Michael Burry Doubles Down: NVDA and PLTR in Crosshairs as AI Bubble Nears Breaking Point

Legendary investor Michael Burry—famed for predicting the 2008 crash—just reloaded his short positions. This time, he's gunning for the high-flying darlings of the AI hype cycle: Nvidia and Palantir.

Why now? The numbers scream bubble. Nvidia's valuation now exceeds the GDP of most nations—for a company whose chips might be commoditized by 2026. Palantir? Trading at 25x revenue while government contracts—their lifeblood—face austerity cuts.

Burry's move smells like a contrarian masterstroke... or a career-ending misstep. Either way, Wall Street's algo-traders just got a volatility injection they didn't ask for. Remember: when the 'Big Short' guy bets against the crowd, it pays to at least check your portfolio's pulse.

Bonus jab: Nothing fuels a bubble like VC money chasing the 'next big thing' while ignoring basic math. Meet the new dot-com crash—same as the old dot-com crash.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

A decade later, Burry is back in the headlines with a new bearish bet — this time targeting two of the most celebrated names in artificial intelligence (AI): Nvidia (NVDA) and Palantir Technologies (PLTR).

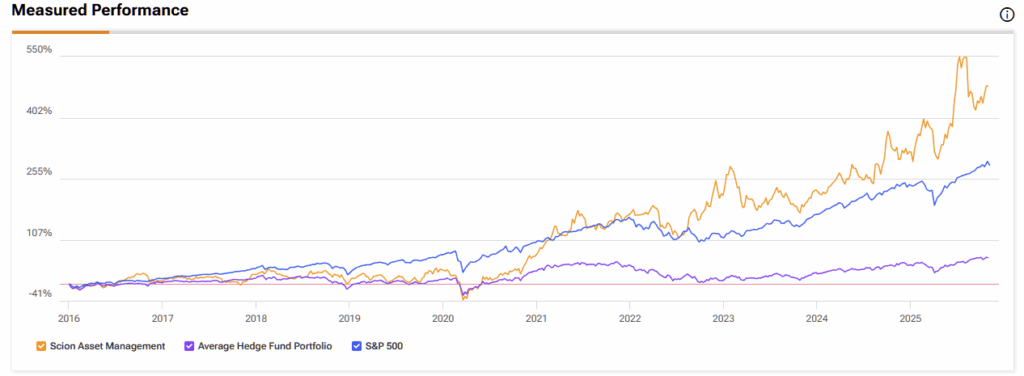

Through put options, he’s positioning to profit handsomely if either stock takes a sharp tumble. Given Scion’s track record over the past decade — and Burry’s uncanny knack for spotting bubbles before they burst — it’s no surprise that market watchers are paying close attention to his latest move.

While I understand his reasoning, I don’t think his short thesis is guaranteed to play out soon. In fact, I remain moderately Bullish on both stocks for the foreseeable future. However, it is difficult to argue against the logic behind Burry’s idea; the critical question is the timing.

Rumors of a Crash Are Bubbling

During the 2008 financial crisis, Burry personally made around $100 million, while his fund earned an astonishing $700 million from its short positions. At the time, almost everyone thought he was mistaken — until the market proved him right.

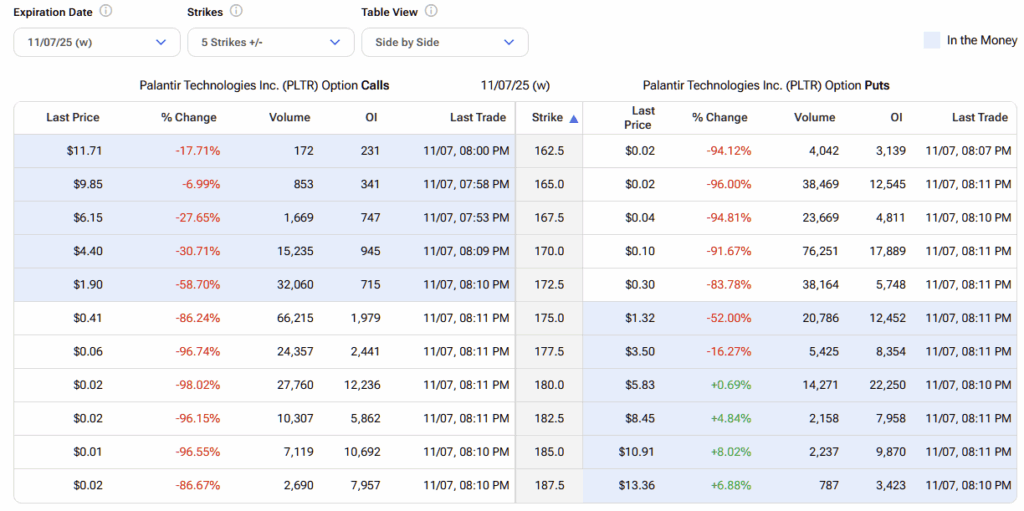

This time around, the potential payout may not reach those Hollywood-worthy heights, but it could still be substantial. Although the details of his current put options are undisclosed, filings suggest the underlying positions represent $187 million in Nvidia and $912 million in Palantir stock.

To illustrate, if Burry spent $5 per contract to secure puts against 5 million Palantir shares, that WOULD be a $25 million outlay. If Palantir’s stock were to drop from $190 to $100, those puts (granting the right to sell at $190) would be worth $90 each, thereby turning a hypothetical $25 million into $425 million — a 17x return before taxes.

The AI Hype May Hit a Speed Bump

Talk of an AI bubble has intensified as valuations across the sector stretch to dizzying heights. Adding to that concern, major U.S. grid operators such as PJM Interconnection (PJM) and the Electric Reliability Council of Texas (ERCOT) are warning that the explosive energy demand from AI data centers is beginning to strain existing infrastructure.

An energy supply crunch doesn’t signal the end of the AI boom, but it does point to considerable short-term volatility and insecurity about the long-term future. Unless hyperscale cloud providers rapidly expand their infrastructure overseas — a MOVE slowed by regulation and permitting delays — bottlenecks could temporarily cap AI’s growth momentum.

I’m Staying Bullish (and Hedged)

As a shareholder of both Nvidia and Palantir, I’m not dismissing Burry’s concerns. But I’m not following his path either. Instead, I’m hedging intelligently. Recently, I added Natural Gas Services Group (NGS) to my portfolio as a dual-phase hedge against AI-related energy shortages. Unlike Burry’s outright bearish bets, I remain bullish long term on Nvidia and Palantir — but I want protection in case a correction hits.

Alongside NGS and First Solar (FSLR), I’m maintaining a 20% cash position. If markets tumble, these positions should cushion my downside — and the cash will enable me to acquire AI leaders at discounted prices.

Wall Street Loves Nvidia but Still Doesn’t Get Palantir

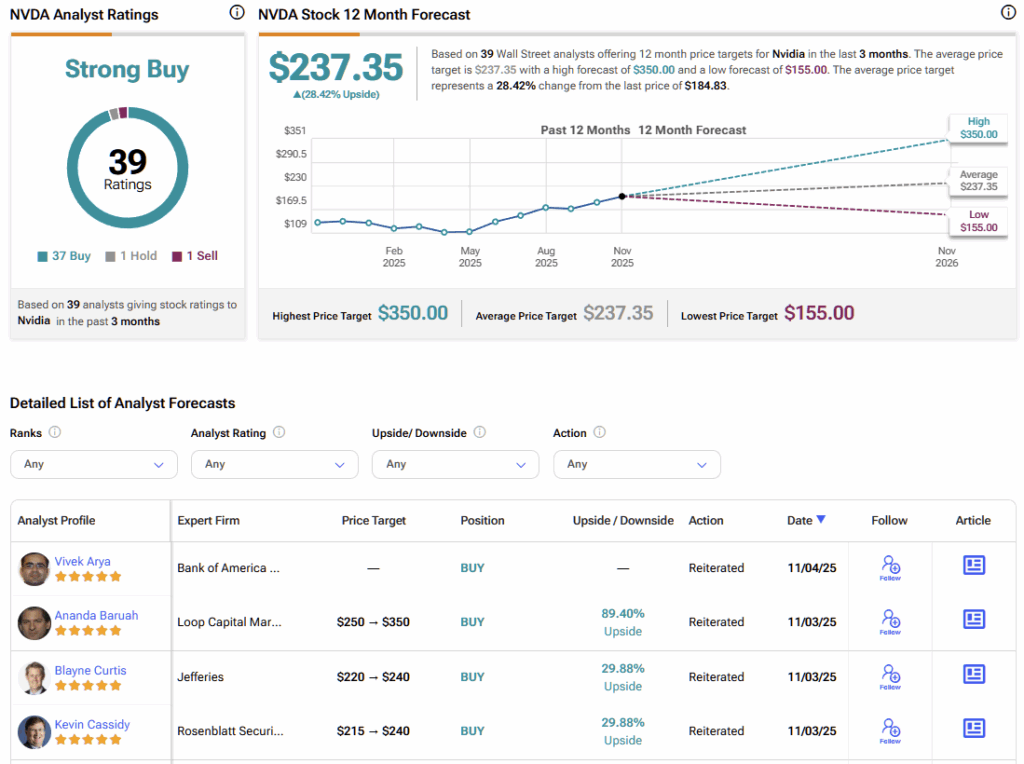

Wall Street analysts, as usual, are lining up strongly behind Nvidia, while taking a far more measured stance on Palantir. Nvidia’s coverage is almost unanimous on Wall Street: 37 Buys, one Hold, and not a single Sell rating. The consensus is a Strong Buy, with an average price target of $237.35, implying ~28% upside over the next 12 months.

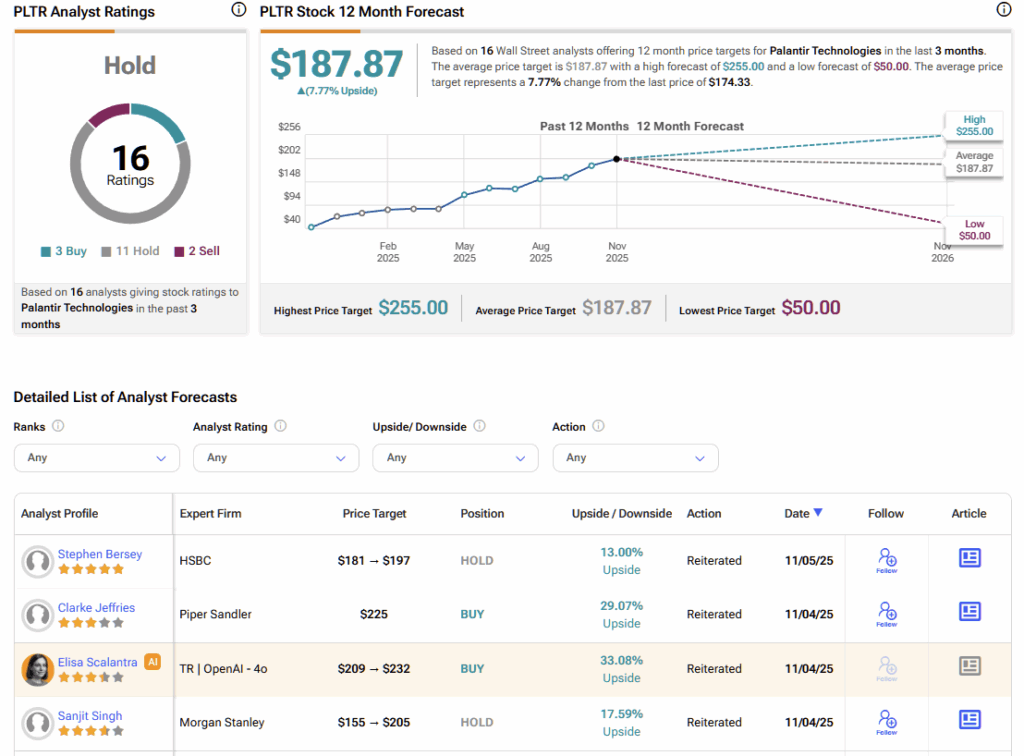

In contrast, Palantir occupies a murkier middle ground for analysts. The defense-sector tech juggernaut has acquired two Buys, eleven Holds, and one Sell, translating to a consensus Hold rating and an average target of $187.87, implying ~8% in potential upside over the next twelve months.

Notably, analysts have been wrong about Palantir before—on multiple occasions. Despite rating the stock a ‘Hold’ almost nonstop over the past five years, the stock has soared more than 1,000%.

That persistent underestimation highlights how Wall Street often struggles to properly value companies that defy traditional categories—particularly firms like Palantir, which operate at the intersection of technology and defense. So while the current consensus might seem lukewarm, seasoned investors know better than to take those ratings at face value.

Many Palantir bulls see the company today much like Amazon (AMZN) in 1997—at the embryonic stage of evolving into a global household name with a powerful competitive moat, poised to generate hundreds of billions in resilient, recession-proof cash flow over the long term.

Stay in AI but Keep Your Eye on the Ball

Michael Burry is often early — rarely wrong. But in markets, timing is everything, and being right too soon can feel a lot like being wrong. His put options on Nvidia and Palantir reflect legitimate medium-term risks — from mounting energy bottlenecks to sky-high valuations — yet those concerns don’t herald the end of the AI revolution. That’s somewhat premature, although by the same token, so too are the sky-high valuations of fast-growing names like Palantir, which may have also raced a bit too far ahead of their fundamentals and perhaps a little too prematurely into investors’ good graces.

Investors who bolt for the exits now risk missing the next major leg higher once the market shakes off its current anxiety about a so-called “AI bubble.” I count myself among the bullish camp staying long on AI’s long-term promise, but I’m not doing so blindly. I’m hedged by a healthy cash reserve, ready to pounce on any undervaluations that emerge if a correction hits. My recent additions in the energy sector further solidify my portfolio, providing insulation if my bullish AI thesis suffers a setback.

In short, I see where Burry’s coming from: his logic is sharp, his caution warranted. But this time, I’m choosing conviction over imitation.