BofA Exposes Wall Street’s Semiconductor Stock Playbook – Here’s What They’re Buying

Wall Street's latest obsession isn't AI or crypto—it's the silicon fueling both. Bank of America just pulled back the curtain on how institutional money is piling into semiconductor stocks.

Big Money Bets on Chips

While retail traders chase memecoins, the smart money's loading up on foundries and fabless designers. No surprise—semis are the new 'picks and shovels' play in this digital gold rush.

The Real Winners in Tech

Forget Nvidia's latest GPU—the real action's in the suppliers, testing gear, and specialty materials. Wall Street always finds a way to tax both sides of every tech revolution.

Bullish on silicon? You should be. Just remember: when institutions move into a sector, the smartest trade is usually front-running their exit.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

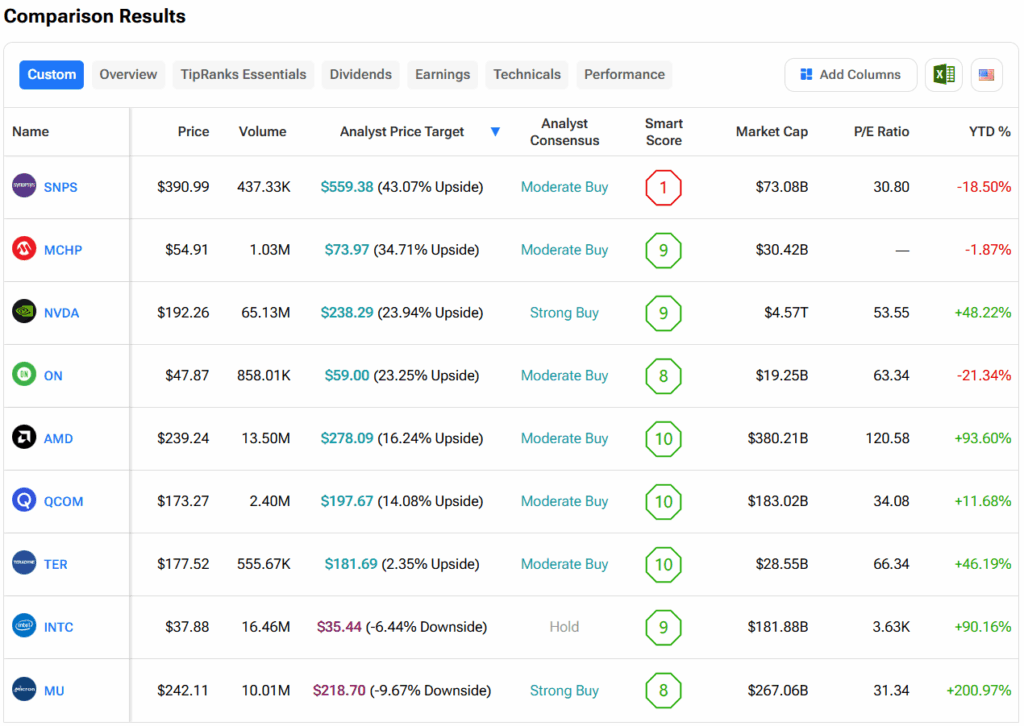

In fact, 76% of fund managers hold the stock, which is up 219 basis points from the previous quarter and 539 bps year-over-year. Still, the stock’s portfolio weight is only slightly above its peers, at 1.11x compared to a 1.06x median. In contrast, Advanced Micro Devices (AMD) is still underweight, held by just 24% of fund managers. That’s up from 20% in July but down sharply from 38% in October 2024. AMD’s relative weighting also ROSE slightly to 0.19x, but it’s still far below last year’s 0.59x. Nevertheless, BofA kept its Buy rating and $300 price target on AMD.

In addition, the biggest gains in fund ownership this quarter were seen in Synopsys (SNPS), which added 466 bps after its $35B Ansys deal closed in July. On the other hand, Qualcomm (QCOM), ON Semiconductor (ON), and Microchip Technology (MCHP) saw the largest drops in ownership. In terms of portfolio depth, AMD, Teradyne (TER), and Intel (INTC) saw the biggest increases, while ON, Micron (MU), and Qualcomm declined. Overall, semiconductor weighting in portfolios sits at 0.96x, which is slightly lower than December 2024 but a bit higher than August 2025.

Which Semi Stock Is the Better Buy?

Turning to Wall Street, out of the stocks mentioned above, analysts think that SNPS stock has the most room to run. In fact, SNPS’ average price target of $559.38 per share implies more than 43% upside potential. On the other hand, analysts expect the least from MU stock, as its average price target of $218.70 equates to a loss of 9.7%.