape doesn't care about your doubts—it just shows who's actually making moves while everyone else is still reading the prospectus.

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

Fund Flows and Sentiment

The SMH ETF tracks the performance of the MVIS US Listed Semiconductor 25 index. Recently, it has drawn considerable attention due to high-profile deals being conducted in the AI sector.

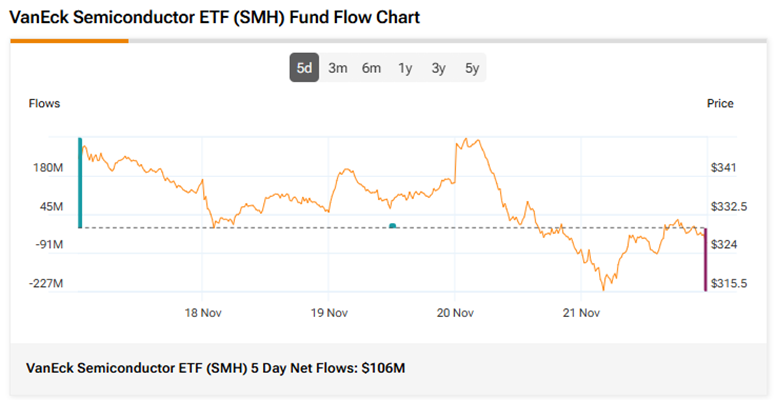

Over the past five days, the SMH ETF has witnessed net inflows of roughly $106 million, while over the past three months, it has reported net inflows of about $4 billion.

Today’s SMH ETF Performance

According to TipRanks’ unique ETF analyst consensus, which is based on a weighted average of analyst ratings on its holdings, SMH is a Moderate Buy. The Street’s average price target of $407.06 implies an upside of nearly 22%.

Currently, SMH’s five holdings with the highest upside potential are:

Revealingly, SMH’s ETF Smart Score is Seven, implying that this ETF is likely to perform in-line with market expectations.