Citigroup CEO Warns: The AI Gold Rush Has Reached ‘Exuberant’ Levels—Here’s Why

AI hype is hitting peak frenzy—and Citigroup’s CEO isn’t buying the fairy tale. From boardrooms to trading floors, artificial intelligence dominates conversations. But how much of it is substance versus speculation?

The Reality Check

While AI promises to revolutionize industries, the rush to capitalize feels more like a land grab than a measured evolution. Startups slap ‘AI-powered’ on pitch decks, stocks surge on buzzwords, and VCs throw cash at anything with a neural network. Sound familiar? *Cough* dot-com bubble *cough*.

The Finance Jab

Wall Street’s latest darling? AI tokens. Because nothing says ‘sure thing’ like algorithmic trading bots fueled by ChatGPT knockoffs. Meanwhile, Citigroup’s chief cuts through the noise: ‘Exuberance’ isn’t innovation—it’s a warning sign.

The Bottom Line

AI’s potential is real. The hype? Maybe not so much. Time to separate the disruptors from the delusional.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Fraser explained that AI currently benefits large, established companies that can afford to invest heavily and MOVE quickly, suggesting that smaller players may struggle to keep up. She described the speed of change in the AI industry as “unprecedented,” saying that companies now measure competitive advantages “in weeks, not even in months and years.” Although she believes investing in computing capacity will pay off in the long run, she warned that the AI boom will create both winners and losers as industries adjust to the technology’s impact.

At Citigroup, Fraser said AI tools are already improving efficiency across the company. About 180,000 employees use AI to help write performance reviews and credit memos, which has boosted productivity and improved customer service. She added that while large financial institutions are well-positioned to benefit from AI, smaller companies without strict credit standards could face challenges. For Citigroup, Fraser said AI is only “the tip of the iceberg” when it comes to transforming how the bank operates and grows in the future.

Is Citigroup Stock a Good Buy?

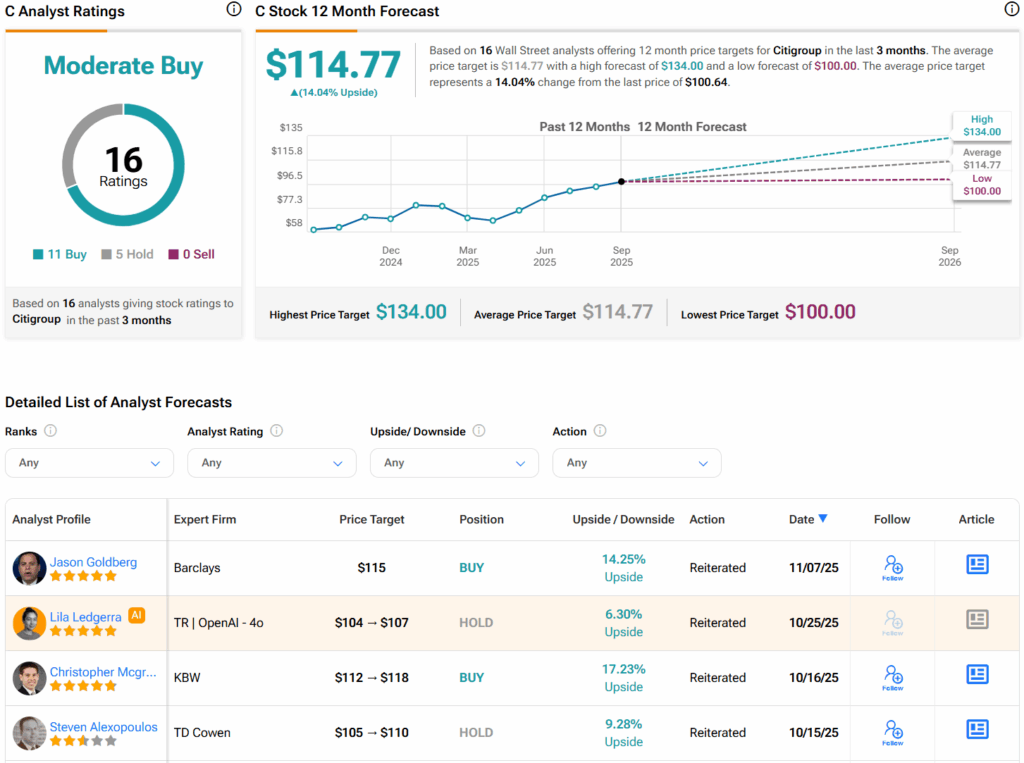

Turning to Wall Street, analysts have a Moderate Buy consensus rating on Citigroup stock based on 11 Buys, five Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average Citigroup stock price target of $114.77 per share implies 14% upside potential.