Cathie Wood Dumps AMD—Pumps $26M Into These 2 High-Stakes Crypto Bets

ARK Invest's queen of disruption makes her move—bullish on blockchain, bearish on semiconductors.

From chips to chains

Wood's latest pivot screams conviction: $26 million redeployed from AMD into two under-the-radar crypto plays. No half measures here—just classic Cathie high-conviction swings.

Wall Street shrugs, crypto nods

Traditionalists will cluck about 'speculative excess' while conveniently ignoring that Wood's 2025 crypto portfolio already outperforms most hedge funds' three-year returns. The irony? These 'risky' bets now look safer than legacy finance's crumbling yield plays.

The bottom line

When the ETF oracle speaks, markets listen. This isn't diversification—it's a calculated assault on conventional asset allocation. And frankly? Your boomer portfolio manager's 60/40 split just got served.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

ARK Trims AMD Position

The biggest sale came from AMD, shortly after the company detailed fresh AI and data-center plans at its 2025 Analyst Day on November 11. The event drew strong interest from Wall Street analysts and investors, sending the stock up about 10%. However, it fell 4% on Thursday to close at.

ARK sold 87,051 shares through the ARK Innovation ETF (ARKK), worth about $22.5 million. The sale marks a meaningful step back from one of the most widely held chip names and may reflect profit-taking after the recent swing in the stock.

Alongside the AMD sale, ARK also sold 572,735 shares of Pinterest (PINS) for about $15.6 million and 12,083 shares of Regeneron (REGN) worth roughly $8.2 million. It also exited 21,974 shares of Salesforce (CRM) for about $5.4 million.

ARK Steps Up Its Buying in Circle, BMNR, and Biotech

On the buy side, ARK made several notable additions. The firm increased its stake in Circle Internet Group, buying 188,941 shares across the ARK Innovation ETF (ARKK), ARK Next Generation Internet ETF (ARKW), and ARK Fintech Innovation ETF (ARKF) for roughly $16.3 million. This follows a large purchase the day before and shows growing conviction in Circle’s digital-asset platform.

ARK also boosted its crypto exposure by buying 242,347 shares of Bitmine Immersion Technologies (BMNR) for about $9.8 million, adding to its bet on digital infrastructure.

In biotech, ARK added 140,193 shares of BEAM Therapeutics (BEAM) valued at around $3.1 million. ARK has been building this position all week, showing steady interest in gene-editing names. It also bought 261,439 shares of Recursion Pharmaceuticals (RXRX) for about $1.2 million.

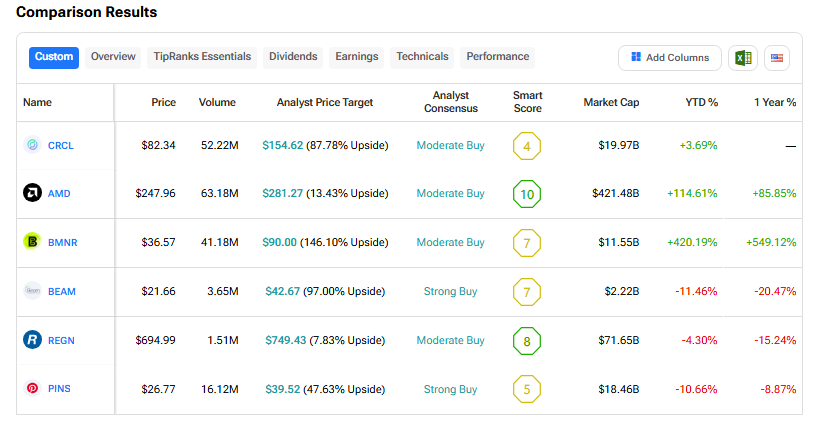

Let’s see how these stocks perform using the TipRanks Stock Comparison Tool: