Mobile-health Network Stock (MNDR) Soars: Here’s What’s Fueling the Rally

MNDR rockets upward as telehealth revolution accelerates

The Digital Health Surge

Mobile-health Network shares are catching serious momentum today, riding the wave of explosive growth in remote healthcare solutions. Investors are piling into the stock as telehealth adoption hits unprecedented levels—because apparently nothing says 'bull market' like getting medical advice through your smartphone.

Market Momentum Builds

Trading volume spikes as institutional money flows into the digital health sector. The stock's trajectory mirrors the broader shift toward mobile-first healthcare infrastructure—proving that sometimes the best prescription for portfolio health is betting on technology that actually improves human health.

Wall Street's Latest Infatuation

Analysts scramble to update price targets while retail traders chase the momentum. Another day, another healthcare stock getting the tech treatment—because if there's one thing financiers love more than complex derivatives, it's simple solutions to complex problems.

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

Mobile-health Network intends to invest up to $120 million in this AI data center deal. The company will obtain the funds to do so through the issuance of 3 million shares of MNDR stock. This deal hasn’t been finalized yet, and the finer details of it could change when it is.

Mobile-health Network noted that the MOU with PP GRID is designed to “strengthen and expand” its AI-powered health and technology ecosystem.

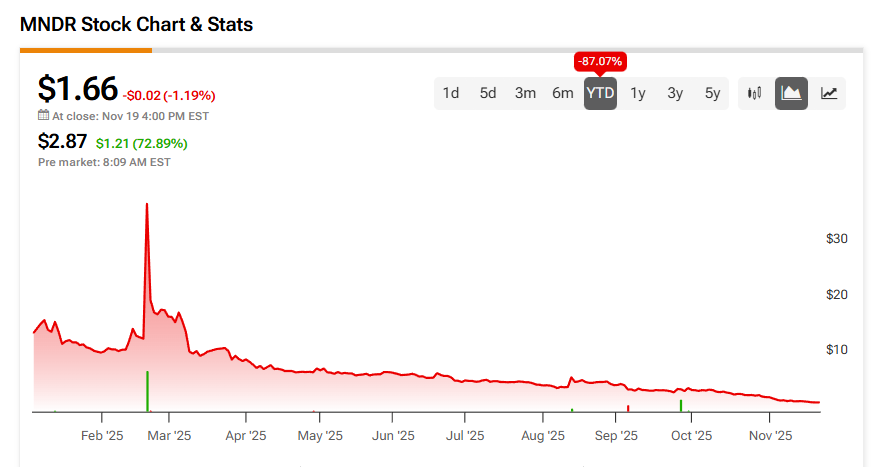

Mobile-health Network Stock Movement Today

Mobile-health Network stock was up 72.89% in pre-market trading on Thursday, following a 1.19% fall yesterday. The stock has decreased 87.07% year-to-date and 85.4% over the past 12 months.

With today’s AI data center news came heavy trading of MNDR stock. As of this writing, more than 29 million shares have changed hands. To put that in perspective, the company’s three-month daily average trading volume is about 200,000 units.

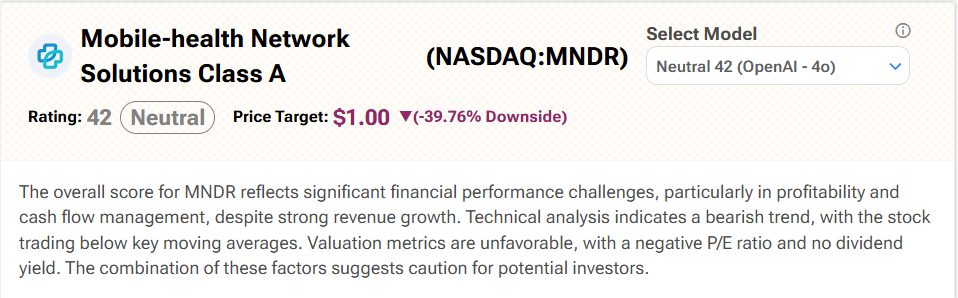

Is Mobile-health Network Stock a Buy, Sell, or Hold?

Turning to Wall Street, analyst coverage of Mobile-health Network is lacking. Fortunately, TipRanks’ AI analyst Spark has it covered. Spark rates MNDR stock a Neutral (42) with a $1 price target. It cites “significant financial performance challenges, particularly in profitability and cash FLOW management, despite strong revenue growth” as reasons for this stance.