D.A. Davidson’s Top Analyst Doubles Down on CoreWeave (CRWV) Bear Call—’Profitability Erosion Spells Trouble’

Wall Street's favorite cloud skeptic isn't backing down.

D.A. Davidson's lead analyst just slapped CoreWeave with a fresh bearish note—and the reasoning cuts deep. Forget growth narratives; this call zeroes in on the company's crumbling margins.

The red flags no one's discussing:

- GPU costs chewing through revenue like a crypto miner at a buffet

- Infrastructure spending outpacing client adoption

- A valuation that still prices perfection

Meanwhile, hyperscalers keep undercutting prices. Because nothing says 'competitive moat' like racing to the bottom.

One hedge fund PM quipped: 'They're burning cash to prove they belong in the big leagues—problem is, the league changed the rules.' Ouch.

Final thought: In a sector where profitability gets treated as an optional feature, maybe CoreWeave's just playing the long game... to zero.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

CoreWeave now expects 2025 revenue in the range of $5.05 billion to $5.15 billion, below Wall Street’s consensus estimate of $5.29 billion.

Top Analyst Retains Sell Rating on CRWV Stock

Luria noted that CoreWeave’s Q3 revenue growth marks a “notable” sequential slowdown from the 207% growth in the second-quarter top line. The 5-star analyst stated that the company’s revenue backlog increased $25.5 billion sequentially to $55.6 billion, driven by a new $14.2 billion partnership with Meta Platforms (META) and a $6.5 billion extended deal with OpenAI (PC:OPAIQ). Luria pointed out that CRWV’s $6.3 billion agreement with Nvidia (NVDA) was not included in the backlog due to the nature of the deal. Under the agreement, Nvidia has agreed to purchase any unsold cloud computing capacity from CoreWeave until April 13, 2032.

Meanwhile, Luria noted that Coreweave lowered its 2025 guidance to the range of $5.05 billion to $5.15 billion, down from its previous outlook of $5.15 billion to $5.35 billion. The analyst also highlighted the downward revision in capital expenditure guidance due to capacity delays at a third-party data center partner.

Furthermore, he stated that CRWV’s adjusted operating income of $217 million and interest expense of $311 million reflected persistent “poor unit economics.” Luria was also disappointed with the notable contraction in CoreWeave’s gross, operating, and net margins. “We continue to believe this business is not worth scaling,” contended Luria.

Several Wall Street analysts lowered their price targets in reaction to CoreWeave’s weak guidance. In fact, JPMorgan downgraded CRWV stock to Hold from Buy, noting supply constraints.

Is CRWV Stock a Good Buy?

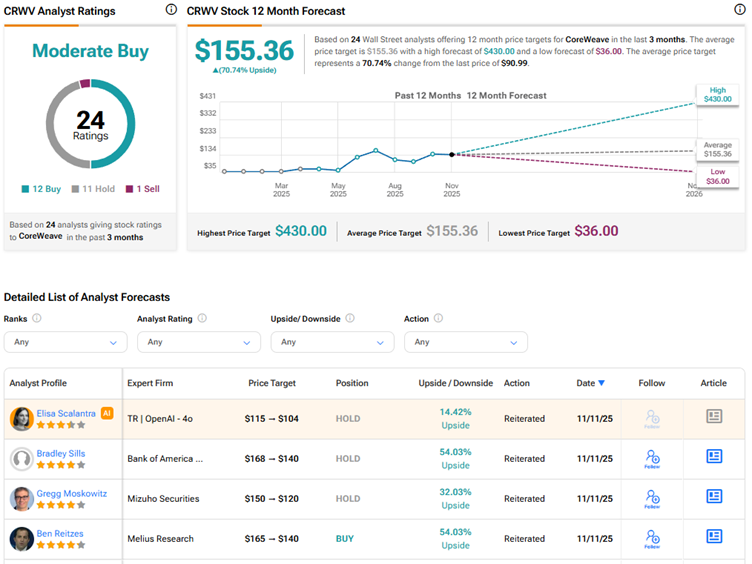

Wall Street has a Moderate Buy consensus rating on CoreWeave stock based on 12 Buys, 11 Holds, and one Sell recommendation. The average CRWV stock price target of $155.36 indicates 71% upside potential.

Note that these price targets/ratings could be revised as more analysts react to the company’s weak outlook.