Michael Burry Exposes AI Valuation Scams: Why Oracle and Meta Stocks Could Be the Next Bubble

Wall Street's favorite new toy—AI stocks—might be hiding a nasty surprise. Michael Burry just dropped a truth bomb about inflated valuations, name-checking Oracle and Meta as potential red flags.

Here's why the smart money's getting skeptical.

When a legend like Burry calls out 'one of the more common frauds,' you'd better listen. The man who predicted the 2008 crash sees history repeating—this time with machine learning hype replacing mortgage-backed securities.

Oracle's cloud revenue? Meta's metaverse pivot? Burry suggests these might be smoke-and-mirrors plays dressed up as AI innovation. Meanwhile, retail investors keep piling in like it's 1999.

Remember: every bubble looks like a revolution—until it pops. And when the 'AI' label gets slapped on everything from chatbots to toaster ovens, even your grandma's portfolio starts looking risky.

Bonus finance jab: Nothing boosts a stagnant stock like an AI press release and a fresh coat of buzzword paint.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In a post on X, Burry accused major tech companies of “understating depreciation by extending useful life of assets,” calling it “one of the more common frauds of the modern era.” He argued that firms ramping up capital spending on Nvidia (NVDA) chips and servers with short product cycles shouldn’t also be stretching out depreciation schedules to five or six years.

Burry Expands His Criticism to Big Tech’s AI Core

Burry’s analysis targeted Meta Platforms (META), Alphabet (GOOGL), Oracle (ORCL), Microsoft (MSFT) and Amazon (AMZN), which are all companies he says are inflating profits by depreciating their hardware too slowly. Most of the hyperscalers depreciate compute and networking gear over roughly five to six years, a timeline Burry says should be closer to two or three given how quickly Nvidia’s AI hardware evolves.

He estimates that this slower depreciation could overstate earnings by as much as $176 billion between 2026 and 2028, with Oracle’s profits inflated by about 27% and Meta’s by 21%. “Massively ramping capex through purchase of Nvidia chips/servers on a 2-3 yr product cycle should not result in the extension of useful lives of compute equipment,” he wrote.

Old Chips Still Hold Value, but Risks Remain

To be fair, not all of Burry’s criticism lands cleanly. Nvidia’s older models, such as the A100 chips launched in 2020, are still heavily used across U.S. and Chinese data centers. Even as new lines like Blackwell roll out this year and Vera Rubin arrives in 2026, older GPUs continue to find demand in training and inference workloads.

CoreWeave (CRWV) CEO Michael Intrator confirmed that trend on Monday, telling analysts that “demand for AI cloud technology remains robust across generations of GPUs.” He said one client even re-signed to use H100 chips, first released in 2022, at a price within 5% of the original deal. That resilience undercuts the idea that older equipment loses value overnight.

AI Stocks Keep Rallying Despite the Critique

Despite Burry’s bearish stance, AI stocks surged Monday. The Nasdaq 100 (NDX) climbed 2.2%, its best one-day performance since May, while Nvidia jumped 5.8%, Palantir (PLTR) gained 8.8%, and Oracle ROSE 0.7%.

Burry says he will release more detailed calculations later this month. At the moment, his criticism adds a new LAYER of skepticism to an AI rally that has defied both logic and gravity and raises the question of whether inflated accounting could be the next fault line in the tech boom.

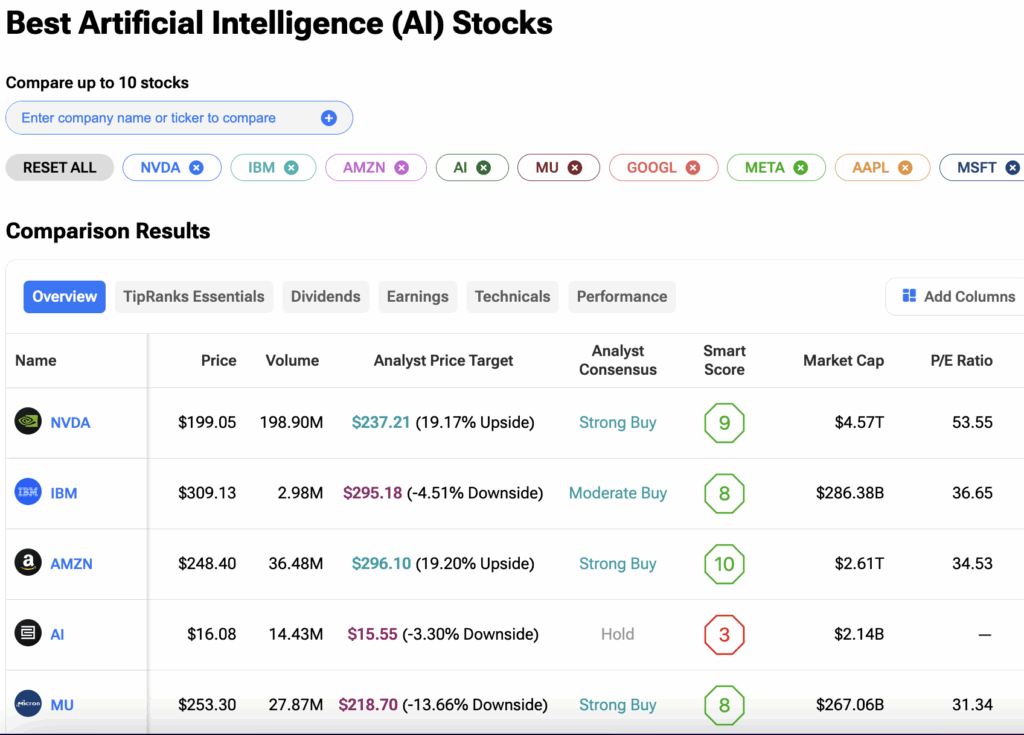

Investors can compare AI stocks side-by-side and filter results based on various financial metrics and analyst ratings on the TipRanks Stocks Comparison Tool. Click on the image below to find out more.