Shocking Leak: 10% of Meta’s Revenue Traced to Scam Ads

Meta's dirty little secret just spilled—and it reeks of fraud.

Buried in leaked documents: a staggering 10% of the tech giant's 2024 ad revenue flowed straight from scam operations. That's right—one-tenth of their cash came from grifters, not legit advertisers.

Wall Street's reaction? A collective shrug—because when growth targets get hit, nobody asks how the sausage gets made.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The documents were part of an internal exercise to gauge how widespread scam ads had become within the company’s advertising business. However, internal data also estimated that Meta earns about $7 billion annually from the most deceptive types of scam ads, labeled “higher risk,” which are estimated to be viewed 15 billion times per day.

These findings have raised questions about the role that such ads play in Meta’s revenue and the potential risks they could pose if the company were to suddenly remove them. While Meta claims it actively fights scams and misleading ads, a company spokesperson described the 10% figure as an “overly-inclusive estimate” and noted that many flagged ads didn’t actually violate policy. The spokesperson also criticized the leaked documents by saying that they show only part of the picture and ignore Meta’s broader efforts to reduce ad fraud.

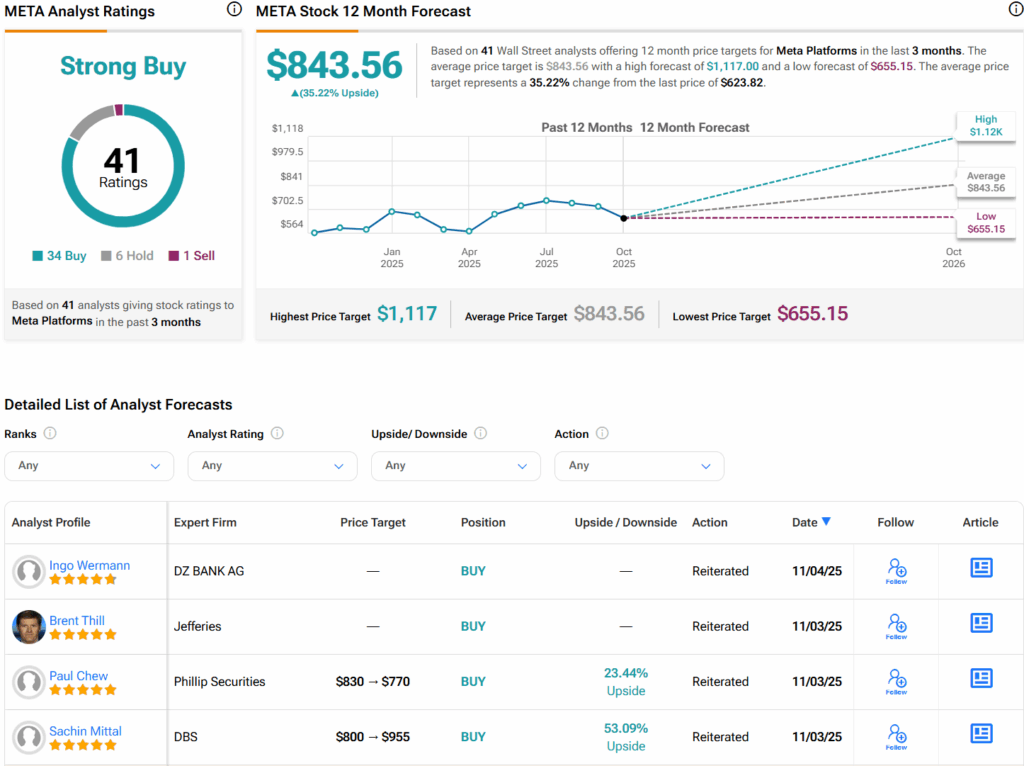

Is Meta a Buy, Sell, or Hold?

Overall, analysts have a Strong Buy consensus rating on META stock based on 34 Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average META price target of $843.56 per share implies 35.2% upside potential.