RUBI Rocket: Why Rubico Stock Surged 45% in a Single Day

Rubico stock (RUBI) just pulled off a gravity-defying leap—up 45% in 24 hours. Was it fundamentals, hype, or just another case of 'buy the rumor, sell the news'?

The Pump No One Saw Coming

Traders scrambled as RUBI ripped through resistance levels like a meme coin on stimulants. No official news, no earnings beat—just pure market chaos doing its thing.

Short Squeeze or Smart Money Play?

Analysts are divided: some spot a textbook short squeeze, others whisper about institutional accumulation. Either way, retail traders got front-row seats to volatility theater.

Post-Rally Reality Check

Now comes the hard part—holding gains. With zero fundamentals backing this surge, RUBI's chart looks like a crypto project that forgot to build a product. Classic 'number go up' economics at work.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The warrants are immediately exercisable and expire one year after being issued. Rubico also noted that the warrants are subject to price resets if certain conditions are met. This WOULD drop the exercise price to $0.4263 on the fourth day of trading and $0.3045 on the eighth day of trading.

As part of this public offering, Rubico has granted Maxim Group LLC, the representative of the underwriters in the offering, a 45-day option to acquire an additional 1,847,290 shares and/or warrants for the public offering price. Maxim Group LLC exercised this right to obtain 1,847,290 warrants.

Rubico Stock Movement Today

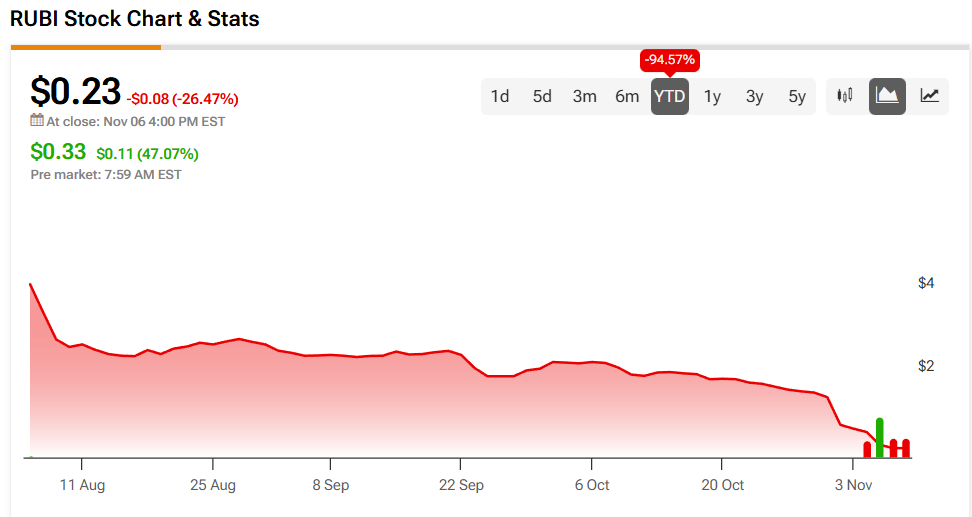

Rubico stock was up 47.07% in pre-market trading on Friday, following a 26.47% fall yesterday. The shares have decreased 94.57% year-to-date.

With today’s public offering news came heavy trading of RUBI stock. As of this writing, more than 89 million shares have changed hands. That’s a massive increase in trading activity, compared to the company’s three-month daily volume of about 63,000 units.

The volatility Rubico stock has experienced over the past couple of days makes sense. A public offering dilutes shares, which often results in the stock’s price dropping. Traders saw that yesterday, and now the shares have bounced back from that news. There could be additional volatility for RUBI stock in the coming days.