Opendoor (OPEN) Earnings Shock: Stock Plummets as Weak Numbers Spook Investors

Another quarter, another reality check for iBuying's golden child.

Opendoor's earnings report just dropped—and so did its stock price. The 'tech-driven' real estate disruptor can't seem to disrupt its own downward spiral.

Wall Street's patience wears thin

No fancy footwork in this earnings call could mask the bleeding. Revenue misses, guidance cuts, and that familiar corporate chorus of 'macroeconomic headwinds'—because blaming the Fed never gets old.

Meanwhile, crypto traders watching this unfold: *sips coffee*. At least DeFi protocols fail spectacularly in real-time, not this slow-motion car crash.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

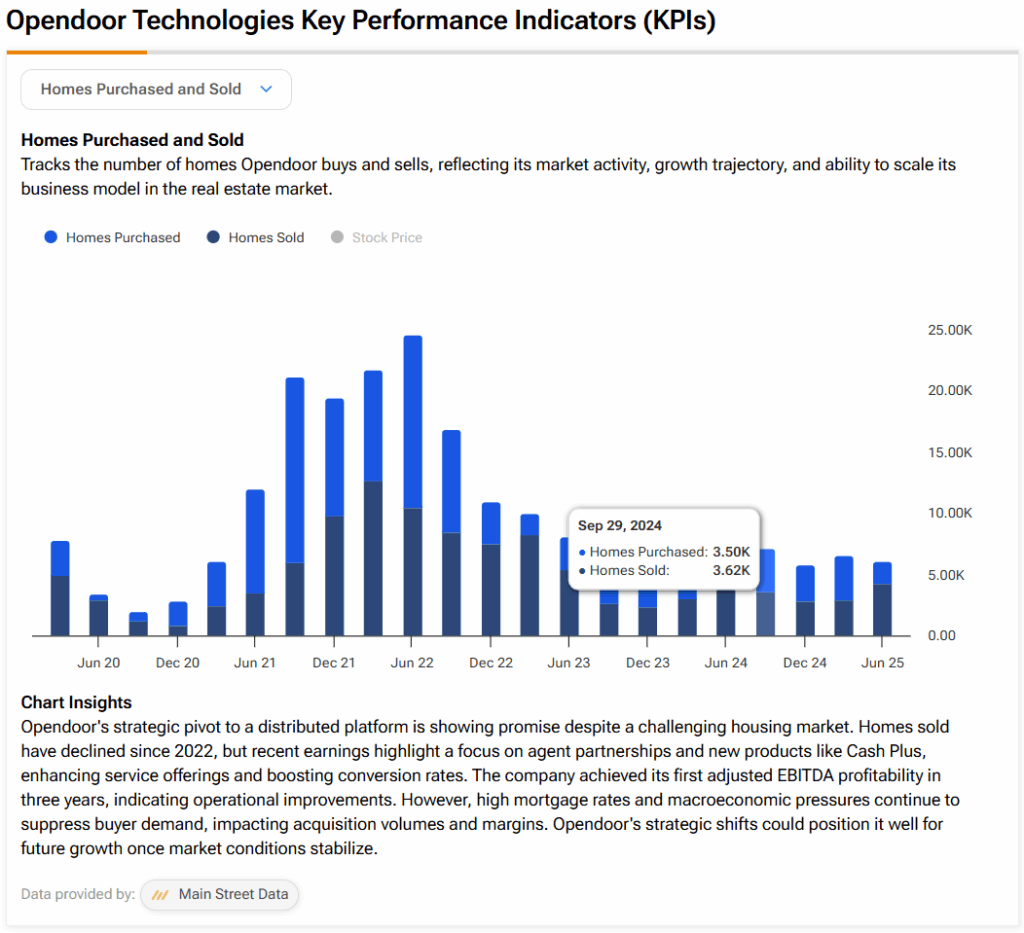

Interestingly, the firm saw 2,568 total homes sold, down from the 3,620 homes sold in the prior year’s quarter, as shown in the image below. In addition, gross profit reached $66 million compared to $105 million in Q3 2024, while gross margin came in at 7.2%, slightly lower than last year’s 7.6%.

At the same time, inventory stood at 3,139 homes and was valued at $1.053 billion, which was down 51% year-over-year. Furthermore, the company purchased 1,169 homes, a drop from the 3,500 purchased in Q3 2024, and ended the quarter with 526 homes under contract for purchase.

2025 Guidance

Looking forward, management has provided the following guidance for Q4 2025:

- Revenue of roughly $594.75 million versus estimates of $545.1 million

- Adjusted EBITDA loss in the high $40 million to mid $50 million range compared to estimates of a $41.2 million loss

As you can see, EBIDTA guidance was worse than expected, which is likely what contributed to the stock’s after-hours move.

Is OPEN Stock a Good Buy?

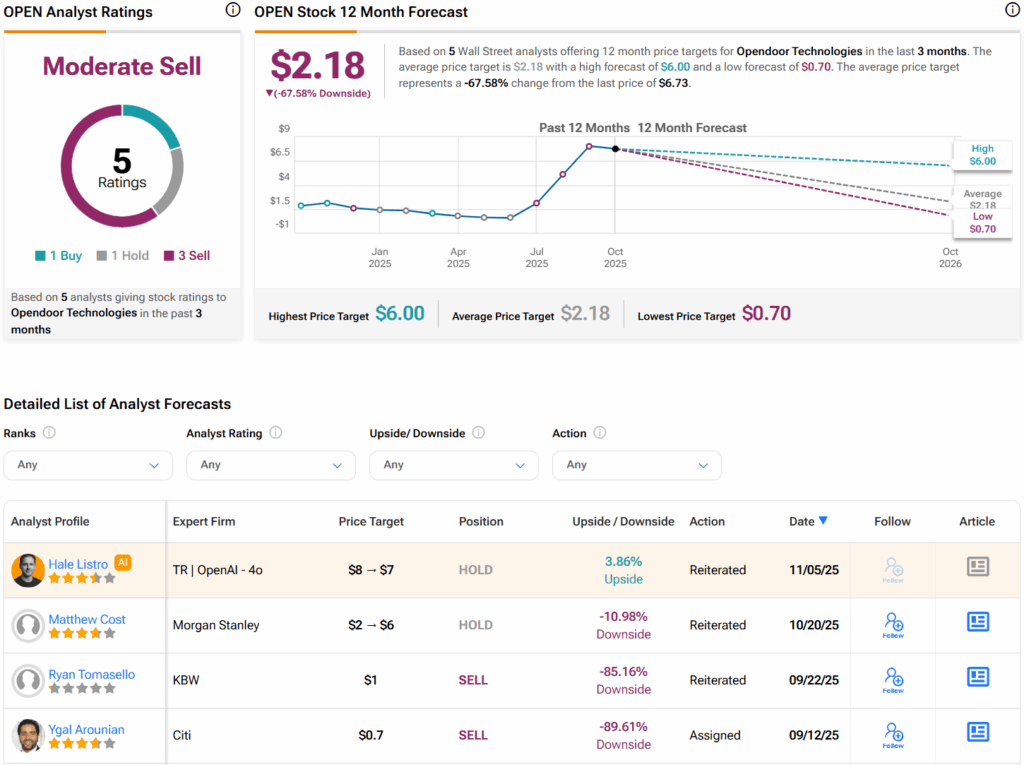

Turning to Wall Street, analysts have a Moderate Sell consensus rating on OPEN stock based on one Buy, one Hold, and three Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average OPEN price target of $2.18 per share implies 67.6% downside risk. However, it’s worth noting that estimates will likely change following today’s earnings report.