Rivian Stock (RIVN) on Thin Ice? RBC Capital Flags Lingering Liquidity Concerns

Wall Street's patience wears thin as Rivian faces cash crunch questions.

RBC Capital just poured cold water on Rivian bulls—their latest analysis suggests the EV darling's liquidity issues aren't going anywhere fast. While retail investors keep betting on fairy-tale turnarounds, the smart money's watching burn rates like hawks.

Here's the kicker: When analysts start whispering about liquidity, it's usually three quarters before CFOs start sweating. Rivian's got the tech, the hype, and Elon's leftovers—but can it outrun the cash-burn marathon?

Memo to shareholders: Those 'strategic pivots' better come with a side of profitability. The market's tolerance for 'growth at all costs' expired with 0% interest rates.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

RBC Analyst Remains Sidelined on Rivian Stock

Narayan noted that Rivian has $7.1 billion in cash and short-term investments and expects an additional $2.5 billion in funding from its joint venture with Volkswagen (VWAGY). Of this $2.5 billion, $1 billion is contingent on the completion of certain technological milestones, specifically winter-testing of prototypes using E/E architecture. The 4-star analyst added that the company seems confident about attaining $6.6 billion in a project-based finance loan from the Department of Energy (DOE), which is dependent on the vertical construction of the Georgia plant, expected to begin next year.

That said, Narayan pointed out that Visible Alpha consensus indicates a cumulative negative free cash FLOW (FCF) estimate of $10.7 billion from the second half of 2025 through 2030. The analyst cautions that if Rivian fails to secure DOE reimbursement and meet the technological milestones required to attain the $1 billion in funding from Volkswagen in 2026, the company might need to raise additional financing as early as 2027.

Furthermore, Narayan noted that Rivian will need to earn enough money to repay its debts of $1.5 billion in 2029, $1.725 billion in 2030, and $1.25 billion in 2031. Given this scenario, the analyst believes that investor focus will remain on improvements in Rivian’s gross profit.

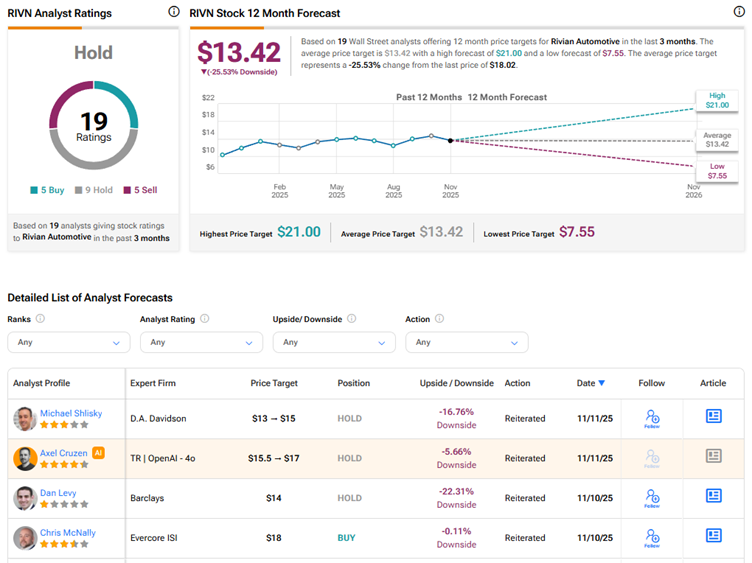

Is Rivian Stock a Buy, Hold, or Sell?

Overall, Wall Street has a Hold consensus rating on Rivian Automotive stock based on nine Holds, five Buys, and five Sell recommendations. The average RIVN stock price target of $13.42 indicates downside risk of 25.5% from current levels.