Boeing’s Bold 787 Surge: Stock Dips Despite Massive Production Ramp-Up (NYSE:BA)

Boeing just threw jet fuel on its 787 Dreamliner plans—but Wall Street isn’t cheering yet.

Production moonshot, investor skepticism

The aerospace giant announced a dramatic production boost for its 787 line, targeting numbers that’d make pre-pandemic execs blush. Yet shares slipped—because nothing says 'confidence' like a sell-off.

The math doesn’t math

More planes should mean more revenue, right? Not when analysts see supply chain ghosts and remember Boeing’s recent 'quality control is optional' era. The market’s voting with its wallet—and it’s not buying the hype.

Bottom line

: Another case of corporate ambition outpacing investor faith. But hey—if the 787 rollout goes smoothly, maybe they’ll finally upgrade from 'dumpster fire' to 'controlled burn.'

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Boeing is planning a massive investment in the 787 Dreamliner facility located in South Carolina, planning to add onto that facility sufficiently to double production at the plant. As it turns out, there is a growing demand for the 787 Dreamliner, and Boeing wants to be able to meet that demand. Or at least, come a lot closer to meeting it than it is currently for the 737 MAX.

Interestingly, Boeing’s South Carolina facility is not a union shop, and the 8,200 workers therein will get another 1,000 jobs or more created over the next five years. Currently, Boeing puts together about eight Dreamliners a month, but the modifications to the South Carolina plant will double that. This will also put Boeing’s quality control measures to a particularly stringent test.

Gaming Training

Meanwhile, Boeing brought an unexpected announcement to the European Aviation Training Summit in Portugal recently. Boeing will be turning to Microsoft (MSFT) for flight training, using a combination of Microsoft Azure and, yes, Microsoft Flight Simulator.

The resulting combination is known as the VIRTUAL Airplane Procedures Trainer (VAPT), which will offer “…realistic flight deck practice through high-fidelity 3D simulations of Boeing aircraft.” Better yet, the training tools require no special facilities to use, and can be run on basic consumer-grade hardware like laptops and tablets. The virtual practice will help get future pilots acclimated to cockpit layout and similar matters before advancing them to physical simulators.

Is Boeing a Good Stock to Buy Right Now?

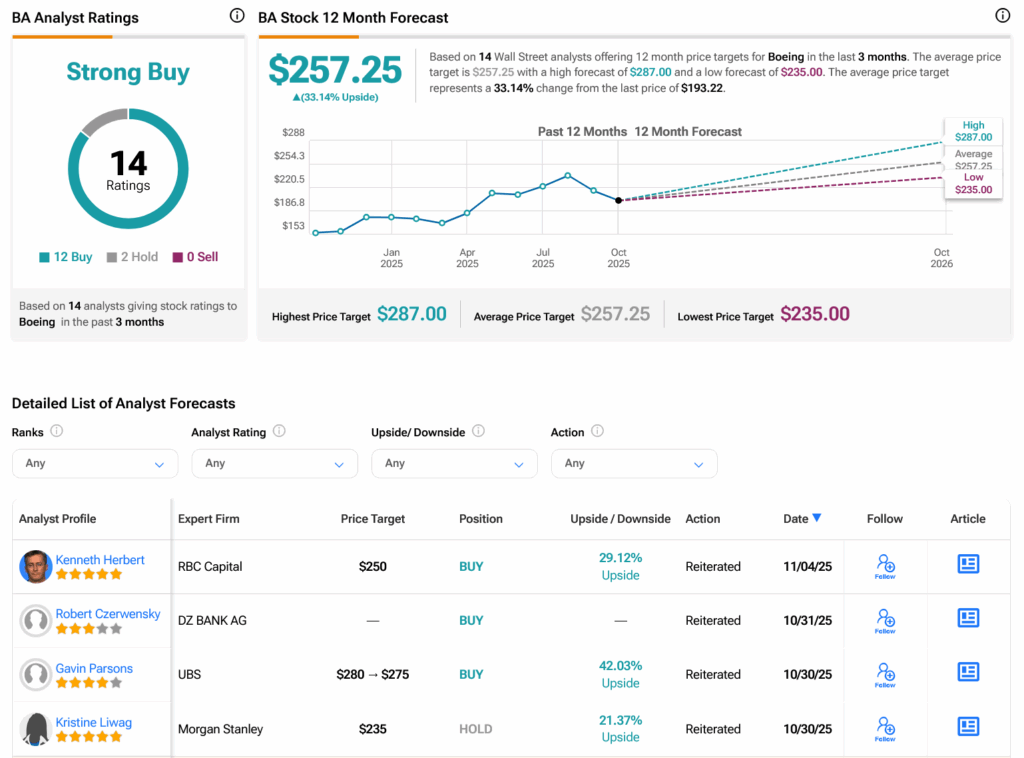

Turning to Wall Street, analysts have a Strong Buy consensus rating on BA stock based on 12 Buys and two Holds assigned in the past three months, as indicated by the graphic below. After a 29.55% rally in its share price over the past year, the average BA price target of $257.25 per share implies 33.14% upside potential.

Disclosure