SOFI Stock Doubles in 2025—Here’s Who’s Banking the Gains

Fintech darling SOFI rockets past legacy banks with a 100% YTD surge—but who’s really cashing in?

The whales behind the rally

Institutional holdings data reveals hedge funds and ETFs are dominating the trade, while retail investors chase momentum. Sound familiar?

Short squeeze fuel

With 18% of float sold short, this could be less about fundamentals and more about Wall Street’s favorite casino game.

Bull vs. bear battleground

Analysts can’t decide if this is the next Square or just another overhyped fintech—meanwhile, the suits collect fees either way.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

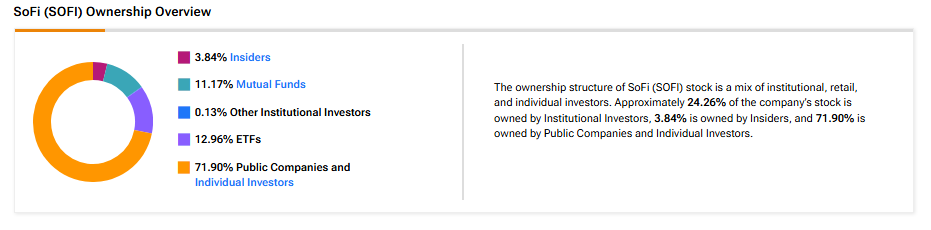

Now, according to TipRanks’ ownership page, public companies and individual investors own 71.90% of SOFI. They are followed by ETFs, mutual funds, insiders, and other institutional investors at 12.96%, 11.17%, 3.84%, and 0.13%, respectively.

Digging Deeper into SOFI’s Ownership Structure

Looking closely at top shareholders, Vanguard owns the highest stake in SOFI at 7.89%. Next up is Vanguard Index Funds, which holds a 7.67% stake in the company.

Among the top ETF holders, the Vanguard Total Stock Market ETF (VTI) owns a 2.97% stake in SoFi Technologies stock, followed by the Vanguard Small-Cap ETF (VB) with a 2.29% stake.

Moving to Mutual funds, Vanguard Index Funds holds about 7.67% of SOFI. Meanwhile, Fidelity Concord Street Trust owns 0.93% of the stock.

Is SOFI a Good Stock to Buy?

Currently, Wall Street has a Hold consensus rating on SoFi Technologies stock based on five Buys, seven Holds, and four Sell recommendations. The average SOFI stock price target of $27.21 indicates 3.5% downside potential.