AMD’s November 11 Analyst Day: The Make-or-Break Moment Wall Street Can’t Ignore

AMD's ticking clock hits zero in four days—will Lisa Su drop a mic or a dud?

Chips on the Table

The semiconductor underdog's Analyst Day lands amid a brutal sector bloodbath. No pressure, just the fate of a $180B company riding on convincing suits that they can outmaneuver Nvidia's death grip on AI.

What Analysts Want

Roadmap specifics on MI300X adoption, any whispers about TSMC capacity deals, and—let's be real—a single slide with 'dividend' spelled correctly. Meanwhile, hedge funds are already placing side bets on whether the stock pops 15% or tanks 20% by noon.

The Real Game

Forget technical specs—this is about AMD proving it's not just a cyclical trade wrapped in a hype cycle. One banking analyst muttered 'show me the damn gross margins' before chugging his fourth espresso. Smart money's watching whether retail investors get another meme-stock adrenaline rush or if institutions start quietly rotating into... sigh... bonds.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

After a strong rally this year, AMD shares have slipped about 10% over the past five days amid broader market concerns about high tech valuations. Analysts believe the upcoming event could act as a near-term catalyst for the stock, and help improve investor sentiment in the weeks ahead.

What to Expect from AMD’s Analyst Day

At the event, AMD’s team, led by CEO Lisa Su, is expected to share updates on the company’s plans and upcoming chip technology. The focus will likely be on progress in data centers, gaming, and AI chips, which remain AMD’s key growth areas.

Investors are looking for updates on AMD’s Zen 6 processors and Instinct MI500 AI chips, both built to deliver faster performance with lower power use. The company is also expected to share its product rollout plans, progress in AI chip production, and new data center wins. Many will watch for clearer guidance on profit margins and spending plans as competition in AI chips continues to grow.

AMD’s Strong Momentum Ahead of the Event

AMD heads into the event on solid ground. In its most recent quarterly report, the company reported revenue of $9.25 billion, up 36% from a year earlier, driven by strong demand for its data center and gaming chips. Growth in these areas reflects the rising need for faster and better chips used in AI and cloud systems.

The company has also strengthened its ties to the AI industry. AMD recently partnered with OpenAI to supply large-scale GPU power for training AI models. The partnership underscores AMD’s push to compete more directly with Nvidia (NVDA) in the fast-growing AI chip market.

Analysts Focus on Execution and Outlook

Wall Street analysts view the upcoming event as an important test for AMD’s management. The company has already impressed investors with strong quarterly results, but Analyst Day will shift attention to how well it can execute its long-term plans.

According to Morningstar, AMD’s recent earnings were strong, but the firm described the upcoming event as “the bigger test,” where AMD needs to prove it can stay on track and hold its ground against larger rivals in the AI chip race.

Similarly, Stifel analyst Ruben Roy said he will closely watch the November 11 Analyst Day for deeper insight into AMD’s technology roadmap, customer adoption trends, and total addressable market (TAM). He believes the event will be important for investors to gauge how AMD plans to scale its AI chip business and expand its reach in data centers over the next few years.

Is AMD Stock a Buy or Sell?

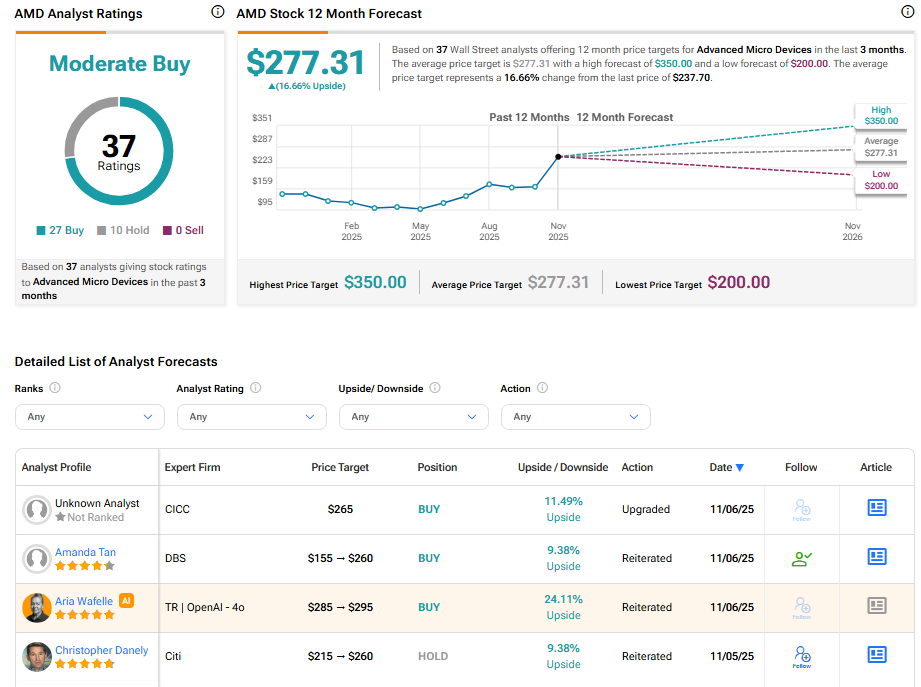

Currently, Wall Street has a Moderate Buy consensus rating on Advanced Micro Devices stock based on 27 Buys and 10 Holds. The average AMD stock price target of $277.31 indicates 16.66% upside potential from current levels.