Brighthouse Stock (BHF) Skyrockets After Blockbuster $4.1B Buyout Deal

Brighthouse Financial just hit the jackpot—and shareholders are cashing in.

The insurance heavyweight's stock surged after announcing a $4.1 billion acquisition deal that sent shockwaves through Wall Street. Forget slow-and-steady—this is a moonshot play that’s got traders scrambling.

Deal or no deal? The market’s already voted with its wallet. Now we wait to see if the champagne corks keep popping—or if the hangover kicks in by Q1. (Because let’s face it: in finance, every Cinderella story turns back into a pumpkin eventually.)

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The deal represents one of the largest insurance-sector takeovers by a private investment firm seen this year. BHF stock climbed almost 27% to $65.75 as of 2:21 p.m. EDT.

Brighthouse Agrees to Go Private

Brighthouse spun off from MetLife (MET), one of the largest life insurance providers in the U.S., in 2017 and went public in the same year. The offer from the New York-based holding company will take Brighthouse private at $70 per share in an all-cash transaction.

The offer represents a 37% premium to Brighthouse’s closing share price on January 27, when news of the arrangement first emerged. The deal is expected to close in 2026 and is still subject to approval from regulators and Brighthouse’s shareholders.

Brighthouse to Keep Brand Name and CEO

As an investment holding company, Aquarian Capital focuses its portfolio on insurance and asset management and currently manages about $25.6 billion in assets. The firm, which counts Abu Dhabi’s sovereign fund Mubadala as an investor, believes that acquiring Brighthouse aligns with its “strategic focus on the United States retirement market.”

If the deal goes through, Brighthouse will maintain its brand name and operate as a standalone company within Aquarian Capital’s portfolio, both companies noted in a statement. The company will also maintain its current base in Charlotte, North Carolina, and continue to be led by Eric Steigerwalt, its current president and CEO.

Is Brighthouse Financial a Good Stock to Buy?

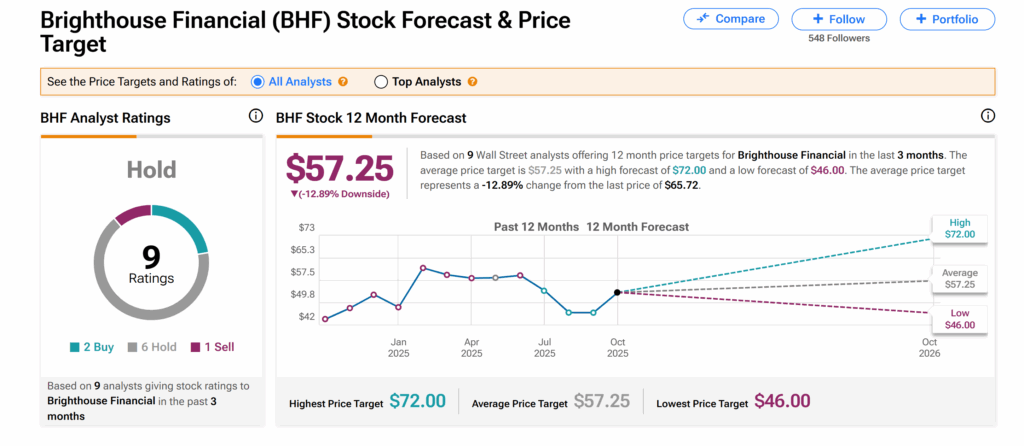

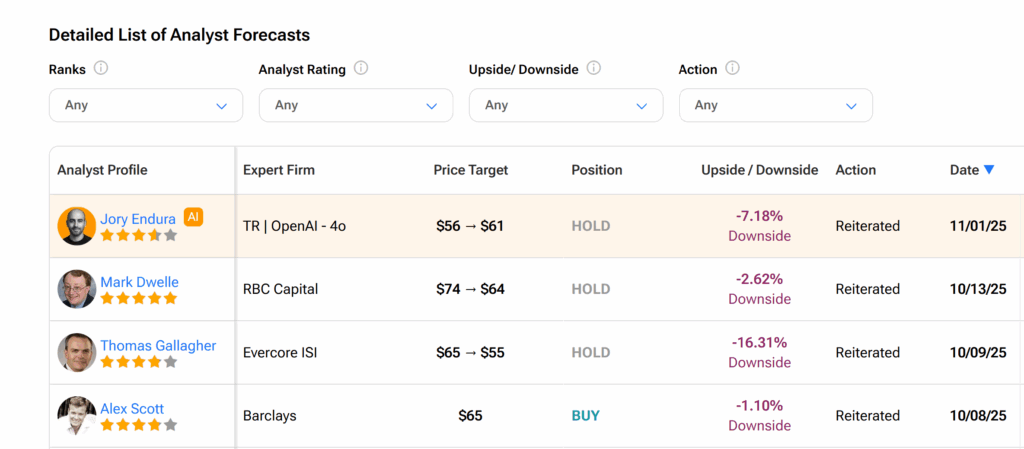

Turning to Wall Street, Brighthouse Financial’s shares currently have a Hold consensus rating, according to TipRanks. This is based on two Buys, six Holds, and one Sell rating assigned by nine analysts over the past three months.

Moreover, the average BHF price target of $57.25 indicates more than 12% downside risk from the current trading level.