Cathie Wood Doubles Down on AI & Chips: Tesla (TSLA) Stake Cut Again in Bold Pivot

Cathie Wood's ARK makes another calculated retreat from Tesla—loading up on next-gen AI and semiconductor plays instead.

Why? The market's sending signals, and Wood's listening. While Tesla bulls panic-sweat over slowing EV demand, she's quietly building positions in the silicon and algorithms driving the real disruption.

Semiconductors: The new oil. AI models: The new assembly lines. Wood's not just rotating—she's rewriting the growth playbook. (Wall Street analysts, meanwhile, are still busy downgrading yesterday's winners.)

One thing's clear: When the queen of disruption trims her crown jewel, it's not a trade—it's a telegraph. The question is whether the Street will decode it before the next earnings bloodbath.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

ARK offloaded around 5,400 shares worth roughly $2.4 million across its flagship funds. The sale marks another step in Wood’s ongoing effort to rebalance Tesla’s heavy weighting in ARK’s portfolio.

Tesla shares have remained volatile in recent sessions as investors weigh slower deliveries and rising EV competition. Notably, Tesla’s China-made electric vehicle (EV) sales declined 9.9% year-over-year to 61,497 units in October and plunged 32.3% compared to the previous month, according to data from the China Passenger Car Association (CPCA).

(: To see more of Cathie Wood’s November 10 trades, click here — Cathie Wood Sells Tesla (TSLA) Stock, and Buys This Stock after Q3 Beat.)

Buys in AI and Semiconductor Names

On the buy side, ARK added 173,798 shares of Pony AI (PONY), valued at about $2.5 million, showing confidence in the self-driving technology space. The fund also bought 16,598 shares of Taiwan Semiconductor (TSM), worth around $4.9 million, as chip demand tied to AI continues to grow.

Another major purchase came from Baidu (BIDU), where ARK picked up 94,095 shares valued at about $12.4 million. The MOVE signals renewed interest in Chinese AI firms after recent market weakness.

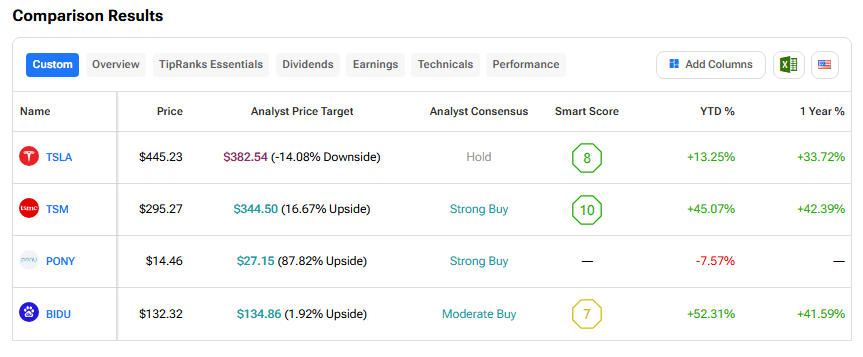

Let’s see how these stocks perform using the TipRanks Stock Comparison Tool: