CoreWeave (CRWV) CEO Breaks Silence as Data Center Delays Trigger Stock Plunge

Another day, another tech stock getting hammered by infrastructure growing pains. CoreWeave's shares took a nosedive after delays at a key data center project—proving once again that even cloud giants can trip over their own server racks.

The CEO's damage control tour began today with vague promises about 'streamlined operations' and 'aggressive timelines.' Investors weren't buying it—CRWV dropped another 5% in after-hours trading. Because nothing reassures markets like a executive suddenly remembering they have a PR department.

Here's the kicker: This was supposed to be their flagship AI-ready facility. Now? A case study in how overpromising meets under-delivering in the hyperscale gold rush.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Interestingly, JPMorgan’s (JPM) five-star-rated Mark Murphy asked if CORE Scientific was the provider in question during CoreWeave’s earnings call, but Intrator declined to name the company. At one point, he said that the issue involved just one data center. Additionally, when asked how many facilities were affected, CoreWeave did not provide a specific number and instead referred back to comments made by Intrator.

Moreover, he added that the company reacted quickly in Q3 when it noticed delays and doesn’t expect the issue to affect its contract backlog. Even with the delay, CoreWeave posted strong Q3 results, bringing in $1.36 billion in revenue, a 134% increase from $583.9 million in the same quarter last year. Still, the company now expects 2025 revenue to fall between $5.05 billion and $5.15 billion, which is below the $5.29 billion analysts had predicted. Nevertheless, Intrator reassured investors that the company will still earn the full value from its contracts.

Is CRWV Stock a Good Buy?

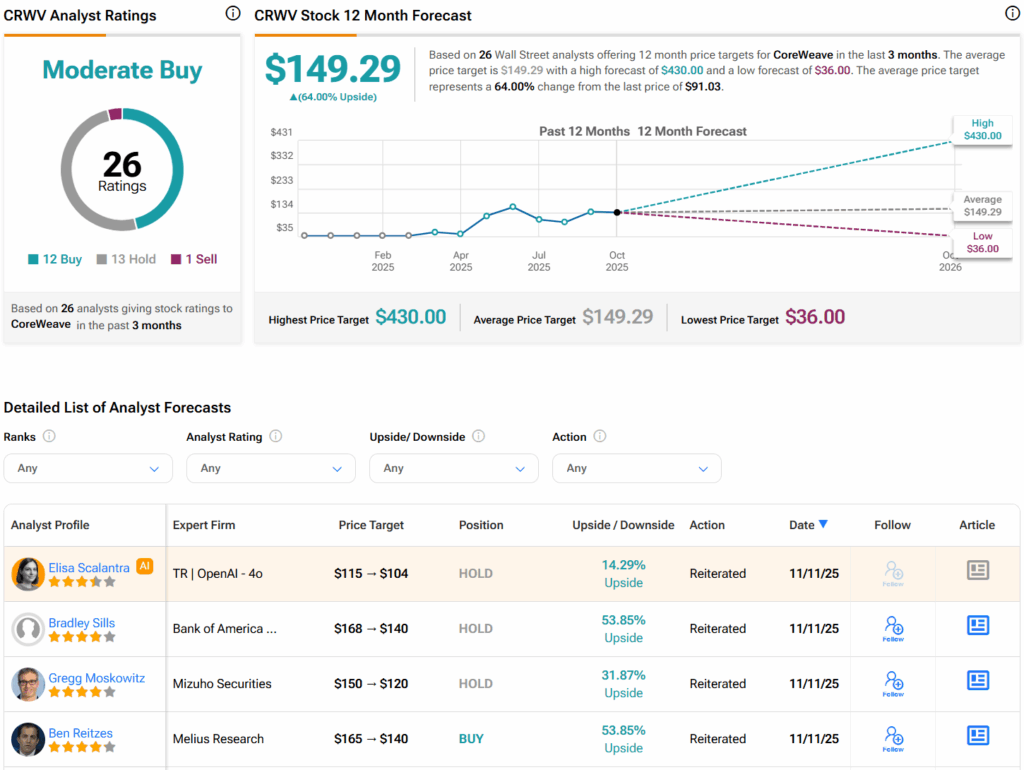

Turning to Wall Street, analysts have a Moderate Buy consensus rating on CRWV stock based on 12 Buys, 13 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average CRWV price target of $149.29 per share implies 64% upside potential.